Compound’s Bug, um, Compounded in Size

October 4, 2021 / Unchained On daily basis / Laura Shin

On daily basis Bits ✍️✍️✍️

- A malicious program in Coinbase’s multi-factor authentication SMS option led to at least 6,000 Coinbase accounts being drained; the substitute says this could well reimburse customers.

- The SEC pushed attend reduce-off dates of 4 Bitcoin ETF applications till leisurely 2021.

- Grayscale added SOL to its $494 million astronomical-cap crypto fund.

- The final crypto market cap crossed $2 trillion to delivery up “Uptober.”

- Société Générale (SocGen), with out a doubt one of the most largest banks in France, utilized for a $20 million MakerDAO loan.

- Cryptocurrency substitute KuCoin is shutting down accounts of mainland China residents.

- Axie Infinity is launching a decentralized substitute.

- El Salvador mined Bitcoin the consume of geothermal energy.

- Zero Hash, a crypto companies startup, raised $35 million in a Series C round led by Point72 Ventures.

- Multicoin hired Greg Xethalis as its first overall counsel (and he’s going to appear on Unchained the following day).

- An NFT from SolanaMonkeyBusiness purchased for $2.1 million — the most costly Solana NFT sale to this level.

- The Biden administration is inspecting numerous concepts to defend a watch on stablecoin issuers.

What Produce You Meme?

What’s Poppin’?

The outdated day, a malicious program positioned all the way through the Comptroller contract of the DeFi lending protocol Compound changed into as soon as exploited for the 2nd time in trusty a few days.

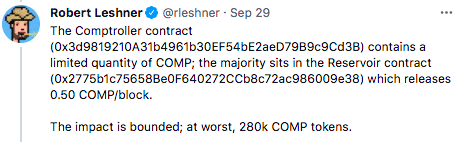

The first mishap came about closing week, quickly after Proposal 62 changed into as soon as implemented. Proposal 62 changed into as soon as intended to interrupt up COMP mining rewards to a governance station ratio, moderately than the outdated 50/50 rupture up fragment mannequin. Soon after the give a clutch to went are residing, the Comptroller contract began distributing rewards disproportionately, with a few customers coming in to scoop up hundreds of thousands of bucks of COMP. In accordance with Compound Labs CEO Robert Leshner, the malicious program changed into as soon as bounded at 280,000 COMP, or roughly $85 million.

In line with the contract, traditional customers of Compound would no longer be affected. The suitable menace is that determined customers would acquire unfairly astronomical rewards of COMP

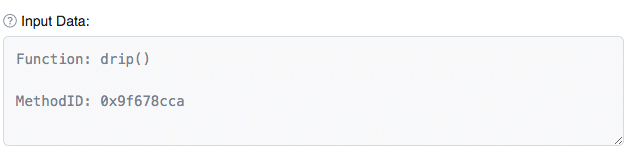

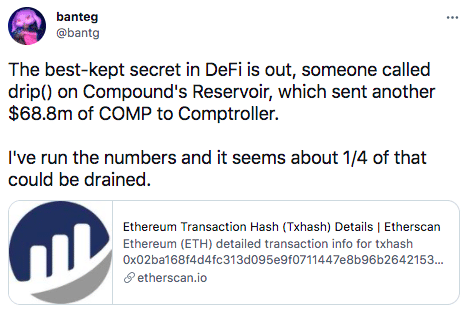

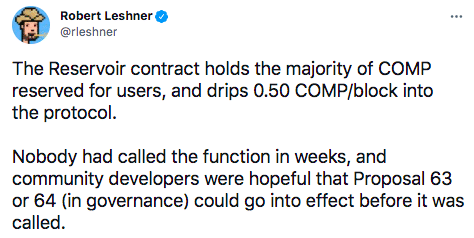

On Sunday, the Compound malicious program nearly doubled in scope. By calling Compound’s drip() fair, an Ethereum person changed into as soon as ready to append an further 202,000 COMP ($66 million) to the Comptroller contract, genuinely giving one more community of customers one more to claim an outsized fragment of rewards.

Banteg, a core developer at Yearn.Finance, calculates Compound as losing out on $147 million in COMP, a number that he believes makes it the largest neatly-organized contract introduced about fund loss ever. In accordance with Banteg, the “drip() fair” changed into as soon as the “easiest kept secret in DeFi,” had been recognized for a few days sooner than it changed into as soon as assign into action.

On the change hand, attributable to the way Compound governance is structured, it takes seven days to appropriate coding errors. Leshner, in a tweet, outlined that the team had hoped to earn a patch in sooner than the drip changed into as soon as called.

At publishing time, Compound’s COMP is ideal down 2.83% over the final 24 hours and 6% on the week.

Urged Reads

- Study about the great thing about Bitcoin from a, um, croissant:

- Decrypt on shocking cryptocurrency substitute customer strengthen:

- Tascha Che on the systemic shock of crypto:

On The Pod…

Crypto And not using a doubt Fixes This: How Code to Inspire Makes consume of Crypto in Afghanistan

Fereshteh Forough is the founder and CEO of Code to Inspire, a coding college for girls in Afghanistan. She discusses her background as a refugee, how she makes consume of crypto to fund the college and pay college students, and the way the US militia’s departure has affected student lifestyles. Themes embody:

- Fereshteh’s hotfoot from refugee to computer science professor to founder and CEO of Code to Inspire

- what Code to Inspire presents to younger Afghan women and what dangers they take by getting an training

- how Code to Inspire success stories are changing the attitudes of student’s households and communities

- the importance of Afghan Hero Girl, a video recreation created by Code to Inspire college students

- why crypto funds are an even bigger change to PayPal and Western Union for Code to Inspire and its college students

- how Code to Inspire and its college students substitute crypto to fiat

- what the perception of crypto is in Afghanistan

- how the Taliban is stifling the studying of girls and the way Code to Inspire is attempting to proceed its curriculum

- how crypto corporations can provide help to Code to Inspire

- what aspects and products Fereshteh thinks would attend the crypto industry genuinely monetary institution the unbanked

- how listeners can attend Code to Inspire and the assign to search out more files on Fereshteh

Book Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Enormous Cryptocurrency Craze, is now readily available for pre-speak now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-speak it this present day!

Which that you can perhaps also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com