Coinbase Will Protect User Property If They Fling Bankrupt

Could well merely 12, 2022 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

UST’s de-peg continues and LUNA plunges 98%.

-

Produce Kwon struggles to rating investors to attach UST.

-

The Monetary Accounting Requirements Board (FASB) began a venture to overview how publicly traded companies memoir for digital resources much like bitcoin on their stability sheets.

-

FTX.US utilized with the Unusual York Division of Monetary Services for a belief structure.

At present time in Crypto Adoption…

-

The metropolis of Cell, Alabama, presented a brand new Bitcoin mining venture.

- Brazil’s supreme digital monetary institution, Nubank now enables its potentialities to amass BTC and ETH

- Grayscale and the SEC met to say about a bitcoin ETF.

The $$$ Nook…

-

Crypto Exchange Kucoin Raises $150 Million At $10 Billion Valuation.

-

Moralis, a crypto startup, raises $40 Million.

-

Fasanara Capital, a London-based fully asset supervisor, is elevating $350 million for a enterprise capital fund to make investments in crypto companies.

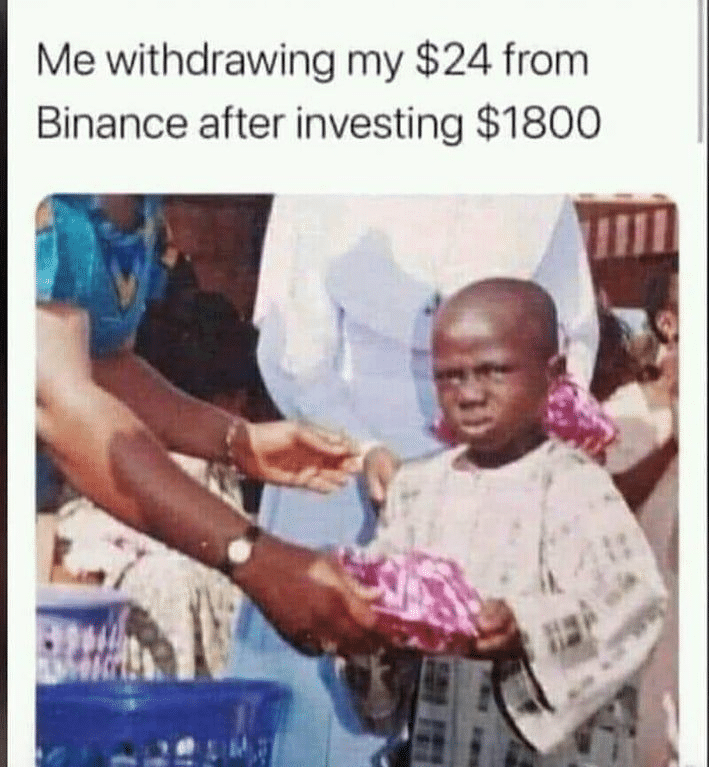

What Produce You Meme?

What’s Poppin’?

Coinbase Warns Users They Could maybe Lose Their Property

Coinbase, the largest cryptocurrency replace within the United States by trading volume, warned its potentialities that any resources held on replace by users would per chance maybe maybe be in risk if the firm were to file for financial spoil.

Coinbase released this disclosure in its first-quarter earnings file, wherein Coinbase reported an absence of $430 million and a 19% fall in monthly users. It turned into as soon as integrated as one amongst the risk factors of the exercise of the platform.

“On memoir of custodially held crypto resources would per chance maybe maybe be considered as to be the property of a financial spoil estate, within the tournament of a financial spoil, the crypto resources we have in custody on behalf of our potentialities would per chance maybe maybe be enviornment to financial spoil court cases and such potentialities would per chance maybe maybe be treated as our regular unsecured collectors,” the firm explained.

Brian Armstrong, Coinbase’s CEO, took to Twitter to account for the topic and bring aloof to the millions of oldsters that exercise the replace. “Your funds are safe at Coinbase, lawful as they’ve continually been,” he acknowledged. “We predict about our Top and Custody potentialities appreciate strong lawful protections in their terms of provider that protects their resources, even in a dusky swan tournament appreciate this,” he added.

He went on to account for that Coinbase has “no risk of financial spoil.”

The firm stock, COIN, which closed at $103.74 final Friday, closed at $fifty three.72 the day prior to this, in step with Yahoo Finance. This accounts for practically a 50% drawdown in decrease than every week, as crypto markets continue to bleed

Urged Reads

-

Placeholder VC’s Chris Burniske on the endure market.

-

EThe Defiant on how NFTs will revolutionize intellectual property.

-

Joakim Book on working out the monetary plan.

On The Pod…

Will Optimism’s OP Token Blueprint Of us Abet to Layer 2s on Ethereum?

Kain Warwick, founder of Synthetix, and Ben Jones, cofounder and chief scientist at Optimism Foundation, discuss the present mumble of Ethereum Layer 2s, Optimism’s new governance building, why Synthetix selected to carry out on Optimism, and more. Expose themes:

-

what Optimism and Synthetix are

-

how zero-files rollups differ from optimistic rollups

-

why Synthetix decided to carry out on Optimism

-

what makes L2s more curious to carry out on than diversified L1s

-

how Optimism’s governance goes to replace with the originate of the Optimism Collective and OP token

-

what points Synthetix has had with Discord governance and early token vote casting, and how they’ve now solved this by forcing users to consolidate pockets addresses

-

what retroactive public goods funding is and how it would per chance maybe maybe carry out a “flywheel” of sort on Optimism

-

why whales would per chance maybe maybe be excluded from Optimism’s token grant to Synthetix

-

why Ben thinks the future is about the “superchain” somewhat than multi-chain

-

what Kain and Ben mediate bridging between L2s and Mainnet

-

why Optimism is a staunch backer of EIP 4844

-

how the merge would per chance maybe appreciate an affect on Optimism and Synthetix

Book Exchange

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Broad Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now accessible!

Which it’s probably you’ll additionally own it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com