Legion Launches Original Instrument to Identify Most efficient Contributors in Crypto Fundraises

Crypto fundraising platform Legion this day equipped the originate of the Legion Fetch, a unique recognition system designed to evaluate investors on criteria that mosey beyond simply their financial contributions.

The system, incubated by Delphi Labs and dealing throughout more than one blockchains including Solana and Ethereum, aims to manufacture a more balanced, transparent fundraising ambiance within the crypto condo.

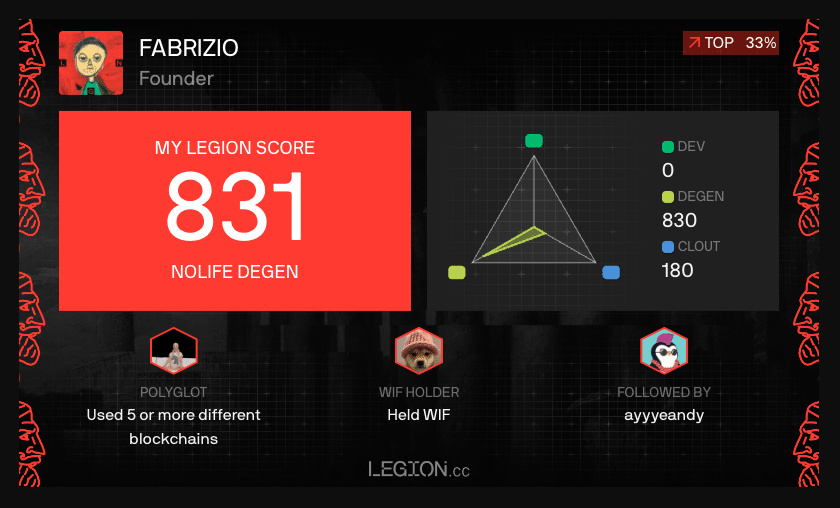

The Legion Fetch assigns investors a ranking from 0 to 1,000 based fully mostly on components much like their social impact, technical talents, community involvement, and solutions supporting them.

Initiatives seeking funds can exhaust the rankings to establish investors that align with their values and dreams, prioritizing qualities beyond capital resources.

“Legion Fetch flips the parable on who gets to participate in token raises … the set up non-financial contributions — admire time, skills, or community-constructing — are valued proper form as worthy as capital,” Alex Svanevik, founder of Nansen and an early Legion investor talked about in a Legion press originate.

The originate comes amid rising scrutiny of project capital (VC) practices within the crypto universe, with critics arguing that VCs customarily extract tag from token launches by securing indispensable allocations at low valuations, a pattern that has birthed the term “VC cash.”

These practices are perceived by some as unfair to retail investors, who customarily face tag distortions as soon as tokens mosey public. Such sentiment has spurred a wave of memecoins this cycle which had been renowned as “superb launches” because they lack pre-gross sales and allocations for insiders, now not like many VC-backed projects.

By emphasizing investor contributions over speculative capital, Legion aims to counter concerns over equality of different in token raises.

Legion Scores can even undergo changes based fully mostly on investor behavior post-fundraising, promoting accountability.

Additionally, the platform uses the EigenTrust algorithm to diminish bot and sybil dispute and requires know-your-customer documentation, guaranteeing that every particular person investors are uncommon contributors.

“By incentivizing participants to defend a obvious standing all over the community, Legion creates a highly effective feedback loop that enhances the everyday of communities formed by our platform,” Fabrizio Giabardo, Legion’s co-founder, talked about within the firm’s originate.

Legion’s platform, which is compliant with the EU’s MiCA regulations, also permits venture groups to place time when vetting investors by figuring out folks that bring more to the desk than proper form deep pockets.

Source credit : unchainedcrypto.com