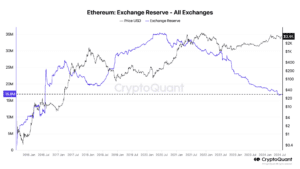

ETH Held in Substitute Reserves Drops to 8-Year Low With ETFs Area to Beginning Procuring and selling

The amount of ETH held in reserve by crypto exchanges has dipped to its lowest stage since July 2016, seemingly driven by the reality that put ether swap-traded funds are at closing role to starting up up procuring and selling on Tuesday.

Exchanges spherical the field collectively retain 16.9 million ETH price roughly $58.3 billion, a decrease of greater than 10% for the reason that starting up of the year when exchanges had 18.8 million ETH price about $65.0 billion, in step with recordsdata from blockchain analytics agency CryptoQuant.

The closing time exchanges held as limited an amount of ETH as now was as soon as in July 2016 when ETH traded at spherical $11. On the time of writing, a single ETH token was as soon as procuring and selling at nearly $3,500.

Suki Yang, an recordsdata scientist at Electric Capital, told Unchained that the major reason for the fall in ETH swap reserves was as soon as seemingly the reality that put ether ETFs are role to starting up up procuring and selling on Tuesday.

“The excellent thing that took put with Ethereum this year has been the ETF,” mentioned Yang. “What occurs with the ETH ETFs potential establishments are keeping extra Ethereum that’s in the liquid circulating provide.”

Yang celebrated that “whereas you query the query basically how attain establishments aquire ETH, it’s thru [over-the-counter], indubitably now not thru the launch market on exchanges. So the reserve of Ethereum on these exchanges dropping potential that most of the establishments are coming in and they’re consuming Ethereum off of these exchanges.”

The swap tale wallets of establishments are linked to the obtain and therefore extra inclined to on-line exploits. So these accounts are where establishments switch cash spherical and conduct procuring and selling, in step with Yang. The decrease in ETH in exchanges stems from establishments searching to retain ETH in custodial wallets or chilly storage, a long way off from exchanges and the market.

Read extra: Grayscale Costs for Web web site Ethereum ETF 10 Times Increased Than Competition

Coinbase and Binance had the greatest detrimental changes in their ETH reserves. Fixed with onchain intelligence platform Nansen, the two exchanges saw their ETH holdings decrease by about $1.2 billion over the closing seven days.

Coinbase High, which is aimed at establishments, was as soon as accountable for the overwhelming majority of the good deal that took place this past week, with the group’s token balance of ETH unnerved by $747.9 million.

Source credit : unchainedcrypto.com