CRV Sitting on Exchanges Reaches an All-Time High as CRV Sign Hits All-Time Low

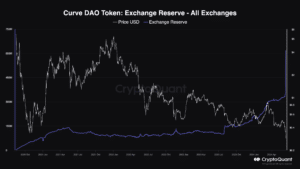

The quantity of CRV tokens sitting on exchanges has reached an all-time excessive, on the identical day the cryptocurrency’s heed has plummeted to an all-time low.

Per blockchain analytics firm CryptoQuant, exchanges are holding 613 million CRV tokens price over $177 million. That 76% lift from the prior day, when the decide sat at 347.5 million, is likely a signal merchants are offloading CRV from their holdings.

While CryptoQuant’s recordsdata shows that exchanges withhold roughly 50% of CRV’s circulating present, recordsdata from on-chain intelligence firm Nansen calculates that 72% of the CRV’s circulating present is held on exchanges.

Within the past 24 hours, The quantity of CRV on Binance elevated by $64 million, whereas OKX, Bybit, and Bithumb saw their CRV alternate reserves soar by nearly $11.7 million, per Nansen. Change reserves are the total different of tokens held on a given alternate, and in most cases encompass buyer deposits..

The price of CRV sank 22% within the identical duration to 23.9 cents, its lowest stage for the reason that token started shopping and selling in Aug. 2020. On the time of writing, the cost has settled at spherical 29 cents, per CoinGecko.

Curve Founder Will get Liquidated

This heed decline for CRV – the cryptocurrency that powers the incentive structure and governance system of the decentralized stablecoin alternate Curve – has resulted in forced liquidations of Curve’s founder Michael Egorov.

“Michael Egorov used to be liquidated for $140 million in CRV,” wrote crypto recordsdata firm Arkham Intelligence on X. “The price of CRV fell via Egorov’s liquidation threshold this morning, in conjunction with his whole 9-decide lending disclose liquidated across 5 protocols.”

“The Curve Finance team and I even were working to solve the liquidation possibility whisper which happened this day. Masses of you would possibly per chance per chance very well be aware that I had all my loans liquidated. [The] size of my positions used to be too lustrous for markets to deal with and brought on 10M of incorrect debt” mentioned Egorov on Thursday over X. “I even bask in already repaid 93%, and I intend to repay the comfort very quickly. It must wait on customers no longer to undergo from this whisper.”

Despite getting liquidated, Egorov “didn’t appear to lose the relaxation, as he had already cashed out and bought a mansion in 2023,” wrote Lookonchain on X. “The losers are $CRV holders and investors who bought $CRV at $0.4 by OTC in August 2023.”

Final 365 days, Egorov confronted a a linked possibility of liquidation when the cost of CRV dropped following an exploit that impacted Curve’s intellectual contracts on the cease of July 2023. Egorov used to be capable to steer clear of liquidation on the time because he raised about $42 million via over-the-counter gross sales of CRV tokens. Wintermute, DWF Labs, Gnosis Chain, and Reserve Protocol were among the lustrous investors of CRV tokens that participated in these OTC deals.

Source credit : unchainedcrypto.com