FTX.US Has This Aid Over Coinbase

September 1, 2021 / Unchained Day after day / Laura Shin

Day after day Bits ✍️✍️✍️

- Offchain Labs, the developer in the succor of Arbitrum, an Ethereum L2 resolution, launched its mainnet, dubbed Arbitrum One and announced a $120M Sequence B elevate the day prior to this.

- El Salvador’s Congress popular a $150M fund to relieve facilitate fiat-BTC conversions.

- Larva Labs (the firm in the succor of CryptoPunks, Meebits, and Autoglyphs) signed a address United Abilities Company (UTA), representing the NFTs trusty through movie, TV, video games, publishing, and licensing.

- Syndicate, an physique of workers funding DeFi protocol, raised a $20M Sequence A.

- For the week ending August twenty seventh, Bitcoin funding products seen outflows for the eighth consecutive week.

- MetaMask hit 10M+ month-to-month users in July, marking an 1800% amplify when in contrast with final One year.

- Tether requested the Contemporary York Supreme Court to block the NYAG’s situation of job from releasing paperwork to CoinDesk.

What Terminate You Meme?

What’s Poppin’?

FTX.US, the affiliate of Sam Bankman Fried’s crypto change FTX, announced its first acquisition the day prior to this. The firm has sold LedgerX, a crypto derivatives change, for an undisclosed sum. The deal, if done, may presumably well end as soon as October.

This is huge news, because it signifies that FTX.US is planning to present crypto derivatives in the US — something competitors admire Coinbase, BinanceUS, or Kraken enact no longer yet give a take to.

Particularly, LedgerX is a Commodity and Futures Procuring and selling Association (CFTC)-regulated crypto derivatives change. The newly got firm has already performed famous of the regulatory legwork for FTX.US. Encourage in 2017, LegerX fell into the crosshairs of the CFTC after asserting the initiate of its derivatives products without first obtaining the an vital licenses, which resulted in its two co-founders occurring administrative depart.

Since then, LedgerX, led by a brand unique management crew, has checked all of its regulatory containers. The firm has already submitted and been popular for a derivatives clearing organization (DCO) license, a selected contract market (DCM) license, and a swap execution facility (SEF) license from the CFTC. Furthermore, the change is already purposeful, offering futures, alternate strategies, and swaps on BTC and ETH, allowing FTX.US to enter the derivatives sport immediate and efficiently.

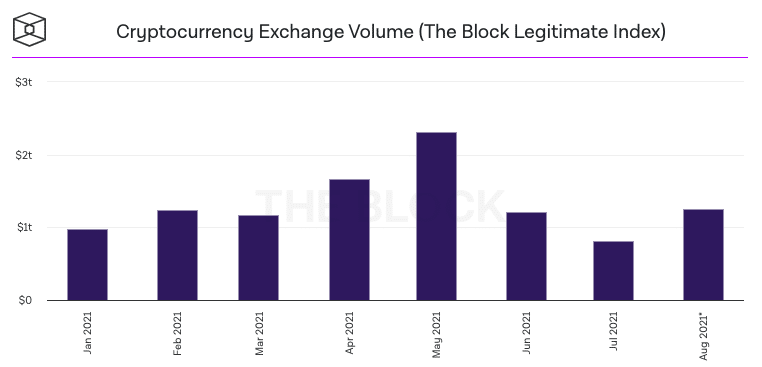

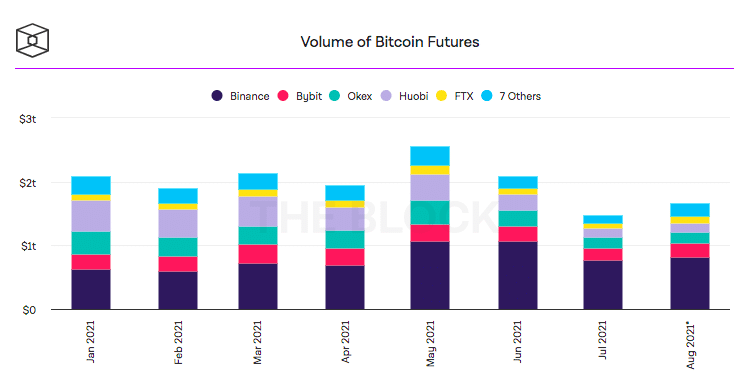

Brett Harrison, President of FTX.US, described the acquisition as a “well-known milestone” for the firm. the crypto market, it’s miles wise why Harrison may presumably well be thrilled about the gain. Crypto derivatives, which may presumably well be monetary products based on the price of an asset in wish to the actual asset itself, if truth be told come up a bigger market than crypto save of living buying and selling, as you may presumably well presumably also mediate from the charts below. For example, data from The Block reveals that Bitcoin futures quantity YTD sits at roughly $15.85T, while Bitcoin save of living quantity is at $10.66T.

Zach Dexter, LedgerX co-founder and CEO, additionally expressed optimism for the deal. “US crypto derivatives is an incredibly underserved market, and it took time and resources for us to develop into a regulated entity below the existing frameworks,” acknowledged Zach. “FTX.US has taken the stumble on, which we piece, that US regulators are ready and inspiring to accomplice on innovative products, and it’s the accountability of the change as a entire to step up and work with agencies admire the CFTC.”

Per a Forbes narrative, Harrison plans to merge LedgerX and FTX.US product offerings into one platform.

Suggested Reads

- Sam Trabucco on adapting in the crypto world:

- HackerOne on DeFi bug bounties:

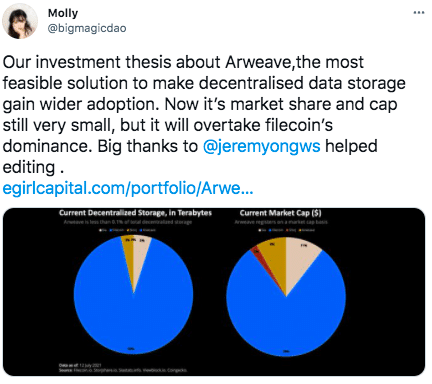

- eGirl on Arweave:

On The Pod…

How Pplpleasr Helped Fortune Journal Sell Extra Than $1 Million in NFTs

Pplpleasr, the artist in the succor of Fortune journal’s contemporary crypto duvet and Uniswap’s V3 announcement animation, talks about her crypto bolt and how NFTs are changing the game for creators. Demonstrate highlights:

- how no longer getting a job at Apple changed her life without slay

- how the Pplpleasr-Uniswap collaboration came about

- what goes into her ingenious route of

- how Pplpleasr bought employed for the Fortune journal duvet

- why she selected to indicate anon-avatars on the Fortune duvet

- why Pplpleasr used to be shocked by Fortune’s response to her artwork (and crypto in long-established)

- what originate of crypto personas are represented on the Fortune duvet and why

- how NFTs are changing the paradigm of monetization for creators when in contrast with the primitive art world

- what pplpleasr is having a are looking ahead to in future NFT dapper contracts

- why NFTs are composed tiny perfect now

- why institutions, admire Budweiser and Visa, are all of a sudden attracted to NFTs

- what Fortune is doing to grow its NFT series

- how DAOs are changing art curation and gathering

- why Pplpleasr used to be shocked that a DAO (bearing her name) bought the Uniswap V3 animation

- the save Pplpleasr thinks the NFT bellow will race in the next One year or so

Book Change

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Gigantic Cryptocurrency Craze, is now readily in the market for pre-uncover now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-uncover it this day!

You may presumably well presumably also gain it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com