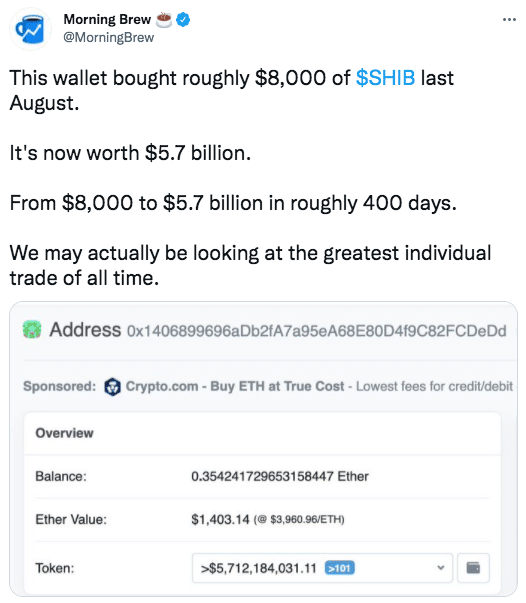

Holy SHIB: Somebody Grew to become $8,000 to $5.7 Billion in ~400 Days

October 28, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

Ethereum’s provide is on tempo to yearly shrink as a result of the introduction of EIP 1559 to the network.

-

SHIB, a meme token, broke into the end 10 cryptocurrencies per market cap the day past following a 70% sign spike in 24 hours.

-

El Salvador’s President, Nayib Bukele, announced the nation “sold the dip” the day past — to the tune of 420 BTC.

-

Blockchain firms petitioned Valve, the firm in the relieve of the gaming platform Steam, to reverse its decision to boot NFT video games from its platform.

-

Coinbase skilled prolonged outages on Wednesday affecting its main app, along with Coinbase Pro and Coinbase credit playing cards.

-

BanklessDAO launched a brand new index on Index Coop the tell of the ticker $GMI.

-

The Direxion Bitcoin Strategy Salvage ETF would retain rapid publicity to BTC future contracts if authorized by the SEC.

-

Biden’s nominee to pass the CFTC wants the CFTC to be the “main cop” on the crypto regulatory beat.

-

Bitcoin dropped underneath $60,000 for the first time in 10 days the day past.

-

Anchorage, a crypto financial institution, is place of dwelling to teach a funding spherical that might sign the firm between $2 billion and $3 billion.

-

The Cryptocurrency Assignment Pressure of Miami-Dade County in Florida is creating a job power to search the feasibility of accepting cryptocurrency as payment.

What Enact You Meme?

What’s Poppin’?

Cream Finance, a DeFi lending protocol, used to be hacked the day past. In step with Cream’s Twitter yarn, the attacker removed roughly $130 million rate of crypto tokens from their markets earlier than a patch might perchance per chance be implemented.

PeckShield first identified the flash-mortgage exploit at 9:12 am ET, at which period CREAM used to be trading at roughly $150 per token, per CoinMarketCap. By 10:00 am ET, CREAM had fallen underneath $120, where it stayed for the remainder of the day.

Significantly, the attacker appears to be expert, because the flash mortgage exploit fervent 69 token transfers and rate 9.16 ETH in gasoline to achieve. Mudit Gupta, a blockchain safety researcher, outlined 23 certain steps the attacker took in his prognosis of the hack. “The attacker actually idea this via,” acknowledged Gupta on Twitter. “They even sold some dusd and redeemed it for yUSD that they are able to burn to minimize complete provide of yUSD. Decrease complete provide requires smaller donation to double its sign. Total, this used to be a extremely detailed exploit,” he added.

That is the third time that Cream Finance has misplaced funds this one year to flash mortgage assaults. In February, Cream misplaced $37.5 million to an attacker the tell of Alpha Homora, and in August, Cream suffered an exploit of roughly $25 million via a malicious program in its AMP token contract.

Suggested Reads

- Will Clemente, an on-chain analyst at Blockware, on Bitcoin sign targets:

- An anon on the legality of DAOs:

- John St. Capital on DAOs and crew investing:

On The Pod…

Now now not Reporting Data on Some Transaction Partners Might perchance perchance Soon Be a Felony

Take into accout the $1 trillion infrastructure bill, which caused appreciable backlash from the crypto community as a result of the language concerning “brokers?” Abe Sutherland, an adjunct professor at University of Virginia College of Regulation, believes but any other provision tucked at some level of the bill might perchance end up being a much extra serious problem for somebody transacting in digital property. Mumble highlights:

-

how Abe fell down the crypto rabbit gap

-

what provision 6050I is and the intention in which it will hold an affect on somebody transacting with digital property

-

how 6050I works and when it can per chance per chance put collectively

-

why violating 6050I will be a criminal

-

how 6050I discourages digital asset transactions

-

how 6050I would put collectively to varied transaction forms, esteem stumble on-to-stumble on trades, NFT gross sales, and tidy contract escrow accounts

-

what files recipients of digital property must check from the sender

-

how the federal government came up with the $10,000 reporting threshold and why Abe believes this quantity is outdated

-

why Abe thinks proposing 6050I interior the infrastructure bill is excessive

-

what reasons the federal government has to are making an are trying to position such stringent reporting requirements on digital asset transactions

-

how 6050I suits underneath the financial laws of the Monetary institution Secrecy Act

-

why Abe believes the amendment might perchance level-headed be struck from the infrastructure bill

-

what Abe thinks of the constitutionality of 6050I

-

how Abe views 6050I as much less about generating tax income and additional about tracking of us’s digital asset transactions

-

what motion steps he says the crypto community can lift to fix the bill

E book Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, is now on the market for pre-teach now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-teach it as of late!

You’d purchase it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com