The vogue to Yield Farm — With out the Bother

(Nonetheless with various possibility.)

It’s been a loopy week in crypto, or DeFi in particular, which is seeing a battle of forks between Uniswap and SushiSwap, and which noticed its yield farming craze taken to fresh heights, with yETH, a more or less one-stop store for yield farming. The assign that is all headed is somebody’s wager — will SushiSwap earn in the cease as yield farmers dash yields? Or will Uniswap’s v3 turn the tide? Or, will SushiSwap simply fork v3 to boot with a brand fresh twist on the yield? Plus, will Ethereum scale in time for DeFi demand? Because it doesn’t gaze worship it, we’ll survey the assign liquidity goes.

On Unchained, Haseeb Qureshi of Dragonfly Capital and Dan Robinson of Paradigm destroy down the upward push in the class of dexes identified as automatic market makers — why has Uniswap been ready to overhaul Coinbase’s 24-hour volume? Why are of us paying more in expenses on Uniswap than on Bitcoin? On Unconfirmed, Nadav Hollander and I focus on the battle between SushiSwap and Uniswap. Learn on to discover more of the DeFi craziness that happened this week, and the assign the beautiful delivery vogue is going.

This Week’s Crypto Data…

DEX Volumes Hit Original All-Time Excessive as Uniswap Overtakes Coinbase

Decentralized exchanges noticed $11.6 billion in swap volume in August, up from less than $1 billion in January. This sets a third consecutive monthly list in DEX volume, up from $4.5 billion in July. As Denis Vinokourov, head of be taught at Bequant, told CoinDesk, “It signifies that the DeFi flippening is ideal and already right here.”

Uniswap is main the charge in decentralized substitute boost, with a reported 283% elevate in 24-hour procuring and selling volume from July to August, and better than $1 billion in procuring and selling volume on Tuesday and on Wednesday this week, which became roughly 50% elevated than the 24-hour volume on Coinbase Pro at the time.

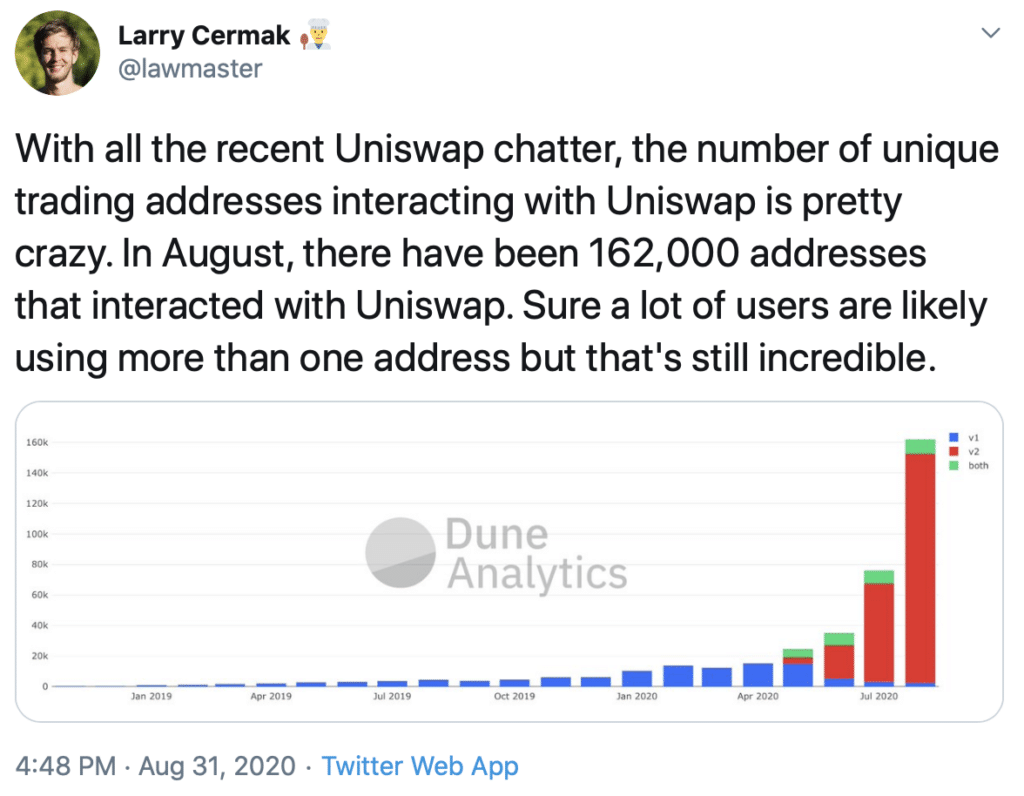

For instance right how big the elevate in procuring and selling on Uniswap has been, Larry Cermak of The Block posted a graph on Twitter showing the staggering elevate in weird procuring and selling addresses on Uniswap by myself in the earlier few months.

