12 Charts That Roar the Tale of Crypto in 2023

When revelers rang in 2023, bitcoin (BTC) was hovering spherical $16,600 and crypto traders had been licking their wounds following the cave in of crypto alternate FTX. The brand new year looked position to be muted relative to the heady years of crypto past, however, as traders who had been across the block know, it’s no longer regularly ever aloof in crypto, and 2023 has been no a quantity of.

From switch layoffs to heightened regulatory scrutiny to the mess ups of three crypto-friendly banks to the intelligent prison trial of FTX founder Sam-Bankman-Fried and the euphoria over the likely approval of a bid bitcoin alternate-traded fund within the US, 2023 has had a bit little bit of the full thing.

Read extra: Crypto’s Easiest and Worst in 2023: The Slicing Block

With as many americaand downs as an alt-coin buying and selling chart, Unchained asked among the switch’s leading be taught firms to portion the charts and files that most interesting hiss the story of crypto in 2023.

1) World Crypto Adoption Falls

World Crypto Adoption Index chart, which sums together the index adoption ratings of 154 worldwide locations per quarter. (Chainalysis)

Blockchain files platform Chainalysis’s global crypto adoption index is a measure of the global grassroots adoption of crypto. Chainalysis measures 154 worldwide locations’ usage of a quantity of varieties of cryptocurrency services by rating the worldwide locations across 5 sub-indexes. The records is then collated to generate a closing salvage for each and every country on a scale of zero to one. The closer the salvage is to 1, the upper the country ranks in adoption.

The final global index salvage, which sums up the 154 worldwide locations’ index ratings for each and every quarter, highlights that the switch level-headed has a long solution to head by skill of grassroots adoption after a dramatic drop in 2022, which was a year mired by switch collapses.

“While valuable enhancements had been made, there may perchance be level-headed a long solution to head to come again to 2021’s peak,” acknowledged Chainalysis’s be taught crew.

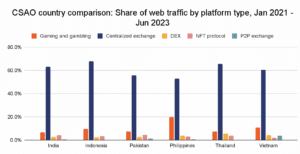

2) Central and Southern Asia Situation Is Gleaming Space in Adoption

Chainalysis analysts are carefully watching the Central and Southern Asia and Oceania (CSAO) build. Though the build ideal accounts for spherical 20% of global exercise, it boasts essentially the most interesting shopping vitality and population, which has ended in six of the pinnacle 10 worldwide locations in Chainalysis’s index being positioned within the build, the analysts acknowledged.

Comparison of the digital property net visitors of CSAO worldwide locations. (Chainalysis)

“Not ideal is the build’s adoption like a flash rising however the rationalization why are additionally very various,” acknowledged Chainalysis’s be taught crew. “The Philippines, let’s take into accout, is amazingly drawn to utilizing digital property for gaming and playing, whereas Vietnam is the right country with a solid hobby in P2P exchanges. These are key elements in predicting how the switch will evolve subsequent year and beyond.”

Read extra: To Count on Where Web3 Gaming Is Headed, Witness to the Philippines

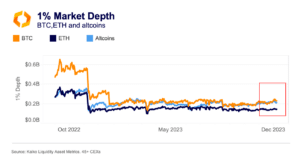

3) Liquidity Continues to Be a Mission

Market depth across bitcoin, ether and altcoins clarify books. (Kaiko)

Market depth is a measure of the want of originate aquire and promote orders for an asset. The larger the want of orders, the upper the depth of the market, which components that mammoth trades are less seemingly to affect an asset’s place. It’s one amongst the ideal indicators of liquidity, acknowledged Clara Medalie, be taught director at crypto files firm Kaiko.

“After the FTX cave in, liquidity collapsed across exchanges, and we are in a position to understanding that it has yet to get better,” Medalie acknowledged.

Surprisingly altcoin liquidity has viewed essentially the most interesting restoration, whereas bitcoin has ideal viewed a itsy-bitsy enlarge in market depth, which is largely attributable to price effects, and ether (ETH) has struggled, Medalie acknowledged.

