Does This Impress the Discontinue of the Web Market?

June 21, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits✍️✍️✍️

- After freezing withdrawals, Babel Finance reached an agreement to repay some of its debt.

- Solend DAO’s controversial governance resolution (lined in the day long gone by’s publication) was as soon as invalidated after a convention-up vote.

- Crypto substitute Bybit plans to prick its personnel.

- South Korea is obstructing contemporary and aged Terra builders from leaving the nation.

- Iran will lower vitality provide to crypto miners in say to prick electrical energy attach a matter to.

- A brand contemporary documentary was as soon as launched accusing the Bored Apes NFT sequence of getting a Nazi custom.

- Folks mock protested against NFTs at NFT.NYC, in a publicity stunt for Adam Bomb Squad.

- DeFi protocol Bancor pauses Impermanent Loss Protection in consequence of “hostile market stipulations,” striking the blame on Celsius in a Twitter Areas.

Currently in Crypto Adoption…

- The UK executive reverses course; decides no longer to fetch non-public info from non-public wallets.

The $$$ Nook…

- Astaria, an NFT lending platform, raised $8 million.

- Admix, a gaming company, merged with LandVault and reached a $300 million valuation.

What Enact You Meme?

What’s Poppin’?

ProShares Launches a Short Bitcoin ETF

By Juan Aranovich

ProShares, an funding product issuer, launched the day long gone by that they’d be launching a recent substitute traded fund that may maybe allow investors to bet on the Bitcoin sign going down or to hedge cryptocurrency publicity.

The ETF known as ProShares Short Bitcoin Approach (Ticker: BITI) and may maybe maybe be listed on the NYSE starting up at the present time, Tuesday 6/20. It is miles meant to “withhold away from the plenty of costs and fees in most cases required to instant bitcoin”, as said on the ProShares online page.

Having an ETF to switch instant on Bitcoin has many advantages over the contemporary choices, love shopping for futures and connect alternate choices. The ETF will develop it that you just may maybe imagine to neutral it by blueprint of a outmoded brokerage tale, so investors will no longer require a futures or alternate choices tale. Also, this would perhaps maybe also no longer require the person to potentially add contemporary funds to withhold margin ranges. Lastly, as it’s far an ETF, there’s no likelihood to lose extra cash than what you set in.

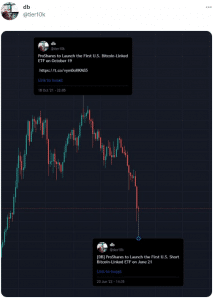

ProShares had been the first company to checklist a Bitcoin futures ETF in October closing year, and is now the perfect provider of bitcoin-linked ETFs in the United States. At the second, BTC was as soon as trading at round $60,000. The initiate of that first futures ETF was as soon as very advance to BTC’s all time high ($68,789). Customers on social media joked that, since the prolonged ETF appears to be like to dangle marked the head, this contemporary instant ETF may maybe maybe potentially mark the tip of the endure market.

Others didn’t steal the facts completely, and are peaceable clamoring for the set ETF to be well-liked by the SEC. “So there’s now a SHORT Bitcoin ETF, a Futures ETF, a closed cease fund trading at a 30%+ good purchase, a 401K likelihood for Bitcoin, but NO Pickle ETF. It is miles evident that Gary Gensler and the SEC dangle an agenda against Bitcoin,” tweeted Bitcoin analyst Will Clemente.

Instant Reads

1) Interview with Vitalik and his dad on Fortune:

2) Grant Stenger on what’s the purpose of crypto:

3) “History is rarely any longer on the facet of the crypto’s grave dancers” by Simon Dark:

On The Pod…

CFTC Commissioner Caroline Pham on Why US Crypto Regulators Salvage a B-

Caroline Pham, commissioner at the Commodities Futures Procuring and selling Fee, discusses how we must peaceable invent a regulatory framework for crypto resources, whether the SEC and CFTC must peaceable work collectively, what dangle been the outcomes of the Terra crumple, and far more.

Indicate highlights:

- how Cmr. Pham got started in crypto and dangle change into a CFTC commissioner

- the importance of the regulatory intention round crypto

- what crypto’s role is in the financial plot

- how bitcoin is a form of money outside of the outmoded financial plot

- how pleasant regulators must peaceable be with the industries they withhold an eye fixed on

- why she believes transparency is definitely one of the most perfect beliefs of American democracy

- how Cmr. Pham believes in self-option and the vitality of free markets

- why Cmr. Pham published an op-ed with SEC Commissioner Hester Peirce

- how the Terra crumple incentivized regulators to peep deeper into the neutral

- whether the US manner in direction of regulation can toughen

- the role of the regulatory companies in making the US the financial chief of the arena

- what Cmr. Pham thinks relating to the contemporary Gillibrand and Lummis bill

- whether SEC Chair Gary Gensler is valid relating to the bulk of cryptos being securities

- what are the low-inserting fruit alternatives for regulators in terms of crypto

- how Cmr. Pham believes we must peaceable dangle a world regulatory framework for crypto

- why she believes algorithmic stablecoins are derivatives

- why issues love Terra may maybe maybe act as a “shadow banking 3.0”

- whether there is a manner to withhold an eye fixed on without needing intermediaries

what Cmr. Pham thinks about FTX proposal to avoid futures commission merchants

E book Change

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Tall Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now readily available!

That you just may maybe additionally aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com