Crypto Hackers Stole $1.7 Billion in 2023, Down 54% YOY, As DeFi Security Improves: Listing

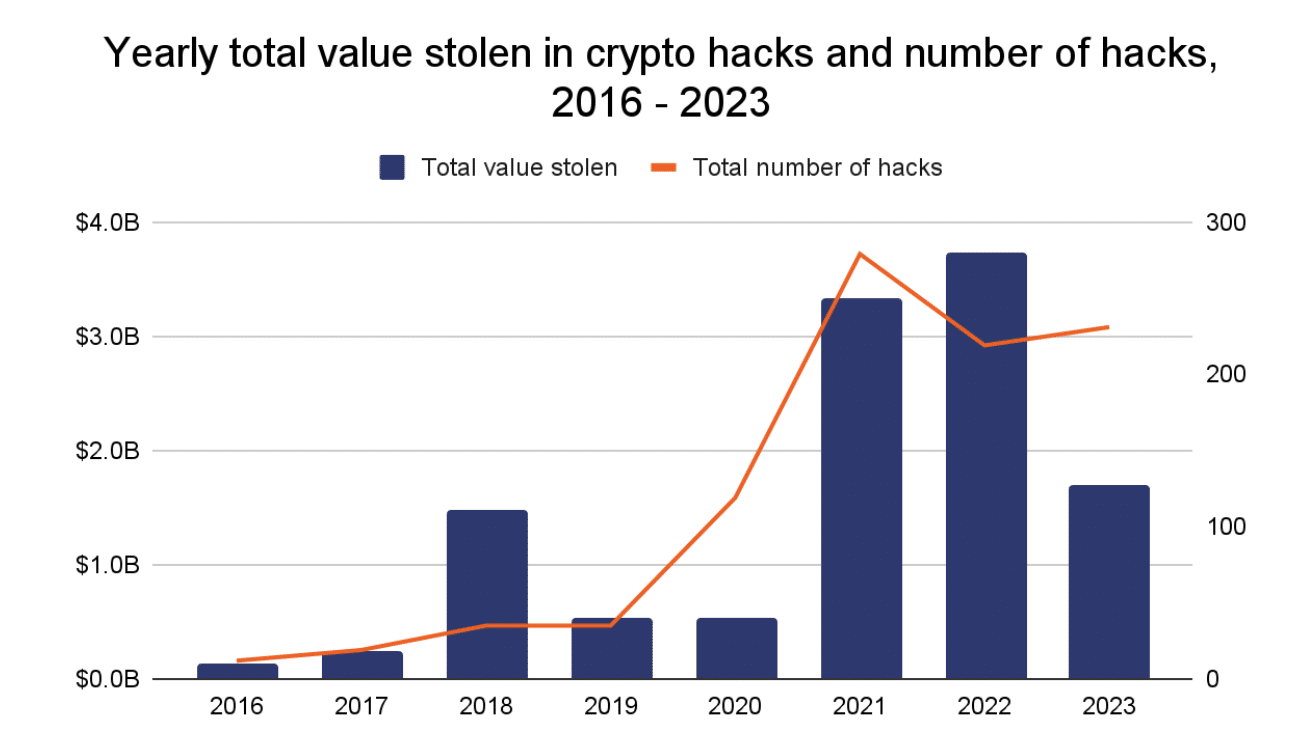

Funds stolen from crypto platforms dropped by extra than 50% in 2023 to $1.7 billion, in accordance with the contemporary Crypto Crimes Listing from blockchain info platform Chainalysis. Decentralized finance (DeFi) observed the supreme decrease overall in each the will of hacks and the quantity stolen.

“Merely put, DeFi operators appear to be recuperating at effectively-organized contract safety,” Eric Jardine, cybercrime research lead at Chainalysis, suggested Unchained in an email.

The total quantity of funds stolen became down from a file excessive of $3.7 billion in 2022, in accordance with Chainalysis. Nonetheless, the overall desire of hacking incidents reasonably elevated to 231 from 219. Considerable attacks in 2023 integrated the $197 million flash-mortgage attack on Euler Finance in March and the $200 million attack on Mixin Network in September.