Liquidity has additionally become extra concentrated this year attributable to a extra complicated atmosphere for centralized exchanges. The eight most interesting exchanges story for spherical 89% of crypto switch volumes and 91% of market depth, in step with Kaiko files.

“Total, liquidity level-headed poses a venture as we creep into 2024,” Medalie acknowledged.

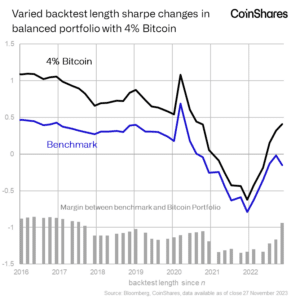

4) Bitcoin Solidifies Its Space as an Different Asset

Sharpe ratio of a portfolio with 4% bitcoin versus one with out. (Coinshares)

This year digital asset funding firm Coinshares seen a dramatic widening within the hole between the Sharpe ratio of a portfolio containing 4% bitcoin and one with out, which components that the portfolio with bitcoin equipped higher possibility-adjusted returns.

The Sharpe ratio is a widely former measure for possibility-adjusted returns – the upper the ratio, the higher the returns. A Sharpe ratio higher than one is believed to be to be simply.

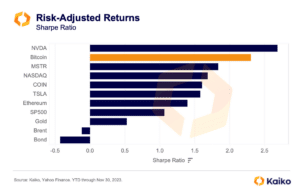

Sharpe Ratio year-to-date measure across property. (Kaiko, Yahoo Finance)

“The rising correlation between bond and equities [is] driving the want for higher diversification, with bitcoin offering the ideal diversification and possibility-adjusted returns of all different property,” acknowledged James Butterfill, head of be taught at Coinshares.

5) Bitcoin Matures as an Asset

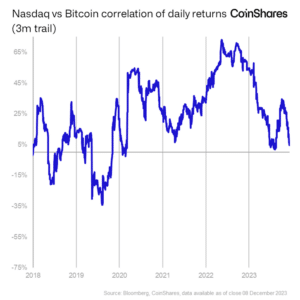

Correlation between Nasdaq index and bitcoin day-to-day returns. (Coinshares)

In the intervening time, bitcoin’s hold correlation with the Nasdaq index has fallen under 5%, Butterfill acknowledged. It is a shift from the 2020-21 bull cycle in which bitcoin’s place was carefully correlated with US equities. The correlation is now staying inner long-term historical norms, he added.

“The rising softness in rate hikes this year and deteriorating macro files hold ended in a divergence between bitcoin and equities prices,” Butterfill acknowledged. “This is seemingly to continue because the Fed takes a softer stance in 2024.”

“Bitcoin has outperformed most frail property, including gold and tech shares,” Kaiko’s Medalie acknowledged. “The steady decline in bitcoin volatility, which hit multi-year lows this summer season, has seemingly contributed to the pattern. Total, bitcoin was this year’s winner across the board.”

6) Investment Flows Procure higher

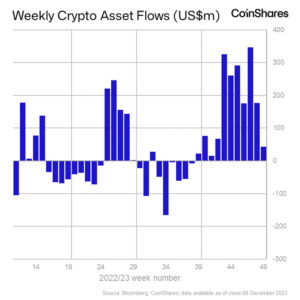

Digital asset funding product inflows by week. (Coinshares)

No topic the cool crypto winter within the early share of 2023, digital asset funding products honest no longer too long within the past experienced their eleventh straight week of inflows, acknowledged Coinshares’ Butterfill.

The full quantity of inflows as a lot as now this year is $1.85 billion, which makes it the third-most interesting year of inflows and essentially the most since the 2021 bull market, Butterfill acknowledged.

7) Institutional Capital Starts to Return

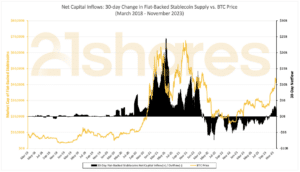

30-day switch in fiat-backed stablecoin provide vs bitcoin’s place. (21Shares, Glassnode, DefiLlama)

Crypto funding firm 21.co has additionally identified a return of institutional capital into crypto markets slack this year by its dimension of the 30-day switch in fiat-backed stablecoin provide. This metric acts as a simply proxy for measuring new waves of capital coming into the ecosystem and has historically positively correlated with bitcoin’s place movements, acknowledged Carlos Campos, be taught analyst at 21.co.

