5 Charts That Highlight How Ethereum Has Modified One Year After Shapella

Ethereum on Friday reached its one-year Shapella upgrade anniversary, which transitioned the blockchain from a proof-of-work validation gadget to the more vitality-efficient proof-of-stake.

The upgrade took place on April 12, 2023, which allowed stakers to withdraw ether (ETH) that had been securing and validating the second-largest blockchain community.

365 days later, Ethereum has changed in numerous ways, from fluctuations in staked ETH to the different of validators in its ecosystem. Here are five charts to illustrate how Ethereum has progressed since Shapella:

1. Complete Staked ETH Securing Ethereum

Staked ether has grown critically in the previous year to 32.2 million ETH, up from 20 million, Nansen info reveals.

Despite the runt decrease in staked ETH from centralized exchanges initiating withdrawals following the rollout of Shapella, staked ETH has since ballooned 61%, marking a $42 billion influx into Ethereum’s staking infrastructure, basically based totally totally on contemporary pricing.

Sooner than Shapella, would-be validators had one chance: depositing ETH into Ethereum’s staking contract. Withdrawing resources used to be no longer likely.

“Based totally totally on how the total quantity of ETH staked on Ethereum grew dramatically since the Shanghai [or the Shapella] upgrade, it’s obvious that the activation of staked ETH withdrawals on the community used to be a well-known de-risking match for the exercise of staking,” acknowledged Christine Kim, Galaxy’s vp of review, in an electronic mail.

Shapella helped de-menace Ethereum, because stakers gained an exit window — with out struggling slashing penalties for ditching tasks. As of newsletter, staked ETH represented 26.94% of the 120 million total present.

Mike Neuder of the Ethereum Foundation outlined in a March blog components space to gas inquire of for staked ETH. Those consist of ETH appreciation, elevated inquire of for restaking, decrease rates of interest that can lead establishments to hunt for different yield, the recognition of liquid staking and the chance of exchange-traded fund companies pushing for staked ETH.

Ethereum builders, nonetheless, are concerned concerning elevated inquire of inflicting staked ETH present to rise “too great and too rapidly,” Kim illustrious.

Learn More: Why the Ethereum Community Is Up in Arms Against a Proposal to Alternate the Monetary Policy

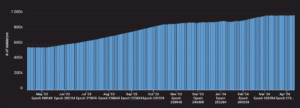

2. Resolution of Validators

Validators hold grown critically since Shapella, easing “some apprehension in the Ethereum community that the skill to withdraw ETH from the Beacon Chain would result in a mass exodus of validators,” Austin Blackerby, EVM analytics manager at Flipside Crypto, suggested Unchained by activity of Telegram.

Nearly 563,000 validators secured Ethereum as of April 12, 2023. The opt has since jumped over 74% to roughly 981,000 validators.

“Additionally, interest to be a a part of the active validator space has confirmed an intensive amplify over the previous 30 days, with the novel queue time for contemporary validators sitting over 9 days,” Blackerby acknowledged. “Conversely, there is virtually no queue to exit the validator space. This implies there is so much more inquire of to be a validator than there is inquire of to gallop away the community.”

Continued validator development has raised additional concerns amongst protocol builders and researchers. Galaxy’s Kim illustrious two critical reasons in a September 2023 file.

“First, a tall validator space dimension creates traces on perceive-to-perceive networking and messaging that can trigger node failures from high computational load and bandwidth necessities,” Kim wrote. A tall validator space also makes future upgrades “more tough and riskier to originate,” she added.

The following upgrade, “Electra,” is expected to address the rising validator space. Electra comprises EIP-7251, an development proposal to lop help validators by rising essentially the most ETH a validator can stake. EIP-7251 targets to permit validators a most of two,048 staked ETH, as a replace of the present limit of 32 ETH.

Learn More: What is EIP-7251 (MaxEB) in Ethereum? A Beginner’s Manual

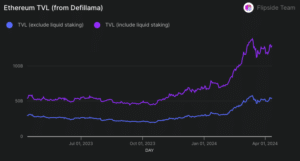

3. Complete Fee Locked (TVL)

Ethereum’s TVL surged after withdrawal activations. On April 12, 2023, customers locked $54.69 billion on decentralized finance (DeFi) applications, with 54% from liquid staking. Since, TVL has grown over 131% to $126.75 billion, with liquid staking comprising about 42%.

Ethereum maintains its high TVL situation, adopted by Tron, Binance Tidy Chain, and Solana, basically based totally totally on DefiLlama. One ingredient using development is ETH appreciation, which surged seventy 9% from $1,920 all around the Shapella rollout to about $3,440 as of newsletter.

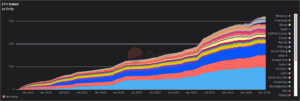

4. Lido Leading the Pack

ETH holders hold two ways to stake: solo dwelling staking or using a third party.

Tidy contract protocol Lido, neatly-known for its liquid staking programs, instructions nearly 9.4 million staked ETH, representing about $33 billion — or 29% of all staked ETH.

Liquid staking refers to staking ETH and receiving a “receipt” token, which represents a critical deposit, apart from rewards. Whereas the ETH is locked, a staker can expend their “receipt” token as liquidity on DeFi applications.

Lido led the pack in phrases of staked ETH on the time of Shapella, boasting a lead of two.97 million ETH over Coinbase. Lido has grown its lead over the previous year. At newsletter, Lido’s staked ETH stood at nearly 9.4 million.

Liquid staking competitors has been heating up. Take be aware of that protocols Renzo, Stader, Mantle and Ether.Fi didn’t hold any ETH staked when ETH withdrawals went live, but are now to blame for 2.16 million staked ETH.

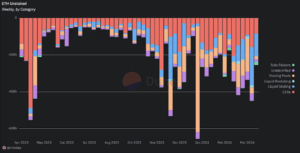

5. Unstaked ETH

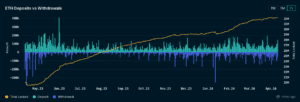

Whereas staking withdrawals haven’t exceeded deposits, withdrawal patterns hold changed since Shapella.

Centralized exchanges hold been the predominant withdrawers of staked ETH in the 2023 aftermath of Shapella. Exchanges that week withdrew 138,912 ETH that had secured the blockchain, dwarfing the collective 72,792 ETH withdrawn from all varied categories, per the Dune dashboard.

A year later, staked ETH withdrawals hold been largely activated by liquid staking protocols. Since Monday, centralized exchanges withdrew 84,128 staked ETH, while liquid staking protocols hold been to blame for 121,472 staked ETH withdrawals. Lido, which withdrew staked ETH Thursday, has considered its staked ETH decrease 1% in the previous week and 4% over the previous month.

Source credit : unchainedcrypto.com