Ethereum Is Lagging. Here’s How It May perhaps well At closing Shake Off Rival Solana

The Ethereum blockchain and its community are facing an unheard of finishing up. They are losing ground to extra person-pleasant rivals admire Solana, which is getting pumped up by millions of memecoins, and facing not-so-pleasant rivals from interoperable networks called Layer 2s (L2s) which may perhaps perhaps perhaps be straight away taking customers, charges, and mindshare. On Tuesday Uniswap, the field’s greatest decentralized alternate, launched its comprise L2 on top of the Optimism network called Unichain.

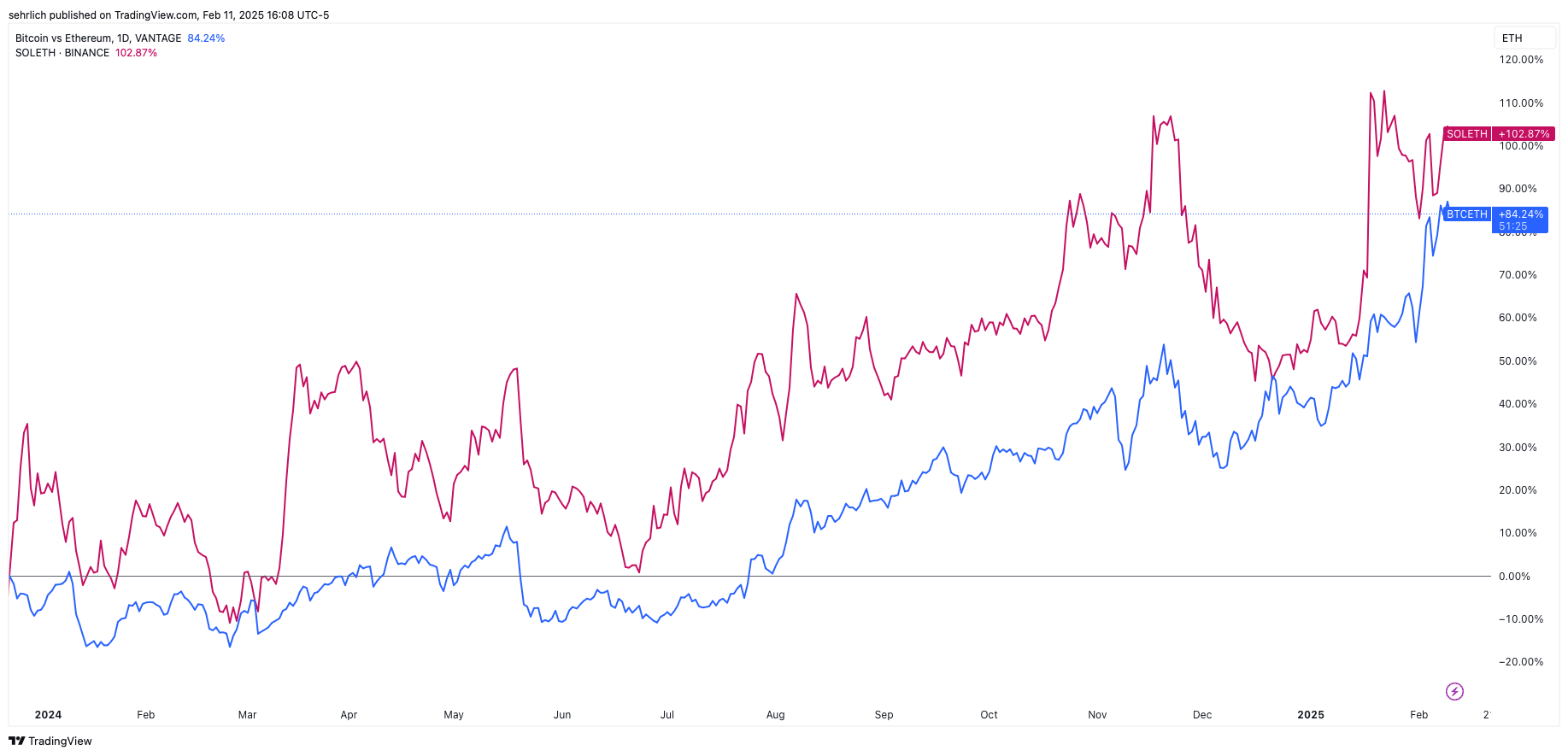

Ethereum’s token observe will most definitely be being left in the grime by Solana and $1.9 trillion Bitcoin. It is a ways up 5.9% over the closing 12 months. By comparison bitcoin has surged 100.58% and solana is up 85%.

