Ethereum’s Dencun Upgrade Can’t Device Soon Ample as Gas Fees Surge

As user demand and hobby in both bitcoin (BTC) and ether (ETH) surges—on the abet of the approval of region bitcoin ETFs in the US and the functionality approval of region ether ETFs — gas costs on Ethereum are spiraling out of absorb a watch on.

At height times, customers are reporting paying over $100 in transaction fees for swaps, which is the alternate of 1 crypto token for one other on the community. The everyday gas price for a swap transaction is currently round $seventy 9, in preserving with facts from Etherscan.

Gas costs for swaps abet above $100 lmao

— Pentoshi 🐧 euroPeng 🇪🇺 (@Pentosh1) February 28, 2024

The “high gas guzzlers” are decentralized alternate Uniswap and Blast, an Ethereum layer 2 community that launched on mainnet the day earlier than presently time. Respectively, they’ve earned $2.5 million and $1.4 million in fees at some level of the last 24 hours, per Etherscan facts.

400 fucking greenbacks emigrate .1 ETH to Blast mainnet.

It's so over.

Pack it up. Ethereum is unusable presently time. pic.twitter.com/hZRrwRAMlz

— Pop Punk (@PopPunkOnChain) February 29, 2024

The high transaction fees as soon as extra draw consideration to Ethereum’s scaling challenges and the procedure in which refined it could moreover very well be to onboard unique customers to the community for the length of times of increased hobby.

Ethereum is now not blind to these disorders, which continue to reoccur in bull market cycles. Ethereum has an mettlesome multi-year roadmap to lower transaction fees, amplify security, and future proof the community.

Learn extra: An Overview of Ethereum Scaling

“Ethereum is attempting to learn from this mistake of pricing away marginal customers to other, less expensive chains,” acknowledged Luke Nolan, Ethereum research affiliate at digital asset investment manager CoinShares. “The proposed and implemented solution is to scale thru layer 2 solutions, largely rollups.”

Two key upgrades from the roadmap have already been implemented alongside with “The Merge,” which changed into as soon as Ethereum’s transition to the proof-of-stake consensus mechanism, and the “Shapella” beef up, which enabled the initiating of staked ether withdrawals. The next foremost beef up is Dencun, which is scheduled for March 13.

Learn extra: What Is the Cancun-Deneb (Dencun) Update on Ethereum?

One in every of the foremost introductions in the Dencun beef up is a unique transaction kind called “blobs.” Ethereum layer 2 rollups currently submit facts to Ethereum the use of calldata. Here is expensive and makes up round 90% of the gas fees that rollups pay to submit bundled transactions to the community. After Dencun, layer 2s will submit the suggestions to blobs, which are extremely optimized and are less expensive than calldata.

“Total, sure fees will lower on Ethereum, nonetheless most appealing for layer 2s,” Nolan acknowledged. “The frequent hope right here is that layer 2s will change into refined ample over time, with seamless UX, high tempo and low transaction costs … In this stop deliver, Ethereum can compete with any unique expeditiously chain that comes out of the box because layer 1 remains to be the exact settlement layer, and layer 2 turns into the suggestions availability layer that enables all of it to scale to unique heights.”

Below the beef up, transaction fees on layer 2s will lower between 10 to 100 times reckoning on the chain, acknowledged Nolan, adding that it could moreover acquire very end to “Solana-esque transaction fees.”

Solana’s Surge

This price reduction couldn’t reach quickly ample for deal of customers. Many Ethereum customers, in particular those who trade NFTs, are speaking about transferring to Solana, which is a layer 1 blockchain that offers less expensive transaction fees.

It costs 52 greenbacks to aquire a former ERC-721 off Blur correct kind now.

It costs one other 20-30 greenbacks per market you favor to must list that NFT on.

and that's with gwei slightly low (70) by bull market requirements

ETH doesn’t create sense for the bulk of NFT collections.

— root (@rootslashbin) February 27, 2024

The everyday transaction costs for NFTs on Ethereum is round $140, per Etherscan, which is generally extra than the set of the particular NFT being traded. Whereas on Solana, the common set of a transaction is 0.000036 SOL, which is $0.0047, in preserving with facts from Solscan.

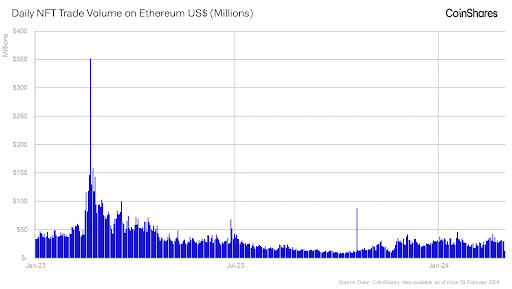

“As of the previous couple of months, deal of consideration has shifted to Solana NFTs, which has surely taken a couple of of Ethereum’s market half,” acknowledged Nolan, adding that Ethereum NFT shopping and selling is now not abet to the same transaction volume ranges as last year.

Most exercise on Ethereum is centering round collections with high ground costs akin to Bored Ape Yacht Membership and Moonbirds, Nolan acknowledged. They’ve ground costs of $75,000 and $4,000 respectively. In these eventualities, a vendor is now not going to be phased by a $100 transaction price.

Each day NFT trade volume on Ethereum in tens of millions (CoinShares)

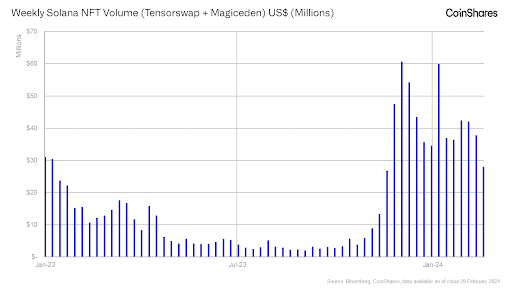

“At the same time as on Solana I would endeavor to voice that the exercise for smaller collections (in addition as huge ones) has been picking up because transaction fees are 100x smaller on common and so the smaller set accounts have logically flocked over there,” Nolan acknowledged. “It has made for a vital extra nice speculative playground for contributors.”

Weekly NFT volume on Solana in tens of millions (CoinShares)

Here is echoed by Anastasia Melachrinos, a DeFi product manager at crypto facts firm Kaiko, who notes that unique customers are generally entering the blockchain ecosystem thru centralized exchanges or straight by the use of Solana.

“It’s miles surely that high throughput upgradeable chains love Aptos or Solana will receive many of the non crypto native online page online visitors, which is many of the field in the case mass adoption does hold location,” acknowledged Sharvin Baindur, chief of crew at investment firm Saison Capital, who makes a speciality of investing and supporting high performance and low set blockchains.

Although gas fees on layer 2s are lowered to Solana ranges, Nolan notes that Ethereum layer 2s unruffled face challenges round fragmentation and dismal user experiences, which is able to behave as a barrier to shooting those smaller set transactions. On the flip aspect, Ethereum and layer 2s have a grand recognition and a truly total ecosystem, so as soon as the execution set is mounted the obstacles to entry to those chains will possible be lowered, Melachrinos acknowledged.

Source credit : unchainedcrypto.com