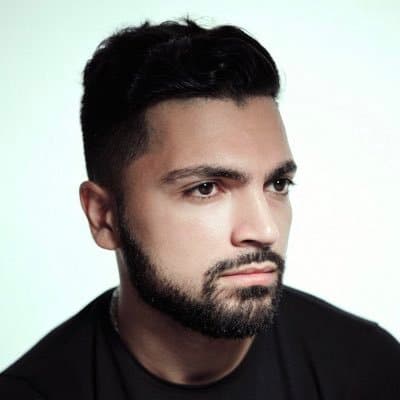

DeFi Must Be More Self sustaining to Prevent Future Crises, Says Sam Kazemian

In the wake of the most fashionable Curve disaster, Sam Kazemian, founder of Frax Finance, emphasised the need for greater autonomy within Decentralized Finance (DeFi). His feedback attain at a fundamental juncture as the DeFi community grapples with the fallout of the Curve attack, an incident that uncovered systemic risks and raised questions in regards to the resilience of the DeFi ecosystem.

The Curve attack, brought on by a vulnerability in obvious Curve pools utilizing the Viper programming language, resulted in a fundamental drop in the value of the protocol’s native token CRV. This set Curve Finance founder Michael Egorov’s easy borrowing attach at likelihood of liquidation. The matter changed into as soon as resolved via a sequence of over-the-counter (OTC) deals, where Egorov purchased a fraction of his CRV tokens to illustrious figures in the crypto issue, including Justin Solar. This allowed him to repay a fundamental fragment of his debt and stabilize the matter.

The need of these OTC deals underscored the constraints of the most fashionable DeFi lending systems. Kazemian argued that if these systems were extra self sustaining and included improvements love Fraxlend’s time-dependent hobby charges, such handbook interventions would not be important. “We would prefer extra DeFi stuff that’s a fair like Uniswap,” he acknowledged, emphasizing the need for self sustaining, self-regulating systems that can face up to such shocks.

Kazemian additionally addressed the dearth of innovation in DeFi lending markets, highlighting FRAX’s efforts to introduce a brand contemporary lending model with isolated ingredients and innovative kinds of hobby charges. One in every of these improvements is dynamic restructuring, a feature that prevents imperfect debt. Kazemian explained, “With dynamic restructuring, there can’t be imperfect debt. If there’s a liquidation, it gets socialized. So no person desires to flee in direction of no matter’s left and then extra or much less brick the pool for what’s last for every person.”

Addressing the compiler field that resulted in the Curve attack, Kazemian acknowledged its severity. He noteworthy that such points discourage developers from experimenting with languages as antagonistic to Solidity, the dominant language for writing natty contracts in the Ethereum network. Nonetheless, he expressed optimism that the Viper language, implicated in the Curve attack, might perhaps well well change into extra strong with increased security audits and consideration in the aftermath of the disaster.

Source credit : unchainedcrypto.com