Meta’s Metaverse

October 29, 2021 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

The Financial Circulation Assignment Force (FATF), a world anti-money laundering watchdog, printed its finalized steerage for regulating the crypto enterprise.

-

The SEC is no longer going to be approving a leveraged bitcoin futures ETF.

-

MicroStrategy added 9,000 BTC to its holdings right through Q3.

-

Coinbase once extra reached #1 on the Apple App Store rankings of primarily the most neatly-appreciated free apps in the US.

-

Wharton, the enterprise college at University of Pennsylvania, is accepting crypto as charge for a category titled “Economics of Blockchain and Digital Assets” (the place I will be making a guest appearance).

-

Alchemy, a blockchain infrastructure company, is elevating$250 million fundraising round at a $3.5 billion valuation.

-

The positive sale rule could per chance likely soon apply to cryptocurrency investors.

-

India is likely to initiating regulating crypto via taxation of transactions and gains.

-

The NBA’s Dallas Mavericks struck a sponsorship take care of Voyager Digital, a crypto brokerage firm.

-

A CryptoPunk offered for $532 million — but on-chain analysts instruct it is going to be a publicity stunt.

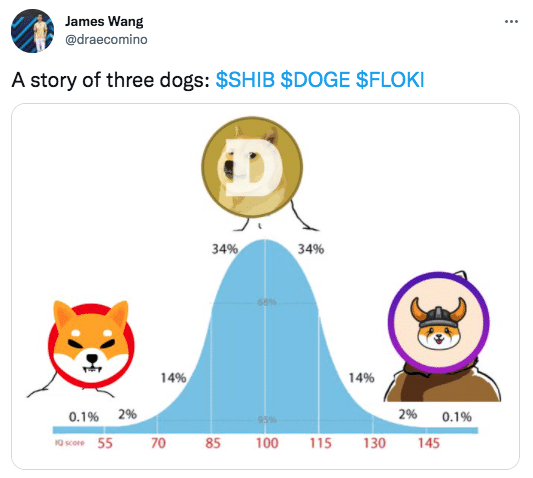

What Enact You Meme?

What’s Poppin’?

The metaverse factual went mainstream.

On Thursday, the social media huge Facebook announced a total stamp overhaul. The Designate Zuckerberg-led company will now stagger by “Meta,” in a nod to the company’s unusual infatuation with the metaverse. (Disclosure: I write a Facebook Bulletin e-newsletter.)

“I mediate we’re mainly transferring from being Facebook first as a company to being metaverse first,” Zuckerberg suggested The Verge after Meta’s formal announcement.

What’s the metaverse? Neatly, that remains to be viewed, but Zuckerberg hinted to The Verge that NFTs probably fit into Meta’s, ahem, metaverse.

“One in all the mountainous questions that folk are going to get cling of about digital goods in the metaverse is, ‘Enact I in point of fact accumulate to get cling of this thing? Or is it factual instruct that any individual can mainly factual rob some distance from me in the future?’ And I’m elegant sensitive to that given the total pressures that we’ve needed to are attempting to navigate round censorship, and what’s the definition of something that’s harmful versus when it is miles well-known to accumulate in the trend of folks being ready to particular something.”

In step with a file from Axios, Facebook is investing billions into its metaverse push. Basically the hottest thought appears to be to be spurring the appearance of digital and augmented truth functions. Meta has already announced a $150 million fund to promote the utilization of such tools and functions.

In a single other metaverse-centric switch, the company’s inventory will open trading beneath the ticker MVRS starting Dec. 1.

Suggested Reads

- Marc Boiron, general counsel at dYdX, on the FATF’s steerage:

- Security researcher Mudit Gupta on the Cream Finance hack:

- Synthetix founder Kain Warwick on DeFi:

On The Pod…

Why Terraform Labs Cofounder Enact Kwon Is Unfazed by US Regulators

Enact Kwon, co-founder of Terraform Labs, become lately served subpoenas by the US Securities and Trade Price right through Messari’s mainnet tournament, main Kwon and Terraform to preemptively sue the SEC. On Unconfirmed, Kwon discusses:

-

what Terraform Labs does and the plan in which it is miles building its DeFi ecosystem round TerraUSD ($UST)

-

why Terraform Labs created its synthetics protocol, Replicate, and the plan in which it works

-

what Enact thinks in regards to the SEC’s investigation into Replicate

-

what came about to Enact at Messari’s mainnet tournament

-

why the SEC’s technique to crypto law does not impact Enact very powerful

-

what Enact thinks about how US regulators are treating crypto corporations

-

how Enact would alter the crypto enterprise

-

why he believes primarily the hottest instruct of crypto law doesn’t work in a world context

-

why he says the SEC couldn’t produce the relaxation to TerraUSD — even though it wished to

-

what two traits are critical in building a decentralized protocol

-

how the crypto enterprise could per chance likely enhance security in light of the $130 million Cream Finance hack

E book Change

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Good Cryptocurrency Craze, is now readily accessible for pre-portray now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-portray it in the present day!

You potentially can aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com