A Glimmer of Hope for This Command of Crypto Taxes?

February 4, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

Jump Crypto modified the 120,000 ETH on Wormhole’s ETH contract so that wETH became as soon as all any other time totally-backed on Solana.

-

Kraken’s proof-of-reserves audit confirmed $19 billion price of BTC and ETH.

-

The Federal Reserve of Boston and Massachusetts Institute of Technology’s Digital Forex Initiative published their joint CBDC research.

-

Paxos is adding pork up for Aave, Uniswap, Chainlink, and Polygon to its wallets.

-

Galaxy Digital says it makes exercise of an 80% sustainable vitality mix across its mining operations.

-

Miami received $5.25 million from CityCoins.

- An $11.7 million gold cube in Central Park is affiliated with $CAST, a cryptocurrency.

This day in Crypto Adoption…

-

All over a dialog at MicroStrategy’s Bitcoin for Company’s conference, Christine Sandler, head of gross sales and marketing at Constancy Digital Property, printed that the firm began mining cryptocurrency and gathering Bitcoin in 2014.

-

GameStop unveiled a partnership with the Ethereum layer 2 solution Immutable X to open its have NFT marketplace.

-

Personalised video app Cameo is launching an NFT flow.

-

Gaming developer Ubisoft has entered into an agreementwith HBAR Foundation to bustle a node on Hedera Hashgraph.

The $$$ Corner…

-

Yuga Labs, the builders in the motivate of Bored Ape Yacht Club, is taking a look to grab money at a $5 billion valuation from a16z.

-

Trust Machines raised $150 million to unlock Bitcoin’s web3 skill.

- Tribal Credit, which no longer too long previously unveiled a corrupt-border payment map with the Stellar Vogue Foundation, raised $60 million in a Series B.

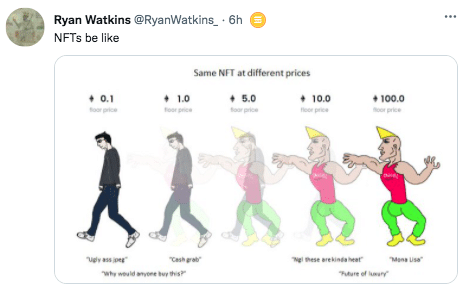

What Stop You Meme?

What’s Poppin’?

Crypto Taxes Are the Converse of the City

A choice by the IRS to train a tax refund to Joshua and Jessica Jarrett would possibly maybe maybe well possess long-lasting implications for how staking rewards are taxed.

Last three hundred and sixty five days, Joshua and Jessica sued the IRS, arguing that that they had incorrectly paid taxes on Tezos staking rewards as if it possess been profits moderately than property. The couple think that staking rewards ought to greatest be taxed as soon as sold.

This week, the IRS issued the Jarrett’s a refund. On the different hand, the regulator did no longer expose the reasoning in the motivate of the refund (and, therefore, is no longer setting a precedent).

In response, Joshua says he’s no longer taking the refund and can as a exchange look forward to an official ruling (and, therefore, precedent). “I refused the provide, attributable to I know that except my case receives an official ruling, I don’t possess any dart in the park they received’t strive to tax me all any other time,” he outlined on Twitter.

Actually, “Josh sued the IRS for readability on taxation of most modern tokens created by technique of staking. The IRS tried to pay him off to tumble the suit. He turned down the money to continue the case & witness binding precedent for us all,” wrote the Blockchain Affiliation’s Jake Chervinksy on Twitter. The long bustle court docket case, alternatively, would no longer be all-encompassing for crypto rewards. In line with CoinTracker’s Shehan Chandrasekera, if the long bustle court docket case is determined in favor of the Jarretts, it can maybe well greatest spot a precedent for proof-of-stake staking profits (and would no longer conceal interest, mining, or airdrop profits).

In associated tax files…

-

A bipartisan community of US Home representatives reintroduced the “Digital Forex Tax Equity Act” the day before this day that will exempt crypto users from paying capital positive factors taxes on transactions decrease than $200.

-

Coinbase has teamed up with TurboTax to enable users to convert divulge and federal tax refunds as we exclaim to crypto by technique of the alternate.

Suggested Reads

-

Arca CIO Jeff Dorman on easy recommendations to resolve out if the underside is in:

-

Joel John on tokenizing NFT marketplace:

-

Forefront compiled 15 of the ideal articles on web3:

On The Pod…

Are Democrats Against Crypto? These Two Congressional Candidates Assert No (Bonus Stammer material: I wrote a abstract of the episode on Medium, which is ready to be chanced on right here.)

Shrina Kurani, a Democrat running for a Home seat in California, and Morgan Harper, a Democratic candidate running to indicate Ohio in the US Senate, expose why they’re running pro-crypto campaigns. They talk about about how crypto will possess an impression on the 2022 midterms, define being both pro-crypto and pro-atmosphere, and talk about in regards to the importance of coaching regulators about Web3. On this episode of Unchained, they spotlight:

-

how Morgan’s work at the American Economic Liberties Challenge and User Financial Protection Bureau led her to bustle for Senate on a pro-crypto platform

-

why Shrina selected to mint NFTs on Solana to lend a hand fundraise for her campaign

-

what points Morgan and Shrina possess with the most up-to-date financial map (and the very top blueprint they suspect crypto would possibly maybe maybe well lend a hand solve such points)

-

why both Shrina and Morgan stress that education is the most major to increasing effective crypto protection in the US

-

what message Shrina and Morgan are attempting to ship to fellow Democrats in regards to the crypto trade

-

why Morgan believes that single-train vote casting for crypto candidates will be terrible

Book Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, is now on hand for pre-protest now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-protest it this day!

You maybe ought to possess it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com