How Some Set Bitcoin ETF Issuers Are The use of Crypto Memes to Develop a Marketing and marketing and marketing Edge

The tickers of the 11 only within the near past-licensed bother Bitcoin ETFs would maybe maybe change into an now no longer renowned differentiating ingredient among them, as payments continue to shrink.

Not easiest possess almost all of the ETF providers waived their payments fully for an introductory length, but they’ve consistently decrease their longer-length of time payments in uncover to reside competitive. On Friday, Franklin Templeton decrease its put up-waiver price to lawful 0.19%, the lowest within the neighborhood, whereas Valkyrie dropped its put up-waiver price to 0.25%, correct within the heart of the pack.

Learn extra: Why Set Bitcoin ETFs Are (Nevertheless Largely Aren’t) a Unparalleled Deal for Crypto

With this intense price opponents, the names of the ETF tickers would maybe maybe emerge as the biggest distinction to plan investors. Let’s assume, VanEck’s HODL and Valkyrie’s BRRR ETFs reference in style memes and jokes.

Persist with it for Dear Existence

“HODL,” in step with the unsuitable spelling of the be aware “take care of,” is broadly identified within the crypto ecosystem to mean “elevate on for expensive lifestyles,” implying now no longer selling when markets are volatile. A Bitcoin fanatic, who goes by the screen name “GameKyuubi,” first historical the length of time on Dec. 18, 2013, on the Bitcointalk dialogue board to steer americans to now no longer promote their BTC.

VanEck, which did now no longer straight reply to Unchained’s put a question to to comment, determined to capitalize on one in all the longest-running memes within the crypto space by naming its bother Bitcoin ETF “HODL,” which is “legendary,” Jim Hwang, chief working officer at Firinne Capital, wrote in a textual enlighten message to Unchained.

“Tickers are take care of branding. Build an correct tag and it turns into memorable,” renowned Hwang. “Tickers with straightforward mnemonics assist investors recall and partner with the investment product.”.

Cash Printer Scramble BRRR

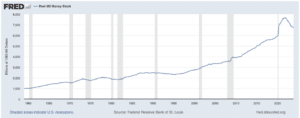

“BRRR,” on the opposite hand, is a reference to how the United States Federal Reserve has a cash machine that would maybe print an never-ending quantity of cash, making the sound “BRRR,” a stark inequity to Bitcoin’s most provide of 21 million tokens. The United States’ cash provide has elevated almost sevenfold since 1960, in accordance with files from the Federal Reserve Financial institution of St. Louis.

Crypto enthusiasts – namely Bitcoin maximalists, americans that possess an unshakable belief that Bitcoin is the most straightforward the truth is helpful cryptocurrency – usually shaggy dog fable about how the U.S. buck does now no longer possess a most provide.

Cash printer plug brrr 👇 pic.twitter.com/wgGF4CFvrT

— Altcoin Each day (@AltcoinDailyio) November 12, 2021

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/gaze?v=ZLlcv5nAm2Y&t=370s

src in org: https://www.youtube-nocookie.com/embed/ZLlcv5nAm2Y?start=370&goal=oembed

src in mod: https://www.youtube-nocookie.com/embed/ZLlcv5nAm2Y?start=370

src gen org: https://www.youtube-nocookie.com/embed/ZLlcv5nAm2Y

Fancy VanEck, Valkyrie’s ETF ticker due to this truth also references a crypto meme in an are trying and uncover apart itself from other ETF tickers reminiscent of Grayscale’s GBTC or BlackRock’s IBIT. Valkyrie did now no longer straight acknowledge to Unchained’s put a question to for comment.

Plan for Marketing and marketing and marketing

“Tickers possess long been identified as an efficient marketing tool for ETF issuers. Since there are extra than 3,000 ETFs available within the market, a relaxing and valuable ticker would assist investors search and observe, namely for self-driven trading platforms,” in accordance with ETF-extinct-turned-crypto-investor Kelly Ye, who’s the portfolio manager at Decentral Park Capital.

“For Bitcoin ETFs in enlighten, since the goal target audience is extra inclined to be younger investors, a cool and valuable ticker would maybe maybe plug viral,” wrote Ye to Unchained on Telegram.

An ETF’s ticker would maybe maybe even change into extra principal than the explicit price structure, in accordance with Firinne Capital’s Hwang. “There are loads of similarities across these ETFs so sponsors are competing on tag, their marketing efforts, and payments.”

James Seyffart, an ETF analyst with Bloomberg Intelligence, mentioned the extra whimsical tickers would maybe maybe signal that these ETFs are aimed at retail, reasonably than institutional investors.

“The less relaxing a ticker is, the extra it is going to be that the goal market is extra for monetary advisors and institutions and the prosperous investors they service,” Seyffart informed Unchained. “The extra relaxing the ticker take care of BRRR, HODL, and [Hashdex’s] DEFI would maybe also signify these issuers are a diminutive extra aimed at retail investors. Or in this case — the crypto and Bitcoin crowd. That mentioned, right here’s lawful a diminutive share of the calculus.”

“It’s sophisticated,” added Ye when requested if a ticker’s name can change into extra principal than its unswerving price. “For the reason that underlying asset is Bitcoin, which is straightforward and already a hot topic among retail, marketing performs a mountainous role. Ticker is one in all the marketing tools issuers use.”

On the opposite hand, on the pause of the day, investors can keep in mind a unfold of components, reminiscent of payments, monitoring error, execution, and issuer background, Ye mentioned.

Source credit : unchainedcrypto.com