May perchance perchance perchance furthermore Solana Develop into ‘the Visa of Crypto’?

January 13, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

The Energy and Commerce Committee launched a crypto mining hearing for 1/20.

-

Turks are ditching native fiat currencies for USDT and BTC.

-

Block CEO Jack Dorsey is funding a Bitcoin licensed defense fund for BTC builders.

-

Ethereum’s burn price hit a document excessive on January 11.

-

Coinbase obtained FairX, a CFTC-regulated derivatives change.

-

Xapo surrendered its BitLicense.

-

The reasonable crypto fund returned 214% in 2021.

-

A community of US banks plans to present a stablecoin, dubbed USDF.

-

Monetary institution of The US thinks Solana would possibly maybe well become the Visa of crypto.

-

El Salvador has reportedly lost money on its BTC purchases.

-

TransUnion is having a behold to introduce credit score ratings to the crypto lending divulge.

-

Merchants are attempting for felony charges in opposition to two South African crypto change founders who allegedly stole $3.6 billion in BTC closing twelve months.

-

Though it’s unclear why, NBA High Shot banned a user whose username “FreeHongKong” remembers an incident when the NBA bowed to Chinese censorship rigidity.

- Royal, an NFT platform backed by 3LAU, crashed one day of its first descend.

Nowadays in Crypto Adoption…

-

Wikipedia is facing rigidity to remain accepting crypto payments.

-

Gap, the apparel retailer, is rolling out an NFT assortment on Tezos.

- Essentially based on a recent Visa see, almost a quarter of runt change house owners one day of nine nations thought to acceptcrypto payments in 2022.

The $$$ Corner…

-

Checkout.com brought in $1 billion in a Series D that valued that firm, which has web3 aspirations, at $40 billion.

-

SEBA, a crypto monetary institution, raised $120 million in a Series C.

- Zero Hash, a crypto startup, raised $105 million in a Series D.

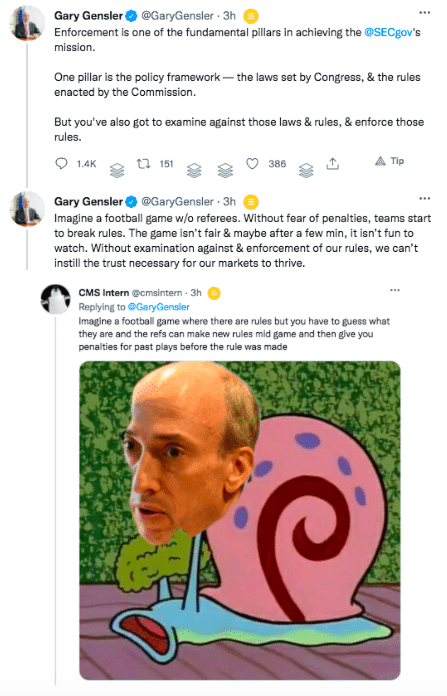

What Scheme You Meme?

What’s Poppin’?

CBDCs Shouldn’t Be Issued Straight to Patrons by the Fed Says Emmer

Representative Tom Emmer proposed an modification to the Federal Reserve Act the day before right this moment that will restrict the Fed from issuing a central monetary institution digital forex (CBDC) straight to folks. The piece of laws attempts to amend Fragment 13 of the Federal Reserve Act by including a brand contemporary paragraph to the tip of the file:

“Aside from as namely licensed under this Act, a Federal reserve monetary institution would possibly maybe well fair no longer offer merchandise or companies and products straight to an individual, like an fable on behalf of an individual, or insist a central monetary institution digital forex straight to an individual.”

Emmer’s circulate comes when CBDCs are being tested one day of the arena. Countries like India, Tanzania, Israel, and Mexicohave all expressed interest in issuing CBDCs. Records compiledby the Atlantic Council displays that 80 nations are increasing, piloting, researching, or like already launched a CBDC. Most notably, China has ramped up its digital forex efforts and has already circulated and is testing its e-CNY, with main tech gamers like WeChat and Alipay integrating with the forex.

Emmer, it looks, does no longer desire the US to like a study within the footsteps of China. “As other nations, like China, fabricate CBDCs that fundamentally omit the benefits and protections of money, it’s more crucial than ever to originate particular that the usa’ digital forex policy protects monetary privateness, maintains the greenback’s dominance, and cultivates innovation. CBDCs that fail to adhere to those three general principles would possibly maybe well enable an entity like the Federal Reserve to mobilize itself into a retail monetary institution, bag in my belief identifiable files on customers, and discover their transactions indefinitely,” Emmer wrote in a observation.

He added, “Now not handiest would this CBDC model centralize Americans’ monetary files, leaving it liable to attack, but it absolutely would possibly maybe well furthermore be frail as a surveillance utility that Americans must by no plan tolerate from their like authorities.” In Emmer’s investigate cross-test, “Requiring customers to start up an fable at the Fed to web admission to a U.S. CBDC would put aside the Consumed an insidious route such as China’s digital authoritarianism.”

Emmer concluded his observation, mentioning that the Fed must no longer be allowed to like adjust over standard monetary institution accounts. “It’s obligatory to designate that the Fed does no longer, and can fair no longer, like the authority to present retail monetary institution accounts. Regardless, any CBDC implemented by the Fed must be start, permissionless, and non-public. This plan that any digital greenback must be accessible to all, transact on a blockchain that’s clear to all, and like the privateness elements of money.”

To be particular, the Fed has no longer indicated any plan to enforce a CBDC. Nonetheless, Federal Reserve Chairman Jerome Powell did teach that the Fed would possibly maybe well be releasing a reporton CBDCs within the upcoming weeks.

Advised Reads

-

@MuseumofCrypto on crypto artwork:

-

MetaMask’s Dan Finlay on web3 wallets (basically based completely on Moxie):

-

Nifty Gateway’s Duncan Cock Foster on Wikipedia and NFTs:

On The Pod…

The Slicing Block: Why the Crypto Markets Accept as true with Been Down This Week

The Slicing Block is abet! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra sever it up about the most up-to-date news within the digital asset change. Advise issues:

-

why crypto sources skilled a drawdown after closing week’s FOMC meeting that hinted at accelerated price hikes

-

which emerging sources Tarun, Haseeb, and Tom envision weathering a undergo market

-

which sources would possibly maybe well be additional hurt by a persevered undergo market

-

the significance of Paradigm and Sequoia investing in Fortress Securities

-

what aspects of Assign CEO Moxie Marlinspike’s web3 article Haseeb, Tom, and Tarun take umbrage with

-

whether Cryptoland is crypto’s Fyre Competition or whether it’s the metaverse

-

what the heck is going on with the Rotund Penguins neighborhood

-

the classes from the CFTC’s graceful of Polymarket (disclosure: a ancient sponsor of my displays)

E book Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Expansive Cryptocurrency Craze, is now on hand for pre-utter now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-utter it at the present time!

You would possibly maybe well aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com