Right here’s How Bitcoin Will get to $50,000

Plus: the crypto firms turning away industry

What would possibly well display cover to be the crypto info of the One year broke this week, with the prolonged-rumored announcement by PayPal that improve for shopping, selling, hodling, and shopping will rapidly make its map to the firm’s customers. Filecoin continues forward with its prolonged-awaited mainnet as several of its high miners object to the financial mannequin.

Fed Chair Powell continues to ponder a digital greenback. We moreover bear the convey of crypto in 2020, in accordance with Digital Currency Community. There’s details about how Bitcoin adoption benefits the continuing protests in Nigeria, regulatory roundups, overwhelming requests for DeFi audits, and extra.

On Unchained, two people of a DOJ strike force centered on cryptocurrency criminals whine how they prosecuted about a of the biggest conditions animated Al Qaeda, ISIS, Hamas, North Korea, the creators of the biggest on-line child porn pickle and extra. And on Unconfirmed, on-chain Bitcoin analyst Willy Woo describes the adjustments he’s seeing in the Bitcoin markets, and explains what this would possibly well well grab to salvage to a $50,000 Bitcoin.

This Week’s Crypto Data…

Crypto to Technique to PayPal; Bitcoin Bounces

PayPal launched Wednesday that it would possibly well perchance most likely well add improve for Bitcoin and quite so a lot of cryptocurrencies in the fundamental half of 2021. The firm plans to let its 346 million customers have and store the digital currencies in its on-line wallet and use bitcoin, ether, litecoin and bitcoin cash for purchases at its 26 million retailers. PayPal moreover plans to make greater improve for Bitcoin and quite so a lot of cryptocurrencies to Venmo in the fundamental half of 2021.

Within the mean time, PayPal will no longer give users salvage entry to to non-public keys or the capability to switch their crypto to quite so a lot of accounts on or off the platform. This resolution became once met with anticipated criticism from the crypto neighborhood. On the other hand, Cinneamhain Ventures accomplice Adam Cochran speculates that PayPal selected to end this attributable to “correct now they bear got to earnings on unfold and bear to salvage sturdy AML in role for transfers.” My non-public guess is that they moreover bear to salvage the splendid fraud protections in role so they don’t salvage eaten alive by fraudsters stealing bitcoins from their platform.

The Block’s Ryan Todd notes that PayPal operates in many jurisdictions which would possibly well well be no longer crypto-pleasant, and so this switch would possibly well force tax regulators to take into chronicle de minimus tax exemptions for paying with crypto. Learning between the strains of the investor family release, in which the firm mentions working with central banks and exploring quite so a lot of use conditions, Todd moreover speculates that here is the fundamental step of a elevated belief to make greater into central financial institution digital currencies and stablecoins.

After the PayPal info, the price of Bitcoin saw a huge rebound to $13,000 as of press time. On CNBC Thursday morning, billionaire hedge fund manager Paul Tudor Jones, who made info earlier this One year when he invested in bitcoin, compared investing in BTC to striking early cash on the support of tech firms like Apple or Google. He acknowledged, “Bitcoin has this colossal contingent of basically, basically natty and complicated these that basically judge in it. … I’ve by no means had an inflation hedge the place you bear a kicker however you moreover bear gargantuan mental capital on the support of it. … If you short the bond market — that’s your inflation hedge — you’re basically making a wager on the fallacy of mankind in role of its ingenuity and entrepreneurialism. So I admire bitcoin great extra now than I did then.”

Are Filecoin Miners on Strike?

A complete lot of fundamental Filceoin miners bear halted or diminished their mining energy since the community’s mainnet start splendid week. The blame for the slowdown is Filecoin’s new financial incentive mannequin, which many miners feel is no longer of their desire attributable to it doesn’t give block rewards to miners without extend however instead vests over 180 days. A lot of the high ten miner IDs bear greatly diminished the amount of storage energy they contributed in some unspecified time in the future of the testnet.

A fundamental Filecoin miner, Li Bai, rejected the idea that the diminished mining energy became once an organized, collective strike, asserting, “It’s no longer a strike. It’s spicy a greater map, given the new economics. With extra capability sell rigidity when there’s no sufficient circulating $FIL at a accurate trace vary, it’s no longer lucrative to pledge a convey $FIL for a future $FIL whose trace would possibly well be lower.”