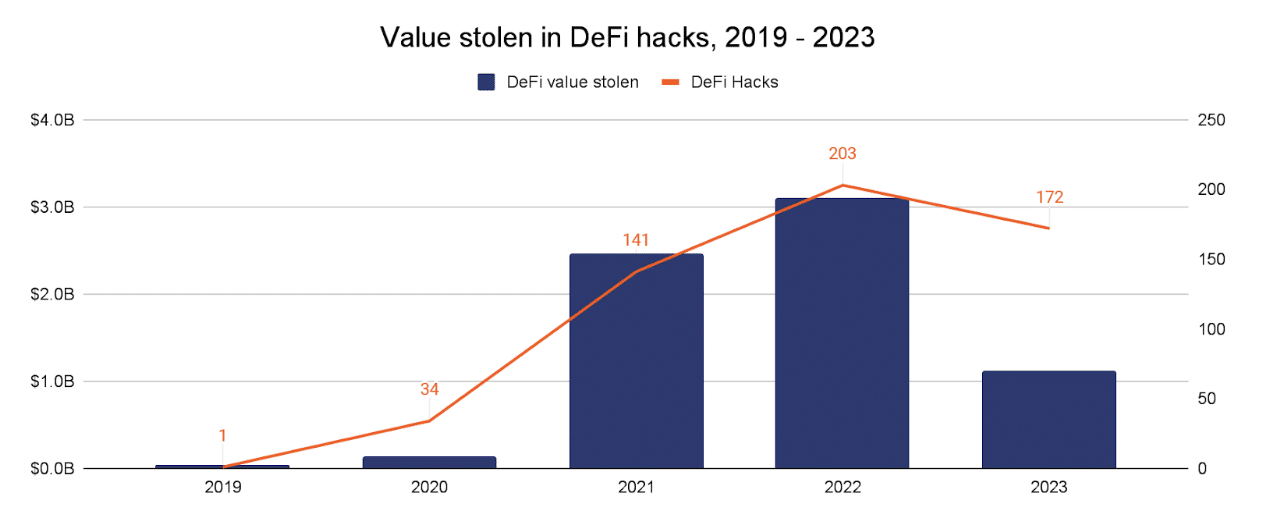

DeFi losses had been down year-over-year for the first time ever, falling 64% to $1.1 billion. The need of attacks in DeFi became additionally down 17%. The techniques that hackers can attack DeFi platforms encompass each on-chain vulnerabilities like effectively-organized-contract exploits and off-chain comparable to compromised deepest keys. The reductions suggest that DeFi firms are doing a greater job at bettering their technology to forestall attacks.

However better safety doesn’t point to the descend in hacks fully. “DeFi activity overall dropped, so it would put collectively that DeFi hacking in the same type observed a descend — meaning that the decline in stolen funds can doubtless be attributed to a combination of reinforced safety and a decline in total price locked in DeFi activity overall,” Jardine outlined.

High-profile crypto hacks can each deter contemporary traders from coming into the market and entice extra regulatory scrutiny, making deal of attacks a particular on your entire industry.

“There’s been a traumatic type in the escalation of each the frequency and severity of attacks inner the DeFi ecosystem,” Mar Gimenez-Aguilar, lead safety architect and researcher at blockchain safety company Halborn, suggested Chainalysis. “In our comprehensive prognosis of the terminate 50 DeFi hacks, we observed that EVM-based fully chains and Solana are amongst the most focused chains, largely in consequence of their popularity and functionality to put effectively-organized contracts.”

The Chainalysis fable additionally highlights the resurgence of North Korea-linked hacking groups comparable to Kimsuky and Lazarus Neighborhood. The groups had been in the support of a file desire of individual crypto attacks closing year, though there became a little decrease in the total quantity stolen to correct over $1 billion from $1.7 billion. The hackers focused fewer DeFi projects, reflecting the overall type.

UPDATE Jan. 24, 10:04 a.m. ET: Modified the lead checklist.

UPDATE Jan. 24, 9:30 a.m. ET: Added feedback from Chainalysis in paragraphs two and 5.

Source credit : unchainedcrypto.com