How the Bybit Hack Finds an Commerce Peaceable Striving for Transparency

After North Korean hackers stole 400,000 ether from the crypto exchange Bybit on Friday, CEO Ben Zhou and the the leisure of his team swiftly moved to reassure possibilities that their money changed into protected and the exchange is solvent.

In a Twitter Areas held on February twenty 2nd, ultimately after the attack, Zhou acknowledged that his chief financial officer told him, “Sure, now we contain sufficient treasury to duvet this [the loss].” Zhou went on to claim within the interview, he changed into “now now not definite how distinguished of our “how distinguished liquidity [was] thru which tokens” and “if now we contain sufficient ethereum” to route of the coming wave of withdrawals.

Alternatively, the staunch story is rather extra complex. It appears to be like that the firm may perhaps well perhaps possibly had been left with a $385 million hole in its exchange wallets earlier than remedying it with loans from industrial partners. Whereas it’s commendable that Bybit changed into in a save of living to temporarily poke the gap so swiftly, this preliminary shortage finds why present industrial standards for transparency, particularly Proofs of Reserves, are lacking for crypto exchange possibilities.

(Insufficient) Proofs of Reserves

The collapse of FTX in 2022 changed into a wakeup demand the entire crypto industrial. It confirmed millions of crypto merchants spherical the globe that they couldn’t belief what their computer and telephone monitors were displaying them. The displayed balances grew to alter into out to be an illusion when info broke that Sam Bankman-Fried raided billions of greenbacks in buyer funds for his contain functions.

One of the best attain to resolve this command is thru an audit, a comprehensive route of managed by an accounting firm that appears to be like at monetary inflows and outflows over time and additionally considers any liabilities or liens that a firm may perhaps well perhaps possibly also merely contain that can within the discount of reduction recoverable property by possibilities. Such an audit is an crucial on the earth of crypto since there isn’t this form of thing as FDIC insurance protection, which guarantees U.S. bank deposits up to $250,000 per legend.

As a result of crypto’s volatile popularity, it has been complex for heaps of companies to salvage audits, and people that originate now now not steadily ever manufacture them public. This means that possibilities contain diminutive different however to rely on an different attain for an exchange to present solvency, a Proof of Reserves (PoR).

These reports, which are equipped by with regards to every major exchange on their web sites, purpose to originate two issues.

- Point to crypto balances at certain 2nd in time at a suppose exchange for each of the tokens equipped for procuring and selling

- Offer a attain thru a cryptographic mechanism called Merkle Trees to let possibilities gape that their suppose balances are integrated within the totals displayed on the score mutter

PoRs are a huge construction, however they are insufficient. In a 2022 interview with Forbes, Kraken founder Jesse Powell highlighted the diversities between an audit and a PoR. “You don’t know if we exact borrowed 100,000 bitcoin from some regarded as one of our merchants or something to originate this snapshot. And then, you understand, we despatched it reduction 5 minutes later.”

Additionally, for a firm adore Bybit, which perfect updates its normal PoR once a month, it puts extra onus on the client to belief that funds within the file will assign there. The aim needs to be extra normal readouts, per chance in exact time. “Whereas you originate this [release attestations] extra frequently, those forms of issues are less more in all probability to happen and extra more in all probability to be seen,” acknowledged Powell. “Order as an illustration you gape 100,000 coins transferring, you understand, on the thirtieth of every month on chain.”

A Bybit spokesperson told Unchained that the exchange is audited, however did now not mutter the name of the auditor or piece any additional crucial functions.

Bybit’s Closing PoR Sooner than the Hack

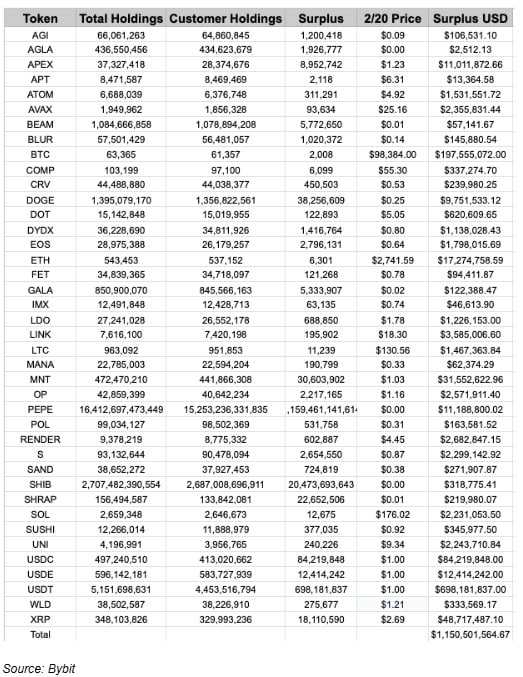

Coincidentally, Bybit published a PoR on February Twentieth, ultimately earlier than the hack. Based entirely on the knowledge, which is presented within the table below, the firm had approximately $17.47 billion rate of property on the platform for the time being. Of that total, $16.3 billion were liabilities within the produce of buyer deposits. This leaves a surplus of $1.15 billion in property spread across every thing from stablecoins to bitcoin, ether, and extra esoteric tokens adore Decentraland’s MANA—unless the firm has additional reserves now now not integrated in its proof of reserves.