In a Twitter thread Monday, Protocol Labs founder and CEO Juan Benet known as the miner strike “nonsense.” He acknowledged, “in splendid 2 weeks, *we* the devs suggested to many miners to decelerate enhance rate to match their token spin, or end till they’ll come up with the cash for to grow incessantly.” He continued, “there are alternative of us hoping to salvage rich rapid with filecoin without contributing price to the community — that’s spicy no longer the map in which it works. This isn’t what the protocol rewards. … we bear already received huge ability, and don’t need great extra but. The community must now focal point on making that ability recommended, by storing treasured info for users.”

Fed Chair Powell Continues to Ponder a Digital Dollar

Federal Reserve Chairman Jerome Powell acknowledged in some unspecified time in the future of a panel discussion hosted by the World Financial Fund on Monday that the U.S. continues to overview central financial institution digital currencies. Powell acknowledged a CBDC would possibly well crimson meat up the broader price machine in the U.S. and reiterated that the Fed has made no resolution on a central financial institution digital currency at the moment. He acknowledged, “I judge it’s extra valuable for the united states to salvage it correct than it is to be first.”

Regulatory Roundup

- A proposed judgment between Kik and the Securities and Change Price would inspect Kik paying a $5 million spicy over its 2017 token sale, as properly as giving the SEC 45 days’ behold on any Family token transactions over the following three years.

- The Financial Crimes Enforcement Network fined Helix and Coin Ninja founder Larry Dean Harmon $60 million for violations of the Bank Secrecy Act because of his operation of what they name digital currency “mixers.”

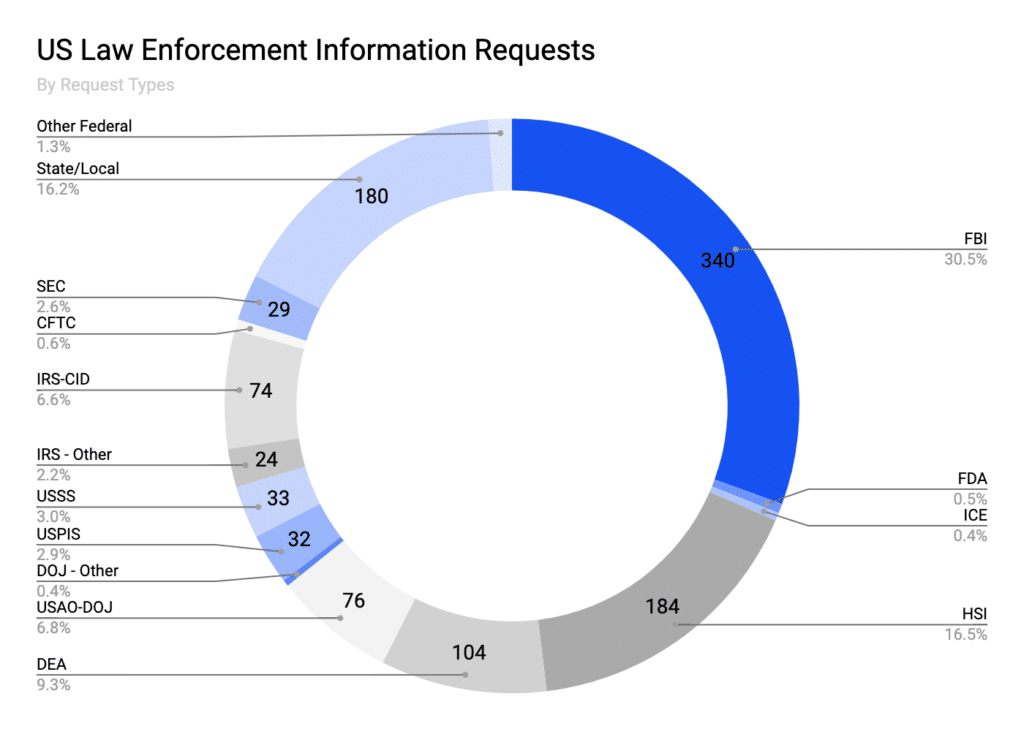

- Coinbase published a transparency document of authorities requests that showed 97% were concerning prison activity, with the overwhelming majority from US regulators. Of these, the FBI made up 30% of these inquiries, Place of origin Security Investigations comprised 17% and convey and native regulators accounted for 16%.

Digital Currency Community’s Express of Crypto 2020

Digital Currency Community’s annual Express of Crypto document, which polled the founders and CEOs of its 150 portfolio firms, paints a image of an outperforming industry amidst the COVID-19 pandemic and ensuing financial shockwaves. 2020 has viewed Bitcoin volatility nearing all-time lows in the splendid half of the One year as signs of a world financial slowdown bear exacerbated local currency devaluation fears in emerging markets.