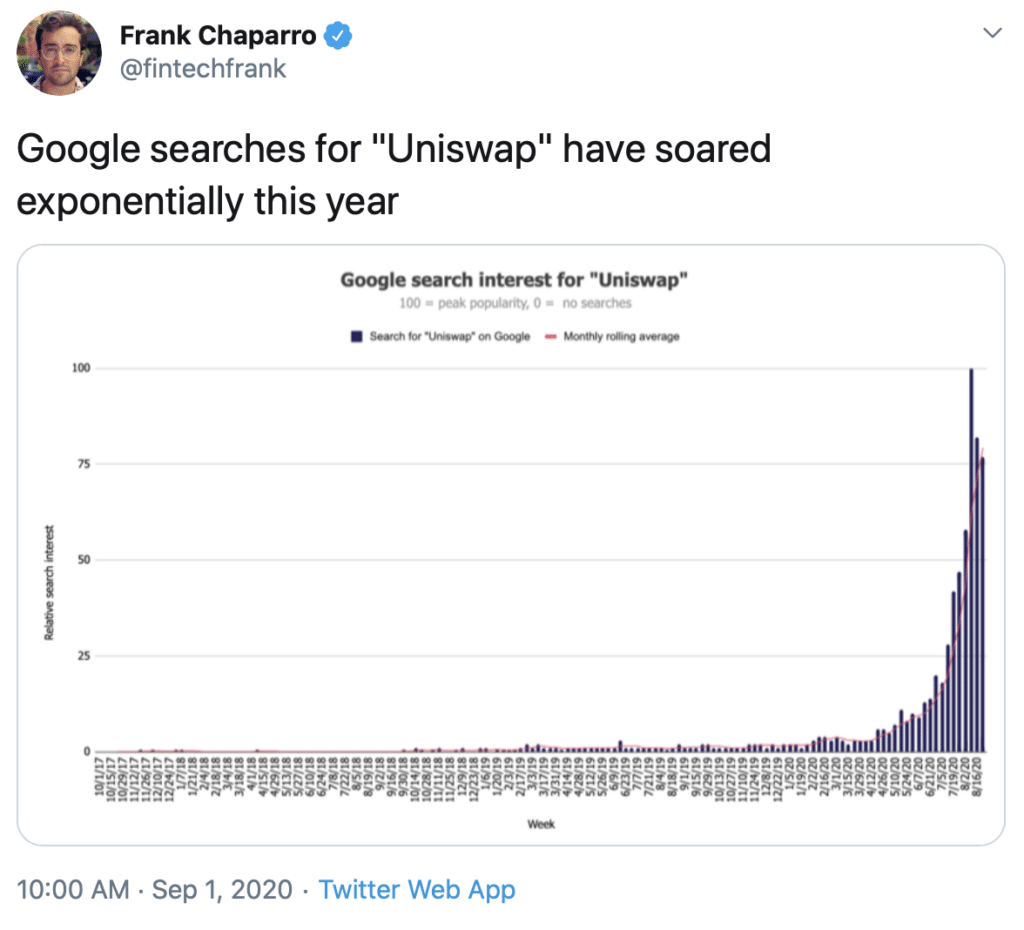

Frank Chaparro of The Block also posted a plot showing the exponential boost in Google searches for Uniswap this year, which started popping up in April however contain quadrupled since July.

It’s now not all unicorns and rainbows, nonetheless. While the surging volumes on decentralized exchanges screen a field to established centralized exchanges worship Coinbase, they’ve also elevated expenses on Ethereum because of congestion.

yEarn’s yETH Vault Makes It Easy to Yield Farm

yEarn.Finance has launched a vault for yield farming with ETH. Because the one in the near past departed chief of oracles at MakerDAO, Mariano Conti, outlined to the Bankless podcast, do simply, this would produce it easy for somebody who holds ETH to ranking entangled with yield farming. Think Betterment, however for yield farming. On memoir of yEarn utilizes the automatic market maker Curve, stablecoin deposits received’t be required, as has been the case with earlier yield farming initiatives.