But, when North Korea’s Lazarus Group took $1.5 billion rate of ether on February 21st, it left a $385 million total hole within the firm’s posted PoR.

Within the ensuing days Bybit labored diligently with partners adore crypto exchanges MEXC and Bitget, as effectively because the high dealer Antalpha to salvage the PoR recapitalized. In an announcement this morning, the firm acknowledged that it has restored “77% of its Resources Below Administration (AUM) to pre-incident ranges” and its ether collateralization diploma is reduction up to 102%.

This swiftly action has calmed the markets, however it doesn’t display mask whether any of the ether received by Bybit post-hack is encumbered in any attain, or what prerequisites Bybit agreed to for the funds. The answer cannot be discovered in a PoR.

How an Audit Completes the Picture

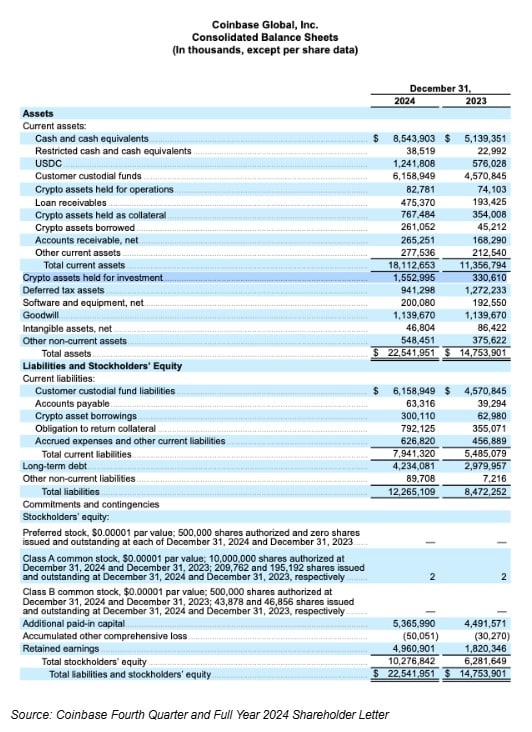

For a publicly traded exchange adore Coinbase, somebody can swiftly peek at its audited balance sheet to peek its pudgy financial portray. The firm’s balance sheet from Q42024, which changed into released on February 13, 2025 shows that the firm has $1.5 billion in property held for investment below property, which attain that they are within the discount of free any buyer liabilities. Curiously, this number is perfect $385 million extra than Bybit’s pre-attack surplus.

However the extra crucial allotment of the balance sheet is the firm’s $10.28 billion in stockholder fairness. This will in all probability perhaps perhaps also be regarded as as extra capital that will almost definitely be deployed for widespread industrial functions or as an emergency fund. There are two major ingredients of stockholder fairness: retained earnings of $4.96 billion, which attain income which contain now now not been taken out the firm by shareholders, and $5.4 billion of additional paid-in capital, which attain money paid by merchants above par save of the stock $0.00001 over assorted sales right a ways from the firm. Particular timelines for the sales will in all probability be viewed within the below balance sheet.

For a personal firm adore Bybit, appealing its retained earnings may perhaps well perhaps be particularly helpful, irrespective of whether it’s within the produce of crypto, stablecoins, or fiat. But that knowledge is now now not publicly on hand.

How Bybit Can Invent Up the Disagreement

Bybit is the arena’s 2nd biggest crypto exchange by procuring and selling quantity, and though the firm did now not provide any additional crucial functions about its financial standing, industrial insiders imagine that there are a complete lot of programs for the firm to poke the gap. One industrial accomplice acknowledged on the situation of anonymity that the firm in all probability had retained earnings now now not counted within the PoR however couldn’t interpret.

The CEO of a rival exchange, who additionally agreed to talk on the situation of anonymity acknowledged that the firm may perhaps well perhaps manufacture up the deficit in just a few months and the entire loss in just a few years. Alternatively, he additionally cautioned that loads goes into the costs of working an exchange. “My baseline bet for a compatible exchange industrial may perhaps well perhaps be a 50% profitability rate,” he acknowledged, adding that bloating advertising and marketing and regulatory compliance budgets can swiftly motive expense ratios to sky-rocket. Assuming that the $1.5 billion hack may perhaps well perhaps legend for a twelve months’s rate of income for Bybit, “then it would take on the very least two years for the exchange to manufacture up the money that changed into misplaced.” That acknowledged, the save of ether has already fallen from $2,800 to $2,300 for the reason that attack, in mutter that can lessen the length of time that it takes to manufacture up the distinction assuming that there is now now not an offsetting decline in procuring and selling quantity.

One other attain to poke the gap would be convalescing the stolen funds. Many groups contain equipped to freeze property if or when it becomes conceivable. The firm has misplaced a bounty program rate up to $140 million for assistance in freezing and convalescing the funds. To this point the firm has paid out $4.23 million, with the wonderful bounty going to Mantle who iced over 15,000 mETH ($34 million).

So there are quite quite a bit of programs for Bybit to salvage better. But as crypto enters a unusual age of legitimacy in 2025 it is crucial to maintain pushing on the transparency part as effectively.

Source credit : unchainedcrypto.com