CoinMetrics Tracks Alameda’s On-Chain Footprint to Label Lost Funds

Crypto records analytics firm CoinMetrics traced Alameda’s blockchain transactions in an strive to respond to the request on all people’s suggestions – the build did the cash hotfoot

In a Nov. 22 document, CoinMetrics said that they discovered that the traces between Alameda and FTX had been blurred attributable to the ownership of the alternate’s native token FTT

The analysts hypothesized that Alameda’s mountainous FTT station used to be outdated skool as collateral for a mountainous loan from FTX, about a of that will win been the alternate’s user funds.

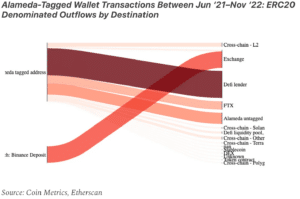

CoinMetrics stumbled on that Alameda wallets deployed a extensive sum of funds in the final quarter of 2021 when the crypto market used to be at its height. Between September and November, Alameda’s aggregated outflows amounted to $22 billion, said the analysts. Of these funds, $13.8 billion used to be in ERC-20 transfers and $9 billion used to be in ETH transfers.

“In our gape, the timing and magnitude of funds deployed main up to the market height in part explains why Alameda would incur colossal losses as the crypto market collapsed over basically the most indispensable half of of 2022,” said CoinMetrics.

The evaluation displays that Alameda deployed $7.8 billion to DeFi lending protocols, $4.6 billion to DeFi LP and farming protocols and $4.4 billion to non-FTX exchanges.

“It’s no doubt improbable: Alameda used to be fascinated with all the pieces from DeFi borrowing and lending to hideous-chain bridges across many varied ecosystems,” tweeted Lucas Nuzzi, head of be taught at CoinMetrics.

Nuzzi believes that Alameda will win lost a mountainous chunk of user funds in early 2022 by directionally hideous trades, DeFi lending markets and hideous-chain bridges that had been hacked or lost price.

CoinMetrics also stumbled on outflows in varied stablecoins that summed up to $27 billion. In accordance with the sheer size of those ouflows, analysts deem there used to be high leverage inviting with the firm the utilization of illiquid crypto sources to collateralize debt.

They also theorized that some funds will win been siphoned off-chain in gentle of FTX Chapter 11 Monetary catastrophe filings that exposed billions of bucks had been loaned to FTX executives.

“It’s imaginable that funds had been also outdated skool to prop up FTT’s tag starting up in early 2022 when it outperformed several other identical tokens,” said Nuzzi, highlighting that the token grew to turn out to be central to every Alameda and FTX’s survival.

Source credit : unchainedcrypto.com