“Most contemporary net inflows into stablecoins suggest a altering market construction going into 2024, with institutional cash returning to the ecosystem like a flash,” Campos acknowledged.

8) NFTs Battle

Nansen’s NFT-500 index, which measures the pinnacle 500 NFT collections. (Nansen)

2023 was a tough year for the non-fungible token (NFT) market with common prices down Forty eight% year-to-date based on files from blockchain analytics platform Nansen, whose NFT-500 index tracks the pinnacle 500 NFT collections.

9) Plump Penguins Buck the Pattern

One essential exception to the NFT pattern was the Plump Penguin NFT sequence, which was got by Luca Netz in April 2022. The sequence made a want of serious announcements this year including the rollout of a sequence of physical products in 2,000 Walmart stores across the US, as successfully as various Canadian Toys R Us locations. The sequence additionally announced that its digital world will originate subsequent year.

Imprint and quantity of Plump Penguins NFT sequence. (Nansen)

“Plump Penguins saw a shallower drop in their common place all year long and a mammoth creep up in direction of the terminate of the year,” acknowledged Martin Lee, hiss material and communications lead at Nansen.

10) A Shake-up in Centralized Exchanges

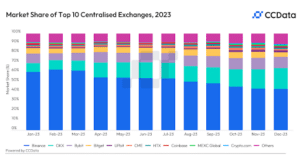

Market portion across centralized exchanges. (CCData)

“Having a watch back on 2023, now we hold witnessed a excellent structural shift within the centralized alternate landscape,” acknowledged Joshua de Vos, be taught lead at digital asset files provider CCData.

The cave in of FTX resulted within the market consolidating within the back of Binance, which reached an all-time high market portion of 62.6% across bid and derivatives in February. Then as honest appropriate and regulatory actions had been taken against Binance all year long, the alternate’s mixed market portion waned, falling for 10 consecutive months to 42.7% in December.

“Contrastingly, each and every OKX and Bybit hold benefited from this displacement of market portion, reaching all-time highs in November of 20.2% and 11.9%, respectively,” de Vos acknowledged.

11) Ethereum Staking Hits Recent Highs

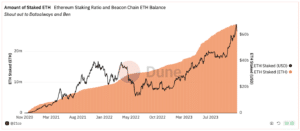

Amount of staked ether (21.co, Dune Analytics)

“Referring to Ethereum fundamentals, the quantity of staked ether hit an all-time high of 28.78 million ether in December, connected to over $60 billion securing the network,” acknowledged 21.co’s Campos. “For the reason that Shanghai toughen, the Ethereum staking contract surpassed 10 million ether in net new deposits, which reveals that enabling withdrawals was one amongst essentially the most valuable de-risking events in Ethereum’s historical past.”

12) Solana Stages a Comeback

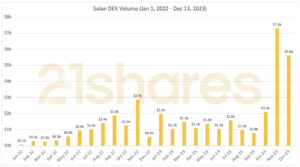

Decentralized alternate buying and selling volumes on Solana (21Shares, DefiLlama)

Shopping and selling volumes on decentralized exchanges on Solana reached an all-time high of $7.3 billion in November and December appears to be like heading within the suitable direction to surpass this figure, in step with files from 21.co. This exercise comes amid airdrops from key Solana initiatives including Jito, Pyth and Jupiter.

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/seek for?v=xwFBD2hzChk&t=361s

src in org: https://www.youtube-nocookie.com/embed/xwFBD2hzChk?birth up=361&feature=oembed

src in mod: https://www.youtube-nocookie.com/embed/xwFBD2hzChk?birth up=361

src gen org: https://www.youtube-nocookie.com/embed/xwFBD2hzChk

“After being tormented by outages in 2021 and 2022, Solana faced its most valuable venture after FTX collapsed in November 2022,” acknowledged 21.co’s Campos. “With many of us calling for the death of the chain and its future at stake, the Solana neighborhood stood together and rose to the occasion.”

Source credit : unchainedcrypto.com