Even extra telling, ether’s observe (currently at $2,600) has been falling in the again of that of bitcoin and solana at a identical wander throughout the final six months—a favorable label that traders are beginning to community these resources collectively at ether’s expense. “It is a ways not glaring to me that there is mammoth question amongst worn traders for neat contract platform use cases,” says Zach Pandl, Head of Research at Grayscale Investments.

Ether needs to rewrite the story for both traders and its community, which will initiate with finding a extra proper product-market match.

Caught Between Bitcoin and Solana

Ethereum has been a sidekick to Bitcoin for goodbye that it had been taken as a accurate that it may perhaps truly perhaps persistently be the #2 blockchain.

However whereas bitcoin’s digital gold story has been an exact additive to its slim performance, throughput, and slightly excessive charges, Ethereum’s boost pushed against its in the same intention restricted throughput that may perhaps perhaps perhaps also simplest tackle a few dozen transactions per second. The Ethereum Foundation, the non-profit steward of Ethereum, embraced a scaling strategy that may perhaps perhaps perhaps spawn heaps of of complementary L2 blockchains to dramatically delay throughput.

The strategy modified into successful, but it proved to be a double-edged sword. On the one hand, the network can now route of greater than 200 transactions per second, but it simplest performed this feat by outsourcing the core capabilities of Ethereum to a constellation of blockchains called Optimism, Arbitrum, Unfriendly, Mantle, Zksync, and loads others. This transition also broke one of the important crucial mind-meld that existed between Ethereum and its customers. “For these who may perhaps perhaps perhaps be an investor in Ethereum, but you may perhaps perhaps be not the use of it straight away, maybe you may perhaps perhaps be pondering that you ought to be procuring the Arbitrum token as an different,” says Carlos Guzman, Vice President of Research at GSR.

The transition in fact accelerated in March 2024 when Ethereum implemented an toughen incorporating a non permanent knowledge storage resolution called blobs that made transactions on these networks nearly free. “You presumably can never look an organization quit 99% of its income to its affiliates,” acknowledged Gauntlet founder Tarun Chitra on The Slicing Block podcast.

And we are talking about proper cash. Coinbase’s L2 Unfriendly has earned the corporate nearly $100 million in income since launching in the summertime of 2023. That’s observe that accrues to the holder of Coinbase stock, not ether. Sarcastically, the include of L2s has made Ethereum extra centralized, as nearly every L2 makes use of a single sequencer, or coordination mechanism admire nodes on a blockchain, to put collectively transactions and put up them to the mainnet. Whereas L2s belief to decentralize over time, this setup is admire having a single miner for the total Bitcoin network.

The chart that simplest exemplifies this conundrum is ether’s circulating provide. In September 2022, Ethereum switched from a Proof of Work consensus mechanism to a Proof of Stake setup. Integrated in this toughen modified into a provision to burn charges despatched to the network, taking them out of circulation. Ethereum modified into aloof emitting contemporary tokens day-to-day to reward stakers, however the machine modified into designed for the blockchain to change into deflationary for the length of times of excessive use for the reason that cash paid in charges by customers would surpass staking rewards. As demonstrated in the chart below, the route of worked as deliberate correct as a lot as the toughen in March that cannibalized the Ethereum mainnet. Since then Ethereum has been inflationary and its total provide of circulating tokens exceeded the 120.5 million tokens that existed earlier than the toughen.

