MakerDAO Decides Where to Place $500 Million

June 29, 2022 / Unchained Each day / Laura Shin

Each day Bits✍️✍️✍️

- CoinFLEX plans to unencumber a $47 million recovery token to seize funds after pausing withdrawals from its platform.

- CoinFLEX CEO Tag Lamb accused Roger Ver, aka “Bitcoin Jesus,” for defaulting on a $47 million loan; Ver answered, “These rumors are counterfeit.”

- The CFO and CEO of Compass Mining announced their resignation attributable to “setbacks and disappointments.”

- Babel Finance is shedding top workers after its resolution to cease withdrawals.

- Cosmos, a proof-of-stake blockchain, may well be releasing a unusual characteristic to enable interchain security.

- Hackers accountable for the $100 million exploit in Harmony started laundering the funds.

- Chainlink token LINK soared after being listed on Robinhood.

- White Rock Administration, a Swiss bitcoin miner, launched its first operations within the US.

- $21 million value of mining equipment became as soon as seized by Argentina’s customs place of job.

Currently in Crypto Adoption…

- Russian parliament approves tax breaks for cryptocurrency issuers.

- New York Community Monetary institution will act as a custodian for one of the important most reserve resources within the support of.

The $$$ Corner…

- Kaiko, a blockchain analytics firm, raised $fifty three million in a Series B funding round.

- Dynamic, a web3 startup, raised $7.5 million in seed funding led by a16z.

- PolySign, a crypto infrastructure firm, raised $fifty three million in Series C funding.

- Web3 network Peaq raised $6 million in a funding round.

What Attain You Meme?

What’s Poppin’?

Maker DAO Is Balloting On an Crucial Proposal

By Juan Aranovich

MakerDAO, the DAO within the support of the DAI stablecoin, announced a governance proposal to settle the formulation to allocate 500 million DAI ($500 million).

The community is currently deciding whether or to not allocate these resources 100% in US rapid Treasuries or to allocate them in a 80%-20% ruin up between rapid Treasuries and funding-grade (IG) company bonds.

“This allocation pollis a result of the passage of MIP65, which introduces a unusual genuine-world asset vault with the motive of purchasing USDC and investing them in high quality liquid bond solutions held by a have confidence arranged by Monetalis [an environmentally-friendly wholesale lending company],” said Maker DAO.

The contrivance within the support of this proposal is to generate extra yield for the treasury. MakerDAO’s treasury is composed of many crypto resources, however the major one is USDC. For the time being, 51% of the DAI in circulation is collateralized by USDC.

To this level, the possibility of the 80%-20% ruin up between rapid Treasuries and IG company bonds has done prominent give a boost to, with 98% of the votes in desire.

Then every other time, 97% of these votes come from lovely two wallets, calling into ask how decentralized the vote in actuality is. Final week, Solend DAO had the same roar, as it passed a governance proposal with 90% of the votes coming from wonderful one wallet. (This became as soon as lined on final Friday’s Unchained level to; don’t omit it!)

DAI is the largest decentralized stablecoin in existence, with a market capitalization of $6 billion and a peak of $10 billion in February this yr. In comparison to the diverse top stablecoins, that are backed by fiat, DAI is in fourth space. USDT is the largest one, with $66 billion of market cap, adopted by USDC ($55 billion), and BUSD ($17 billion).

The vote will cease on Friday, and this is in a position to perchance perchance doubtlessly be a must have for the formulation forward for DAI as a decentralized stablecoin. “With yields greater than zero, it is miles luminous to comprise T-bills at present, and earn the yield as an different of wonderful protect USDC. But then it an increasing selection of looks cherish the diverse two fiat-collateralized stablecoins (…) the US Treasury Department has a easy on/off swap for all the ecosystem,” said Lyn Alden, macroeconomic researcher.

Suggested Reads

1) Jaran Mellerud on Bitcoin miners:

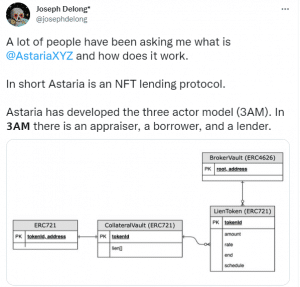

2) Joseph Delong on Astaria protocol and its three actor mannequin (3AM):

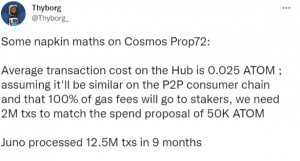

3) Thyborg on Cosmos Prop72:

On The Pod…

Does Enterprise Capital Funding Violate the Ethos of Crypto? Sequoia Says No

Shaun Maguire and Michelle Bailhe, companions at Sequoia, discuss their lengthy speed peek and thesis about crypto, what enact they peep for to make investments in a crypto venture, the takeaways from the blowup of Terra, the insolvency of crypto companies, and heaps extra and heaps extra. Display conceal highlights:

- what’s Sequoia’s lengthy speed peek and thesis relating to the crypto replace

- how diverse our lives will peep 20 years from now attributable to blockchain know-how

- how Sequoia had to adapt to make investments in this unusual asset class and what are the similarities and differences with investing in worn startups

- when a product or service on the fetch wants to be supplied in a decentralized or centralized contrivance

- how Sequoia decides whether or to not make investments within the entity within the support of a venture or within the tokens

- whether or not having enterprise capitalists enthusiastic the least bit goes in opposition to the ethos of decentralization

- why Shaun believes that Ethereum proved that decentralization is also done despite the proven truth that you just happen to open being centralized

- whether or not people underestimate the value that VCs can add to a venture

- why Shaun believes that Solana is shifting towards decentralization

- Sequoia’s thesis about privacy in crypto and the aptitude of zero-recordsdata proofs

- how Michelle sees the macroeconomic ambiance impacting crypto and whether or not this cycle is diverse from the old ones

- the significance of product market fit in crypto tasks

- what crypto tasks wants to be focusing on and the replace mannequin they wants to be pursuing

- the major takeaways of the Terra crumple and the contrivance in which it became as soon as a important setback for algo stablecoins

- how crypto founders may perchance perchance serene constantly enact the loyal thing even supposing there just isn’t this form of thing as a certain guidelines

- whether or not SBF is the Berkshire Hathaway of crypto nowadays

- the teachings to be discovered from the aptitude insolvency of some crypto lenders and funding companies

- how do aside a question to for blockspace will protect increasing and whether or not a single blockchain may perchance perchance provide all that location

- the formulation forward for the metaverse and the contrivance in which it will also be defined

- Michelle’s mental mannequin for crypto and the phases for reaching worldwide adoption

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Colossal Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You would purchase it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com