LayerZero’s ZRO Token Defies the Vogue of Present Airdrops, Surges 40% Over Weekend

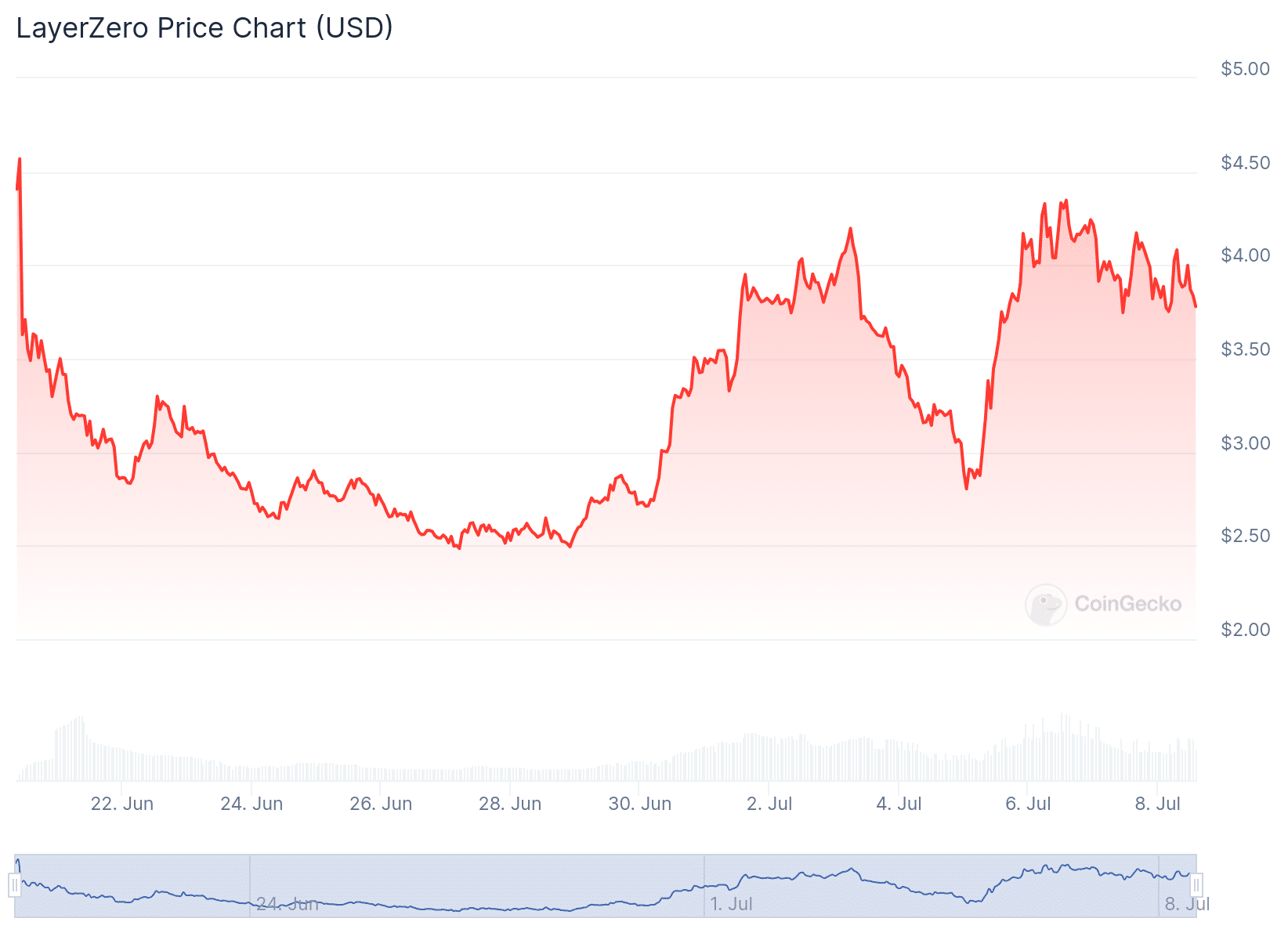

It’s been 19 days since LayerZero’s extremely anticipated airdrop on June 20, and the performance of the ZRO token has taken many unexpectedly. Despite an initial wave of promoting, which drove the worth from a high of $4.57 to lows of $2.48, ZRO has shown unheard of resilience and development, namely when compared with a lot of novel launches.

LayerZero’s ZRO token skilled a fascinating sell-off at the moment following the airdrop, as viewed in the chart from CoinGecko. This market reaction has been typical for newly airdropped tokens, as viewed with ZKsync’s ZK, Blast’s BLAST, Wormhole’s W and Starknet’s STRK, nonetheless ZRO has since bucked the pattern. The token has climbed progressively, now trading at $3.93, up 40% since Friday.

ZRO has not only recovered nonetheless has outperformed both ETH and BTC in the the same length.

Though there’s no sure the rationalization why the token has outperformed, one part will be its Unrealized Beneficial properties to Circulating Market Cap Ratio. This thought used to be highlighted by Delphi Labs’ founder Jose Macedo on a fresh episode of Unchained. Macedo explained the importance of evaluating tokens per unrealized features, which portray the earnings that have not but been realized by early investors or the team. A decrease ratio of unrealized features to market cap indicates that less of the token’s fee is tied up in unrealized earnings, which is ready to decrease selling strain when tokens liberate.

LayerZero’s most fresh investment spherical brought the firm’s valuation to $3 billion, while ZRO’s entirely diluted valuation (FDV) sits at $3.9 billion. Token investors like an unrealized originate of $900 million, calculated by taking ZRO’s FDV in opposition to the firm’s most fresh valuation. While the team, with a 25.5% allocation, protect a $765 million unrealized originate. ZRO has an unrealized features ratio of roughly 3.85, per the entire unrealized features quantity of $1.66 billion compared with its market cap of $431 million.

Delphi Labs’ Macedo pointed out that many tokens trade at a ratio of 4 to 8, that means there is four to eight instances the mission’s circulating market cap in unrealized features. This will also merely result in important sell-offs as tokens liberate, striking downward strain on the worth. In distinction, ZRO’s ratio of three.85 suggests a extra healthy balance, potentially contributing to its fresh fee balance and development.

Additionally, LayerZero’s anti-Sybil measures, in conjunction with needed donations to the Protocol Guild and providing a self-myth option for Sybil attackers, will like furthermore contributed to the unpleasant reception and sturdy performance of the ZRO token.

Be taught extra: Why LayerZero’s New Anti-Sybil Policy Is Getting Both Backlash and Praise

Source credit : unchainedcrypto.com