That modified into the predominant finishing up for holders of ether. The second is that every person of these varied blockchains created a headache of an particular person abilities for somebody on Ethereum. By comparison Solana, whose boost this previous yr has been big, is a smaller community with an spectacular extra person-pleasant on-boarding route of. It is a self-contained ecosystem—the total lot exists on the L1. In rather a lot of cases of us simplest must use a single pockets and they also establish not have to defend tune of which resources are on which L2s. Plus transactions on Solana simplest observe a few cents, making the blockchain change into the pure home of the memecoin craze for over a yr.

Developers are also beginning to level of interest extra on Solana. Consistent with Electric Capital’s 2024 Crypto Developer File, Solana increased its developer count by 83% in 2024. In distinction Ethereum lost 22% of its builders.

Head to Delivery Water

Ethereum may perhaps perhaps perhaps also establish extra to restore religion amongst its community and traders. Some consultants instruct that the community has been too centered on esoteric parts of technological construction and has neglected aspects of usual marketing and marketing. In distinction, the Solana Foundation launched a smartphone and even rented a pop-up store in Hudson Yards on the west aspect of Prolonged island.

Guzman suggested that in the impending years that conversations about scaling the Ethereum mainnet, maybe by the use of a technology called zero-knowledge proofs, are going to continue. One proposal being debated will delay the gasoline restrict per Ethereum block to allow extra transactions. Ethereum founder Vitalik Buterin is already spearheading these style of efforts. However Guzman insisted that from his vantage level any critical scaling plans are years away. Tron founder Justin Sun also suggest a extra radical proposal, albeit with restricted detail, that may perhaps perhaps perhaps establish issues admire build a tax on L2s and lower rewards for validators to compose Ethereum extra deflationary. These discussions will undoubtedly continue.

In the period in-between, extra L2s defend coming off the assembly line. With the exception of Unichain, the tokenized treasury fund issuer Ondo Finance announced plans to open an L2 and gaming and leisure huge Sony launched its comprise L2. “In the end it ought to be the total apps launching their very comprise L2s on top of Ethereum having their very comprise agencies,” says Christine Kim, Vice President of Research at Galaxy Digital. “The block home and ecosystem of the Ethereum mainnet is correct too constrained.”

Kim thinks that Ethereum may perhaps perhaps perhaps also lean into this trend and finish trying to change into the predominant interface layer for customers. For this style to work though, she admits, utilization of the platform would must scale exponentially increased. It is a ways not constructive that traders will reward this strategy anyway.

