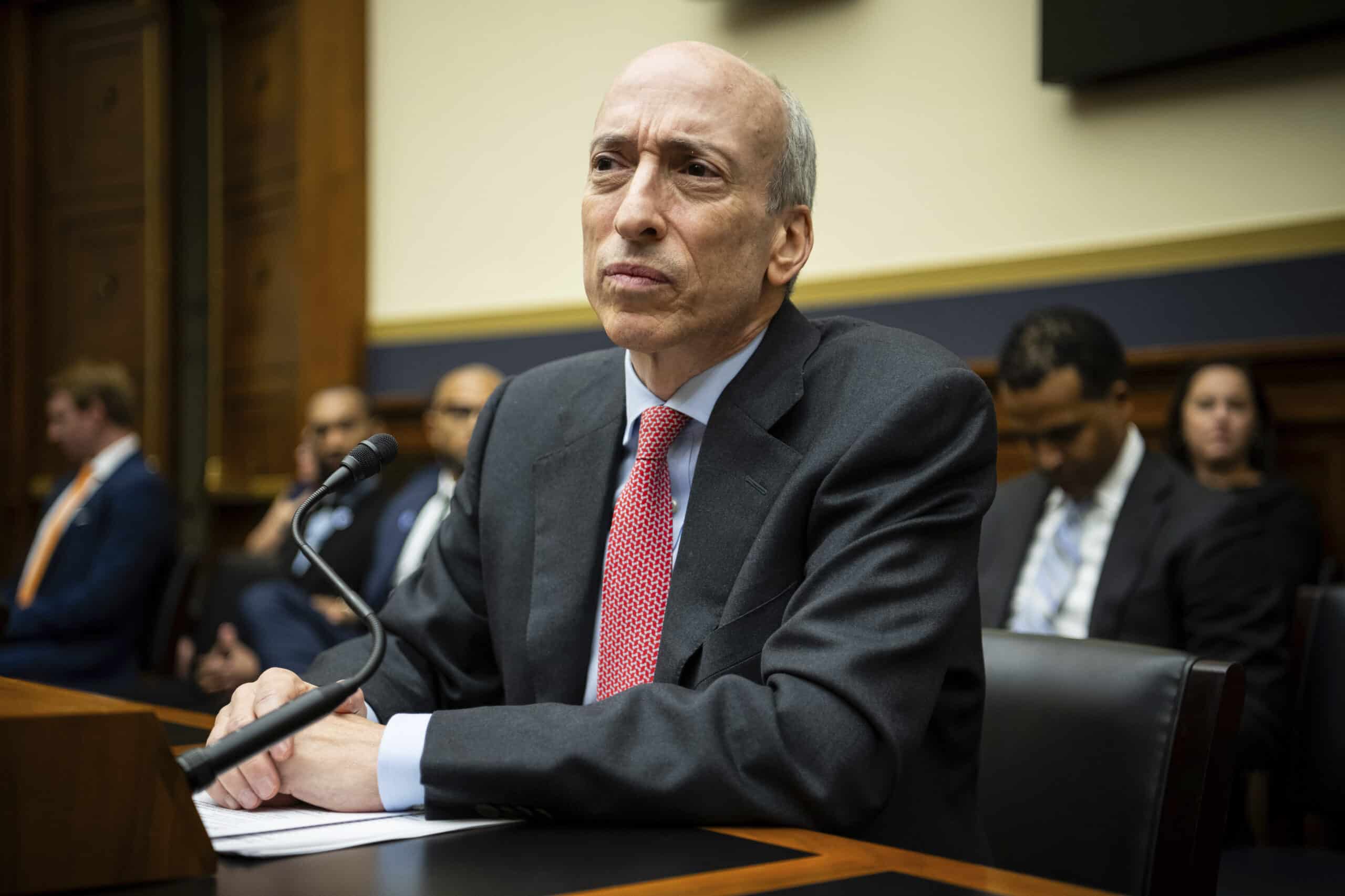

Gensler Grilled in Congressional Listening to Over SEC’s System to Regulating Crypto

Dwelling Monetary Companies and products Committee Chair Patrick McHenry (R-NC) and various Republican people of Congress upbraided SEC chairman Gary Gensler for how his company has regulated the crypto industry at an SEC oversight listening to on Tuesday. Within the meantime, numerous the Democratic people of the Committee praised Gensler for the work he turned into as soon as doing in regulating crypto.

