Make investments $10 in DeFi, Correct now Sue

January 14, 2022 / Unchained On a typical basis / Laura Shin

On a typical basis Bits ✍️✍️✍️

-

DeFi lottery protocol PoolTogether is going thru a lawsuitpertaining to whether it if fact be told is decentralized, independent mission.

-

Tether froze $160 million in USDT across three Ethereum addresses the day prior to this.

-

On-chain derivatives replace dYdX plans to fully decentralize in 2022.

-

Synthetix founder Kain Warwick is serious about appealing the protocol to a total lot of L1s.

-

Swiss National Financial institution concluded a central monetary institution digital currency trial that incorporated the Financial institution for World Settlements, Goldman Sachs, Credit Suisse, Citi, UBS, and Hypothekarbank Lenzburg.

-

ConsenSys is going thru a felony strive against with a broken-down challenge accomplice.

-

OpenSea quantity is heading in the correct route for its biggest month ever.

-

Hackers from North Korea stole nearly $400 million in BTC/ETH in 2021.

-

Gemini obtained BITRIA, a crypto portfolio supervisor.

-

Vulnerable CFTC chair Chris Giancarlo is joining CoinFund as an consultant.

-

Bitcoin and Ethereum ETFs might maybe maybe maybe maybe additionally simply be shortly coming to India.

- Michael Hsu, the acting comptroller of the OCC, thinks monetary institution-like law can be factual for stablecoins.

On the present time in Crypto Adoption…

-

Tesla is sorting out DOGE funds on its web declare, per provide code.

-

Visa is partnering with Ethereum infrastructure company ConsenSys to abet veteran finance companies combine central monetary institution digital currencies.

- Sweet Digital launched an NFT marketplace for formally licensed Necessary League Baseball merchandise.

The $$$ Nook…

-

DeFi Alliance raised $50 million and might maybe maybe maybe maybe additionally simply rebrand to AllianceDAO.

-

The Fan Managed Soccer League closed a $40 million Series A investment round led by Animoca and Delphi Digital.

-

The SEC filing of Rhodium, a Bitcoin miner, implied a market cap of $796 million for its upcoming IPO.

- Proof of Be taught raised $15 million in a funding round that might maybe abet grow the “learn to construct” platform.

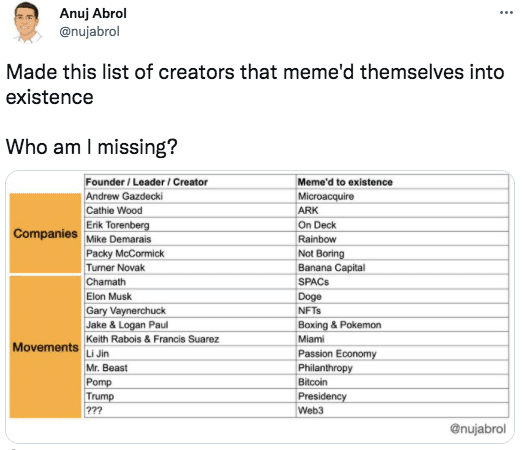

What Bag You Meme?

What’s Poppin’?

Block 🤝 Mining Blocks

In October, Block (beforehand is famous as Square) CEO Jack Dorsey revealed the funds firm used to be serious about building a Bitcoin mining machine.

The day gone by, Thomas Templeton, Block’s frequent supervisor for hardware, announced that Block is formally going forward with its plans to provide mining hardware in an commence-provide formula.

In step with Templeton, incomes Bitcoin is the least attention-grabbing share of organising out mining hardware and infrastructure. “We want to manufacture mining more allotted and ambiance friendly in every procedure, from shopping, to quandary up, to maintenance, to mining. We’re because mining goes a long way past constructing original bitcoin. We witness it as a long-timeframe need for a future that is fully decentralized and permissionless,” wrote the frequent supervisor.

Templeton went on to declare that availability (i.e., constructing hardware that anybody, any place ought to possess a rig), reliability (i.e., solving disorders with warmth dissipation), and performance (i.e., decrease energy consumption) can be the three cornerstones of Block’s mining hardware. He additionally illustrious that Block would place in mind making a original originate of ASIC.

Block’s stock used to be down 5.86% the day prior to this.

Suggested Reads

-

Constancy on digital assets in 2021:

-

@punk6529 on NFTs:

-

The Tie on $MAGIC:

On The Pod…

The Lowering Block: Why the Crypto Markets Have Been Down This Week

The Lowering Block is support! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra cleave it up about the most up-to-date data in the digital asset alternate. Demonstrate issues:

-

why crypto assets skilled a drawdown after closing week’s FOMC assembly that hinted at accelerated rate hikes

-

which emerging assets Tarun, Haseeb, and Tom envision weathering a undergo market

-

which assets might maybe maybe maybe maybe additionally simply be further grief by a continued undergo market

-

the importance of Paradigm and Sequoia investing in Citadel Securities

-

what facets of Stamp CEO Moxie Marlinspike’s web3 article Haseeb, Tom, and Tarun take umbrage with

-

whether Cryptoland is crypto’s Fyre Competition or whether it’s the metaverse

-

what the heck is occurring with the Paunchy Penguins neighborhood

-

the teachings from the CFTC’s neutral correct-attempting of Polymarket (disclosure: a broken-down sponsor of my shows)

Book Replace

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Immense Cryptocurrency Craze, is now accessible for pre-describe now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-describe it this day!

You’d additionally possess it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com