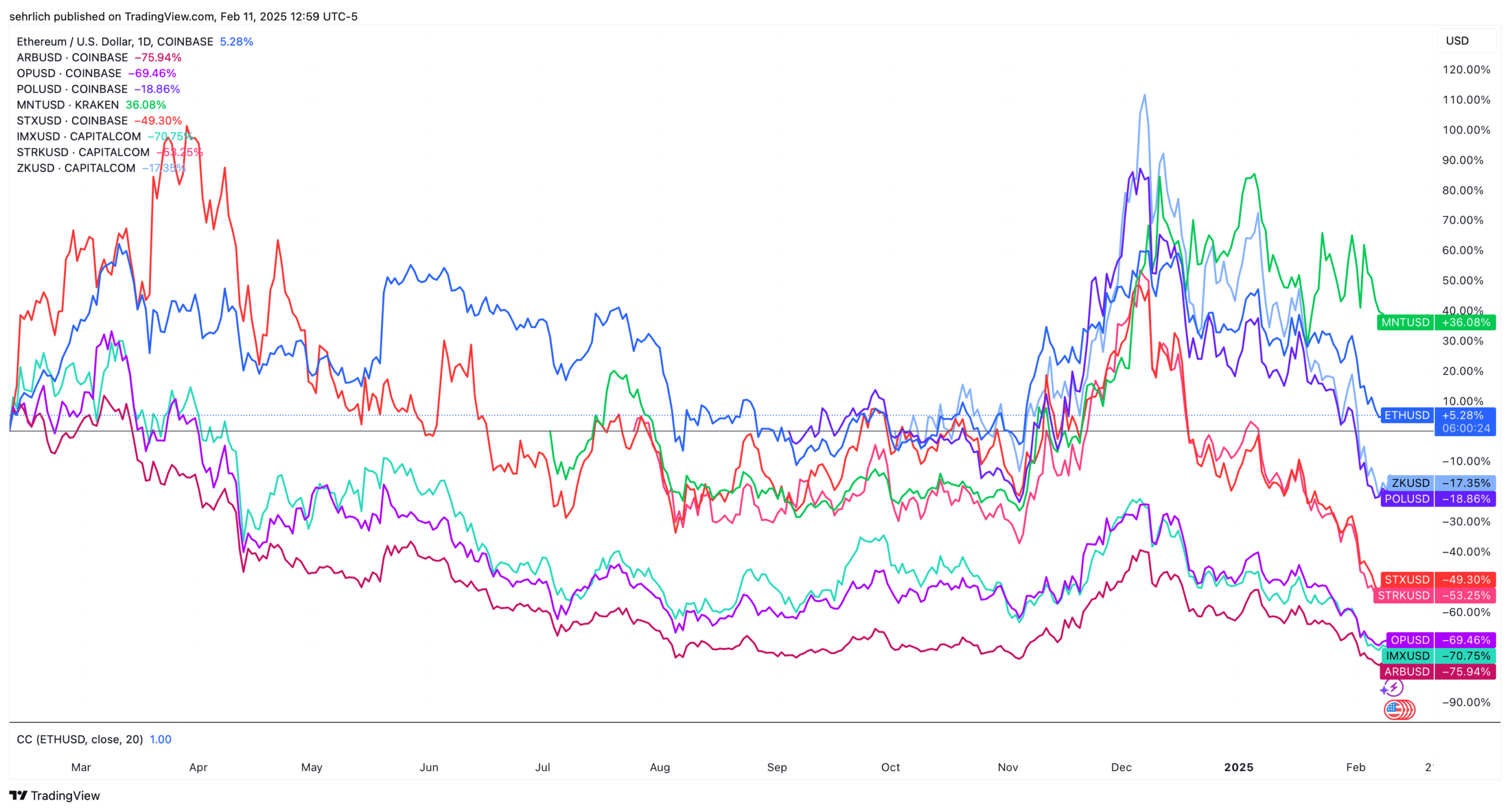

Tellingly, for as powerful angst as traders feel over the observe of ether, it is aloof outperforming nearly every essential L2 token over the closing yr. Thanks to token unlocks, which give insiders such as endeavor capital traders permission to interchange their cash, two essential tokens, Optimism and Arbitrum, are down 69% and 75% over the closing 12 months despite immediate utilization boost.

One other resolution, in step with Pandl, is for Ethereum to play into its core strengths of stability, safety, and decentralization. It is going to aloof let the L2s battle it out with Solana for low-observe transactions. “Ethereum is the leading chain by approach of total observe locked and economic safety, and that makes it the pure platform for institutional finance,” says Pandl.

He particularly pointed to the incontrovertible reality that corporations admire $11.5 trillion asset supervisor BlackRock selected Ethereum to open its $1 billion tokenized treasury platform BUIDL. In truth, Ethereum has extra tokenized proper world resources than every varied blockchain blended in step with knowledge from RWA.xyz.

It also holds a identical share of TVL across all chains.

So clearly, excessive finance—decentralized and onchain—is one convey that is defensible for Ethereum, and this trend is liable to develop. No longer counting the $200 billion stablecoin market, simplest $17.1 billion value of proper-world resources had been tokenized. In 2024 the worldwide mounted income and equity capital markets had been value $255.7 trillion. That may perhaps perhaps perhaps be loads of room for boost.

Presumably then as an different of trying to be the the total lot blockchain, Ethereum must aloof devote its energy to surroundings up this market segment. Other blockchains admire Solana or the L2s are too contemporary or centralized to procure over mainstream financial applications for now.

Ethereum modified into the launchpad for governance tokens, NFTs, and memecoins. Real world resources are the following step in crypto’s evolution and they also straight away cater to Ethereum’s strengths. The two generally is a match made in heaven. For ether traders, it may perhaps truly perhaps be their simplest hope.

Source credit : unchainedcrypto.com