“Below Chair Gensler, the SEC has change precise into a rogue company,” McHenry acknowledged on the listening to’s opening. He then cited numerous circumstances of the SEC ineffectively regulating the crypto industry by enforcement, sooner than noting how the vote casting on FIT21, a market structure bill for digital belongings subsidized by McHenry, demonstrated that extra than two thirds of the Dwelling antagonistic Gensler’s ability to digital belongings. “Correct to assemble, Chair Gensler has doubled down on legislation by enforcement. With out the regulatory clarity and client protections in FIT21, the US will continue to tumble gradual Europe in technological innovation and adoption. That is phenomenal in up-to-the-minute history,” acknowledged McHenry.

Learn extra: Can Gary Gensler Be ‘Fired’ If Trump Becomes President Any other time?

Arguing Over Phrases

Besides to questioning Gensler, Republican Participants of Congress also looked to the two official-crypto Republican SEC Commissioners, Hester Peirce and Label Uyeda, for guidance and crimson meat up. McHenry asked Gensler about the complicated intention that the SEC has ragged a few terms to consult with digital belongings, equivalent to “crypto asset securities” and “crypto security tokens,” Gensler answered by announcing “it’s much less about the terms and additional about the economics.” Gensler then successfully-known that the most fundamental criteria for figuring out whether or no longer a token is a security or no longer are ”whether or no longer an funding contract is being supplied and bought to the public and the public is making an strive to others in a general accomplishing looking ahead to profit.” These are the requirements is called the Howey Test, which got here out of a 1946 Supreme Court ruling.

McHenry then turned to Commissioner Peirce to interrogate whether or no longer the consume of a few descriptions and phrases to describe crypto tokens turned into as soon as problematic. “Sure, that’s fully proper,” Peirce answered. “We comprise now taken a legally imprecise leer to mask the regulatory lack of clarity.”

Peirce then lamented how the SEC had did not successfully abet watch over the digital asset industry by being clearer. For occasion, Peirce introduced up a noteworthy-criticized footnote that turned into as soon as section of the SEC’s no longer too lengthy ago amended complaint against Binance. Within the footnote, the SEC acknowledged that it had ragged the timeframe “crypto asset security” as shorthand and didn’t mean to point out that any crypto asset itself turned into as soon as a security. “[The SEC has] fallen down on our duty as a regulator no longer to be true,” acknowledged Peirce.

Congressman Wiley Nickel (D-NC) and Congressman Mike Flood (R-NE) also puzzled Gensler about SAB 121, a noteworthy-criticized SEC rule that requires entities making an strive for to custody crypto to checklist the belongings on their balance sheet and put a corresponding authorized responsibility equal to the associated price of the crypto. Nickel and Flood authored a joint resolution to overturn SAB 121 that handed the Dwelling and Senate but turned into as soon as sooner or later vetoed by President Biden.

Gensler acknowledged he wouldn’t act to rescind SAB 121 and when Nickel asked why, Gensler answered that the rule of thumb turned into as soon as nothing out of the long-established and sought to provide protection to prospects when the firm that turned into as soon as custodying their crypto went bankrupt, a bid that has took place a big sequence of times in most up-to-the-minute years.

Waters Proposes a ‘Unprecedented Good aquire’ on Stablecoins

In an exciting demonstrate of bipartisanship, Bag. Maxine Waters (D-CA), the top ranking Democrat on the committee, ragged some of her opening time on the listening to to publicly interrogate McHenry for a bipartisan ability to passing a stablecoin bill.

“Sooner than the crash of this twelve months, I desire us to strike a worthy prick value on stablecoins and various lengthy slack funds,” acknowledged Waters. “I strongly allege we are able to reach a deal that prioritizes sturdy protections for our nation’s buyers and sturdy federal oversight.”

McHenry had previously launched the Readability for Cost Stablecoins Act of 2023 into the Dwelling; alternatively, at some stage in a overview of the bill in July of 2023, Waters led a walkout of all Democrats on the Committee to bid the dearth of a bipartisan settlement over how stablecoins wants to be regulated. This ended in a stall in negotiations that had been reportedly occurring between McHenry and Waters for a whereas.

Waters described many paths to the oversight of stablecoins, but highlighted that in assorted worldwide locations, there may perhaps be a position for central banks and thus, that the U.S. ought to be obvious the Federal Reserve has a famend situation in the oversight of stablecoins. Waters also commented on the composition of stablecoin reserves, announcing that “stablecoins can solely be in actuality stable if they are backed by protected and liquid reserves take care of temporary-timeframe Treasury funds.”

In response, McHenry acknowledged he welcomed extra discussions on a seemingly stablecoin bill, but additionally hinted it may perhaps perhaps also be necessary to make clarity for digital belongings in general, a probable reference to his FIT21 bill.

Source credit : unchainedcrypto.com