Here’s the Most widespread on Celsius

June 17, 2022 / Unchained On daily foundation / Laura Shin

On daily foundation Bits✍️✍️✍️

-

Finblox, a crypto yield platform, announced a $500 day to day withdrawal restrict and a $1,500 most monthly withdrawal restrict for all customers in light of a “extremely volatile market” and ensuing from their relationship with Three Arrows Capital.

-

Tron DAO Reserve announced that it’s withdrawinganother $180 million value of TRX from varied exchanges to attend toughen the USDD peg.

-

Elon Musk is being sued for $258 billion over Dogecoin.

-

Circle announced the originate of Euro Coin this week, a in point of fact-reserved, Euro-backed stablecoin.

-

Inverse Finance became exploited for $1.2 million in a flash loan attack.

-

xDEFI, a crypto wallet, added toughen for Arbitrum.

-

Huobi is shutting down in Thailand after the nation revoked the bogus’s working license.

-

BitMEX co-founder Benjamin Delo became sentenced to 30 months probation.

At the present time in Crypto Adoption…

-

McKinsey believes the metaverse would be value $5 trillion by 2030.

The $$$ Nook…

- Animoca Manufacturers got an 80.forty five% stake in blockchain education platform TinyTap for $38 million in money and shares.

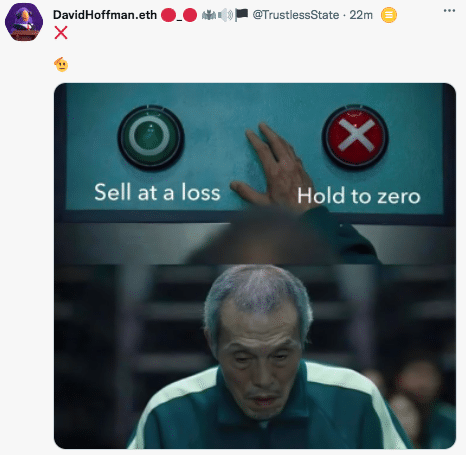

What Fabricate You Meme?

What’s Poppin’?

Here’s the Most widespread on Celsius

Merchants in the crypto lender Celsius are “no longer going” to design extra funds to bail out the crypto lender, in accordance to a reportfrom the Wall Street Journal. The article names outdated investors much like Caisse de dépôt et placement du Québec, a Canadian pension fund, and WestCap Personnel as entities which would be no longer in providing extra capital to Celsius right this moment.

The knowledge coincides with a memoir from Reuters pointing out that regulators all the map by a diversity of states are origin to evaluation Celsius Community in lieu of its decision to freeze buyer withdrawals. Reuters says that reveal securities regulators in Alabama, Kentucky, Texas, and Glossy Jersey are having a glimpse into the topic, with Texas regulators namely being quoted as making the probe a “precedence.”

“I am very concerned that clients—including many retail investors—could maybe well also must straight entry their resources yet are unable to withdraw from their accounts,” mentioned Joseph Rotunda, Texas Disclose Securities Board’s director of enforcement, to Reuters. “The incapacity to entry their investment could maybe well also stop up in considerable monetary consequences.”

Rotunda also mentioned that regulators had been in touch with Celsius since Monday, a day after Celsius announced to its 1.7 million potentialities that it became pausing withdrawals.

There has been puny else communicated from Celsius since their Monday assertion to customers about halted withdrawals. On Wednesday, CEO Alex Mashinsky tweeted that the lender became “working non-cease,” though he did no longer expose any facts about what the crew became engaged on. One map of action that is being hinted at is a monetary restructuring. The Block reportedearlier this week that Citigroup became led to to the case by Celsius to uncover on that you simply would disclose financing alternate choices, much like a advice from rival crypto lender Nexo to produce Celsius’ resources. Furthermore, Celsius also hired restructuring attorneys from Akin Gump Strauss Hauer & Feld LLP.

Rapid Reads

-

SEC Commissioner Hester Peirce on the bitcoin ETF:

-

Vitalik Buterin on the exhaust of ZK-SNARKs:

-

The DeFi Edge on 3AC (microscopic correction: 3AC is largely a proprietary trading firm):

On The Pod…

Mika Honkasalo, just crypto researcher, discusses what’s going on with Celsius and Three Arrows Capital, the importance of getting lawful chance management, and the contagion effects on the industrial.

Deliver highlights:

-

why is it so considerable that Celsius paused withdrawals

-

what’s stETH and why is it crucial to love the Celsius order

-

how the Luna/UST debacle started a contagion design in the crypto reveal

-

why Celsius’s investors obtained’t bail the corporate out

-

what’s going to happen to Celsius’s retail potentialities

-

what Three Arrows Capital (3AC) is and whether or no longer they’ve a solvency self-discipline

-

how 3AC became levered lengthy and whether or no longer they had dejected chance management

-

who shall be afflict if 3AC goes underneath

-

what steadily is the design of 3AC and Celsius collapsing

-

which forms of funds that Mika shall be eyeing to glance if they also stop up in a linked order to 3AC and Celsius

-

why Mika would counsel anybody who keeps their money with centralized crypto lenders to conception their practices

Book Replace

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mighty Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now on hand!

You need to maybe maybe well per chance also accept as true with it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com