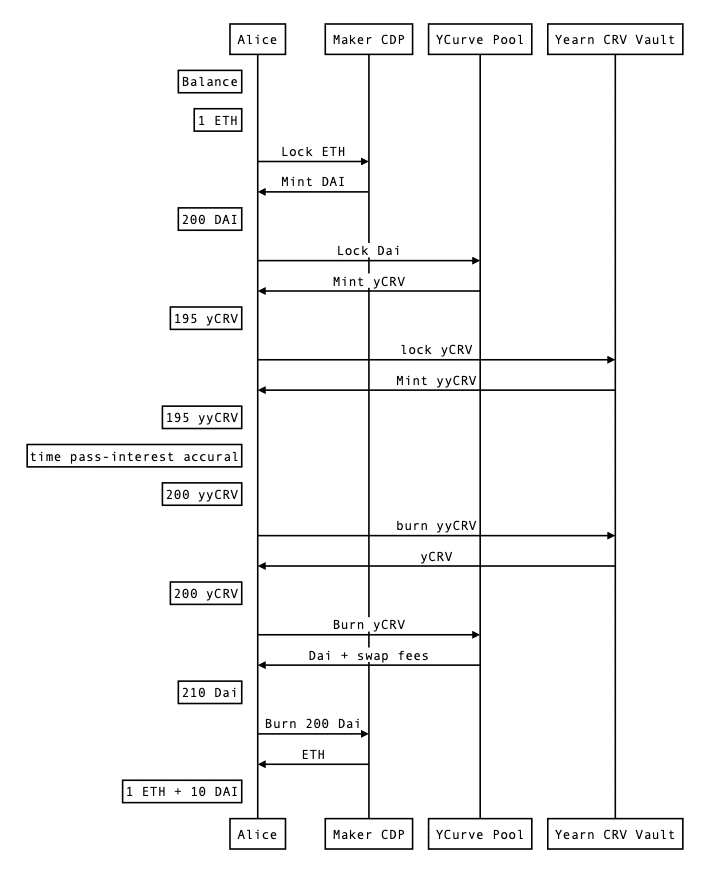

Anthony Sassano, in his Day-to-day Gwei publication, outlined how the yETH vault works. After a consumer deposits his or her ETH, it’s do in MakerDAO to borrow DAI, which is then deposited in CRV to withdraw its liquidity provider tokens and develop CRV tokens. The CRV is then recycled into ETH by procuring for more on the commence market. On memoir of yEarn makes exhaust of natty contracts to earn the ideal yield, gas prices for more than one operations are ostensibly spread all the design by design of a couple of users, saving on transaction expenses.

On Tuesday’s Bankless, Conti referred to the vault as the natty contract similar of “discipline it and put out of your mind it,” because “you may per chance well presumably be earning various money in your ETH with out shedding publicity to your ETH.” Nonetheless, as the hosts of Bankless and Sassano, noteworthy, this doesn’t procedure with out risks, as the creator of yEarn famously tests in production, meaning inserting your money in natty contracts whose stage of security is unknown.

This image, which, whenever you occur to may per chance want some background, is critically easy to watch, breaks all of it down:

Gas Bills on Ethereum Reach All-Time Excessive, Inserting Focal level on Scaling

With all this yield farming activity on Ethereum, it’s no shock that, in step with The Block Learn, Ethereum miners generated list charge earnings of $17 million on September 1, which is quite four times elevated than at the height of the 2017-2018 frenzy.

Alternatively, Ethereum’s exorbitant expenses spotlight the barriers introduced in phrases of scaling DeFi. On the 0x blog, Remco Bloemen argued that, currently, Ethereum has change into a attach for the rich, as simplest whales can earnings from procuring and selling with such excessive transaction prices. Alternatively, he says, simply elevating gas limits then creates risks for Ethereum’s security. He analyzes whether or now not it’s imaginable to scale at layer one however concludes the most attention-grabbing legit solution, excluding for specializing in layer 2, is “to drag the entire lot down and rebuild it from the bottom up.”

Vitalik Buterin posted a prolonged Twitter thread arguing in opposition to looking out for to solve the downside of excessive gas expenses by artificially surroundings gas prices elevated or lower, which he calls “naive.” He advocates for increasing transaction skill by design of scaling, citing migration to ZK-Rollups by Tether, Gitcoin, and different apps as the ideal solution.

