Celsius Files for Chapter 11 Financial misfortune

July 14, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits✍️✍️✍️

- Celsius filed for chapter 11 financial misfortune to stabilize its industry.

- The worth of stETH dropped due to inconvenience of a Celsius selloff.

- Celsius repaid its debt to DeFi protocol Compound and reclaimed $200 million in collateral.

- Ethereum scaling solution StarkNet announced the commence of a native token for September.

- Ukrainian authorities seized the sources of crypto traders who had been allegedly aiding Russia.

- The United Countries released a coverage transient outlining coverage alternate ideas for curbing risks associated with crypto fetch constructing countries.

- A advance to a name denied the SEC to cloak a 2018 speech which could perchance presumably support Ripple in its case

- Michael Barr, a ancient crypto adviser, will change into vp for supervision on the Fed.

At the moment time in Crypto Adoption…

- South Africa is getting ready to support an eye on crypto as a financial asset.

- Polygon became chosen to be a bit of the 2022 Disney Accelerator Program that makes a speciality of NFTs, AI, and AR.

The $$$ Nook…

- Inflection Point, a crypto recruitment agency based totally in Miami, raised $12.6 million and obtained its competitor.

- Merkle Manufactory, a company owned by a ancient Coinbase government, raised $30 million led by a16z.

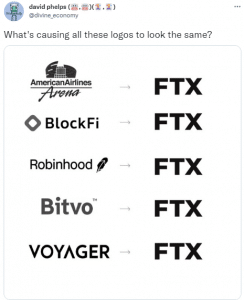

What Make You Meme?

What’s Poppin’?

US Inflation Hits 9.1%. What Does This Imply For Crypto?

By Juan Aranovich

U.S. person inflation reached 9.1% in June, its perfect rate in 40 years. The Consumer Set Index, released the day prior to this, became elevated than the estimates. The major contributors of this expand had been gasoline, food and housing prices.

The Consumer Set Index measures the general trade in person prices over time in response to a book basket of items and services and products. It’s never exact for a rustic to comprise high ranges of continual inflation, in particular whether it is miles unintended. The group guilty for the steadiness of costs (aka having inflation below support an eye on) is the Fed.

With CPI as high as it is miles, the Fed will seemingly be pressured to expand hobby rates, which is the very most spirited tool they comprise on hand to meet its dedication. The hobby rate that the Fed sets is successfully the tag of cash, which impacts on the subject of everything in the financial system.

Nevertheless how does it affect crypto?

- Elevated hobby rates cause a phenomenon known as “flight to security.” This happens when investors fetch out of volatile sources and crawl to safer ones, love bonds or treasury funds. Crypto is aloof viewed as one in all the riskiest sources available, so folks could perchance presumably sell off, causing the costs to head down.

- When hobby rates are elevated, the worth to finance unique projects crawl up. Which design that there’s less money for constructing unique projects, in particular folks that require plenty of preliminary capital, and there are fewer jobs for folks. For crypto, this could perchance presumably translate into less innovation, less marketing and marketing exhaust and no more adoption.

- The elevated the hobby rates, the less money folks comprise, because they are able to’t fetch credit and mortgage interests are up. If folks comprise less disposable earnings, they comprise to exhaust extra on their worth of dwelling and no more on investments love crypto or other financial sources.

After the ideas went out, crypto sources had been no longer down badly – bitcoin and ether every dropped about 5% on the ideas – but that is more seemingly to be because the market had already priced in a high inflation quantity.

The market is now pricing in a 75% probability of 100bps expand (+1%) in the Fed’s rate for the following month. Whether this expand would prick CPI is aloof into query. Inflation is a multi-causal phenomenon. By raising the rates, the Fed would be destroying put an declare to (a extremely effective system to lower the CPI), but what if the arrangement back of inflation is due to a lack of provide?

One of many many conditions that BTC has been talked about to comprise is being an “inflation hedge.” Then again, it looks love BTC has no longer yet gained that quality. Even supposing the inflation rate became fairly high in the previous yr, no longer handiest BTC wasn’t ready to hedge it, but it absolutely became down significantly.

Urged Reads

1) Crypto Thesis by Kyle:

2) Tascha Che on Tokenomics:

3) Kirill Naumov on MakerDAO:

On The Pod…

Put up-Merge, If Lido Becomes Dominant, What Does That Imply for Ethereum?

Ryan Berckmans, Ethereum investor and neighborhood member, and Alexandre Bergeron, Bitcoin investor, focus on about Lido’s dominance as a liquid staking provider, whether that ache is more seemingly to be resolved, and the design it’d be a centralizing power for Ethereum. Ticket highlights:

- what stETH is, what the makes expend of conditions are for stETH, and why it is miles major

- how Lido had a main-mover profit and the design that kicked off community effects

- whether the liquid staking derivatives machine is one in all a “winner-rob-all”

- how mighty of the staked ETH will seemingly be grew to alter into exact into a liquid staking derivative

- how Lido could perchance presumably comprise a large MEV various after the Merge

- what the proposer-builder separation is

- whether Lido’s dominance will expand over time

- whether other opponents were competitive with Lido

- why Lido is a natural monopoly due to the incentives and MEV alternatives

- what the implication of Lido’s monopoly is for Ethereum’s censorship resistance

- whether Lido is successfully a single entity despite having extra than one node operators

- whether there would be a protracted waiting period for turning exact into a validator after the Merge

- how Lido is shifting its staking derivatives to other chains

- how Lido’s unique dual-governance proposal works, why it’d be helpful to decentralize Lido and whether it reduces the flexibility of LDO token holders

- how Lido’s centralization is the most spirited threat to Ethereum in the long time period and what are the possible alternate ideas

- why Ryan believes the worth of ETH comes from its credible neutrality and whether Lido’s centralization could perchance presumably unbiased jeopardize that

- whether discovering alternate ideas around MEV alternatives is a exact system to prick Lido’s monopoly

- whether Lido’s opponents could perchance presumably save an alliance and create a tokenized basket of their staking derivatives to compete with Lido

- whether Lido could perchance presumably airdrop the LDO token to all ETH holders to decentralize its governance token

E-book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Broad Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now on hand!

You need to presumably comprise it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com