Grayscale’s Solana Have faith Continues to Alternate at a High Top charge After 2 Insist SOL ETF Filings

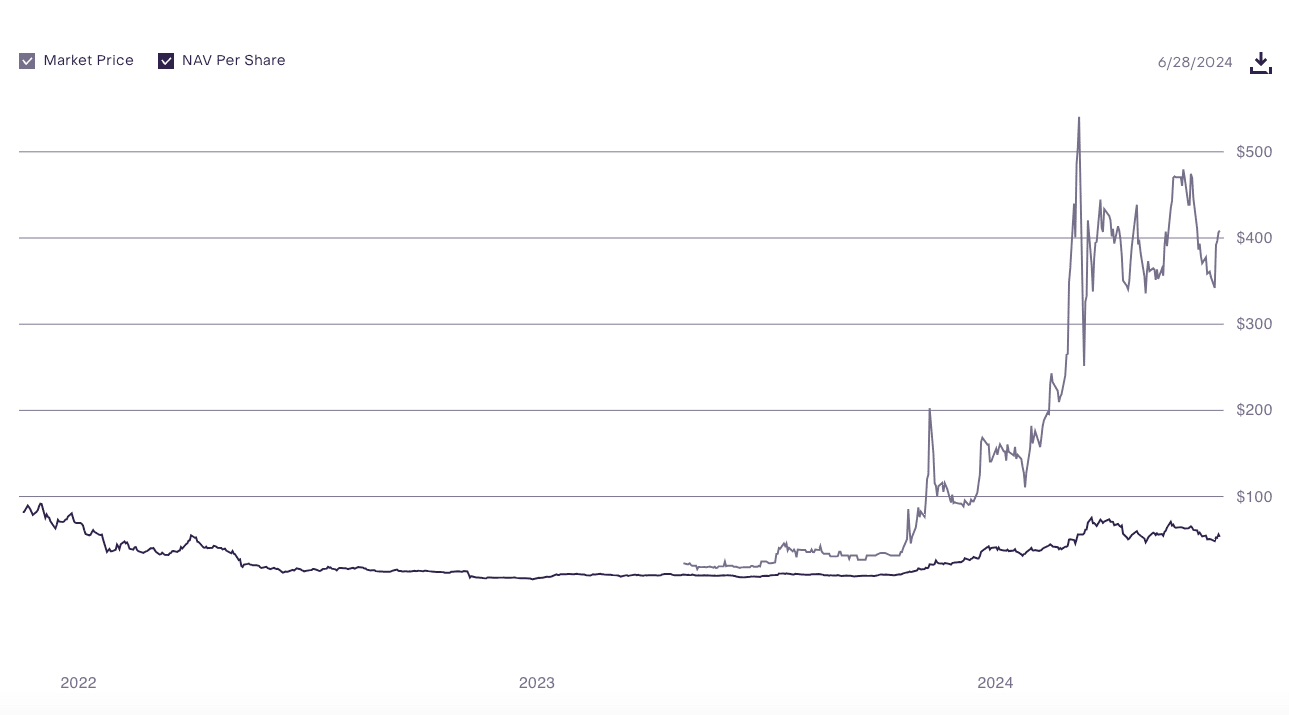

After VanEck filed on Thursday for the first Solana discipline ETF within the U.S., adopted by 21Shares submitting its utility on Friday, Grayscale’s Solana Have faith (GSOL) continues to alternate at a first-rate top class, with the most modern files exhibiting a market designate per half of $408 in opposition to a NAV (Salvage Asset Ticket) of $52.62, when put next with $396 in opposition to a NAV of $51.59 on Wednesday, the day sooner than VanEck’s filing.

This implies that merchants are light gripping to pay unprecedented extra for shares of GSOL than the particular designate of the underlying sources, which is identified as shopping and selling at a top class to NAV.

Grayscale’s trusts are closed-finish funds that delight in a restricted series of shares, which implies recent purchasers must aquire from restful holders, in contrast to originate-ended funds whose shares are on a protracted-established basis issued and redeemed essentially based on investor seek files from. Even after they alternate on the next relative to the designate, merchants can light opt them because these trusts can extra without ache be placed into tax-advantaged accounts than discipline crypto sources.

Su Zhu, cofounder of defunct crypto hedge fund Three Arrows Capital, commented on X that GSOL “is implying $1k per SOL” and that “the numbers are very equivalent to when ETH change into $200 but [ETHE] implied $1k, in 2020.”

GSOL is no longer the finest Grayscale believe shopping and selling at a top class. Its Chainlink, Filecoin, and Stellar trusts are additionally shopping and selling effectively above their respective earn asset values.

A Commentary on SOL ETF Possibilities

Quiet, if the Solana discipline ETF change into expected to be accepted, it would likely lead to a reduce charge within the highest class at which GSOL is shopping and selling. A discipline ETF would offer merchants a extra explain and designate-atmosphere pleasant methodology to make investments in Solana, aligning its designate extra carefully with the underlying asset’s designate. Which capacity, merchants would possibly possibly perchance also shift their funds to the recent ETF, leading to diminished seek files from for GSOL shares and as a result cutting again the highest class.

On the opposite hand, as is evident from the guidelines, right here is no longer occurring, thus likely conveying that merchants are no longer confident that the ETF will be accepted anytime soon.

Why VanEck Filed Now

On the opposite hand, some commentators are suggesting the timing of the filing would possibly possibly perchance be opportune. Scott Johnsson from Van Buren Capital suggested that the timing of VanEck’s filing would possibly possibly perchance also fair were influenced by the upcoming U.S. elections.

Commenting moral after the filing, he posted on X, “SOL baggage staunch got a bigger election outcome catalyst. No longer gargantuan for Biden on the margins.” Johnsson implies that because approval of a discipline Solana ETF turns into extra likely if there is a alternate within the administration, Solana holders would be extra inclined to vote in opposition to President Biden, whose administration has been scandalous toward the alternate.

X particular person @Evanss6 pointed out that the closing date to walk the SOL ETF approval alongside would possibly possibly perchance also coincide with the likely departure of Biden and Gensler within the arriving months.

Source credit : unchainedcrypto.com