While one in 5 executives pointed to far-off work and operational interruptions because of COVID as a serious distress faced in 2020, one in four moreover felt that a world recession would bear the splendid influence on digital currency adoption. As for the splendid risk to the industry, 51% cited compliance and law as an obstacle to sustainable enhance.

Respondents named the upward push of DeFi as the most bullish development of 2020. Those interviewed appeared unconcerned with the ebbs and flows of token prices, noting overall protocol development and industry enhance bode properly for the industry’s future. They moreover contrasted the DeFi surge with the ICO bubble of 2017, asserting that expertise and professionalism are extra productive and moral than earlier than. As for whether Ethereum would live the chain of preference for DeFi, response became once ruin up, with 51% of respondents asserting wander and the remaining asserting “uncertain” or “no.”

DeFi Audit Firms Are Overwhelmed With Requests

Given the a bunch of exploits in unaudited DeFi contracts up to now this One year, it’s doubtless no surprise that audit firms were swamped with requests from DeFi initiatives. The ask has been solid no topic a swift pullback in the DeFi markets, with most tokens falling 19% in the splendid month. Firms corresponding to OpenZeppelin bear acknowledged they bear got booked customers properly into 2021, with “governance token clones of varying quality” making up great of the requests. Audit firm Quantstamp, which disclosure, has been a sponsor of my reveals, acknowledged that it is “rejecting hundreds initiatives.”

Protests in Nigeria Highlight Bitcoin Adoption

Protesters in Nigeria are calling for the disbandment of the special anti-theft squad, aka SARS, accused of illegal homicide, extortion, and torture of harmless civilians. And how are they funding their protests? Bitcoin. The Feminist Coalition, a Nigerian activist neighborhood that had first and significant began elevating funds in so a lot of fiat currencies, stumbled on its financial institution accounts frozen internal days and quickly requested donors to divert their funds to Bitcoin wallets. By October 18, the coalition had raised greater than 7.2 bitcoin, or $82,000, which accounts for 44% of the total funds raised up to now. Likewise, Bundle CEO Yele Bademosi launched that the firm had pickle up crypto wallets to abet lift funds globally in improve of the protesters. Within about a days, the message had begun to unfold, with Twitter CEO Jack Dorsey tweeting his improve for the shriek, among others.

Bitcoin’s use in this case highlights the broader adoption of crypto by a predominantly younger, tech-savvy population of Nigerians. Crypto adoption in Nigeria has grown greatly in the splendid One year as voters grapple with an inflationary local currency and a rising diaspora taking a cost to ship remittances home. Chainalysis ranked Nigeria eighth in its 2019-2020 global adoption index. The nation moreover ranked first among African countries in search for-to-search for payments, appealing $139 million in the splendid One year, as Nigeria’s federal authorities makes plans to wander the map for blockchain adoption.

How Paradigm 3xed Its Preliminary Round in 2 Years

My veteran colleague Alex Konrad at Forbes had a gargantuan characteristic out this week about Paradigm, the crypto VC firm founded by Matt Huang previously of Sequoia Capital and Fred Ehrsam, the cofounder of Coinbase. It minute print how they received marquee institutional investors just like the Harvard and Stanford endowments to present them $750 million — and Huang and Ehrsam set aside all of it into cryptocurrencies, largely Bitcoin, when the bubble had basically deflated in 2018. As Konrad studies, “Bitcoin has tripled in price since Paradigm’s funding, meaning as adversarial to any quite so a lot of bets it’s made, Paradigm’s starting bankroll is already price 3x.” 😮

A Well timed Throwback to a Crypto World Without Paypal

In accordance with the PayPal info this week, Charlie Shrem tweeted a whine of him, Charlie Shrem and Roger Ver at Money 2020 in 2012 for his or her then-firm BitInstant. Charlie acknowledged, “We told them we wanted the handiest booth we are able to also come up with the cash for, however we mandatory to be subsequent to the @PayPal booth so we are able to existing the sector OUR financial machine!” ShapeShift CEO Erik Vorhees’s retweeted the whine, and commented, “I distinctly remember the PayPal folks snickering at us 😏”

I distinctly remember the PayPal folks snickering at us 😏 https://t.co/hKGj1qHDJz

— Erik Voorhees (@ErikVoorhees) October 21, 2020

Source credit : unchainedcrypto.com