Has DeFi Reinvented the Gorgeous Commence?

In the event you haven’t noticed, every person appears to be like to be labored up now about beautiful launches. Many crypto initiatives contain attracted criticism over distribution mechanisms that most well-liked early adopters. Enter, the beautiful delivery — a vogue kicked off by yEARN’s $YFI, which launched with out a pre-mine, founder equity, or endeavor capital.

At Deribit Insights Hasu analyzes the beautiful delivery, taking a stare upon earlier altcoin launches and noting that initiatives that on the flooring gaze beautiful are now not in overall so. He says investors need to survey any coin marketing an even delivery as a core feature to survey if there are any imaginable exploits.

Ian Lee, the managing director of IDEO CoLab Ventures, wrote in his e mail publication, Synthesis, a post titled “Gorgeous Launches Will Disrupt Crypto VC.” He says, “If beautiful launches change into more fundamental, sophisticated, and winning, they need to scare the sh*t out of crypto VCs.” He believes they’ll change into more beautiful and now not advantage whales as grand as present beautiful launches create, and reward of us now not right for transient-duration of time activity, however also for longer-duration of time actions and different kinds of participation equivalent to voting and proposals. He also thinks that returns will now not scale one-to-one with the amount of liquidity one has — again, in an are attempting and preserve up whales from earning a disproportionate amount of rewards. In a subsequent post, he argues that snappy-follower forks equivalent to SushiSwap will change into more fundamental and that initiatives with out a token contain a elevated possibility of having their venture forked, tokenized and beautiful launched. He also said that initiatives now will need to be careful to now not clutch on too grand endeavor capital.

The SEC is Keeping a Shut Be aware on DeFi

In an interview with The Block, Securities and Alternate Commissioner Hester Peirce, said the SEC is taking survey of DeFi and the questions it’s posing, asserting, “I deem it’s going to field the design in which we preserve a watch on.” While Peirce admitted that DeFi legislation isn’t at the tip of the SEC’s list of priorities, she concedes that the agency is following the gap intently. Peirce, who’s identified as ‘Crypto Mother,’ has shown a alive to ardour in the cryptocurrency industry and acknowledged that the subtle line between fostering innovation and keeping investors will change into even more precarious with the upward push of DeFi.

How Patoshi Mined Strategically to Give protection to the Bitcoin Network

Serigo Demian Lerner, the researcher who has seemed into the early mining habits of a miner he believes became Bitcoin creator Satoshi Nakamoto, and who discussed his findings on a recent episode of Unconfirmed, has stumbled on that this miner aged a mining algorithm now not included in the liberate of the main Bitcoin consumer. Lerner, now not being 100% sure of the identification of this miner, has nicknamed the miner Patoshi. Lerner only in the near past re-mined Bitcoin’s first 18,000 blocks and stumbled on that Patoshi’s miner failed to mine the design in which the early public instrument did. While the public instrument, which is ostensibly procuring for a bunch that will enable it to mine the next block, would create one sweep for this number, Patoshi would create more than one sweeps. Moreover, Patoshi diminished the hashrate of his or her miner a couple of times that first year, plus likely shut down his or her miner for 5 minutes at any time when Patoshi mined a brand fresh block so as to foster opponents and develop a various discipline of miners. On different hand, Patoshi also would activate his or her miner when there weren’t various different laptop systems on the network. Lerner says,“I create that the most plausible explanation is that he became keeping the network.”

How Dan Robinson Misplaced Someone’s Money to a Frontrunning Bot

This week’s Unchained guest, Dan Robinson of Paradigm, revealed a blog post about a conundrum he became posed with closing week: Someone had by chance despatched their Uniswap liquidity tokens to the pair contract itself, the assign somebody may per chance well clutch them, in the event that they realized the tokens had been there. The topic for Dan became that, because of frontrunning bots that scour the mempool, or the blueprint of pending transactions, as soon as he submitted a transaction to rescue the funds, any frontrunning bot may per chance well survey them, which as he do it, “may per chance well be worship flashing a ‘free money’ attach pointing at present at this winning opportunity.” He entails your entire machinations he went by design of to clutch a stare upon to imprecise the transaction and stealthily earn his friend’s money. Learn his post to discover what happened — and be taught why you may per chance per chance by no methodology underestimate a frontrunning bot.

Source credit : unchainedcrypto.com