BTC ETF Day 1: (Almost) $1 Billion in Volume

October 20, 2021 / Unchained Day to day / Laura Shin

Day to day Bits ✍️✍️✍️

-

5 democratic senators sent a letter to Facebook CEO Rate Zuckerberg calling for the shutdown of Diem and Novi (disclosure: I write a Facebook Bulletin e-newsletter); Paxosand Coinbase presented relationships with Novi for a pilot program already dwell within the US and Guatemala.

-

The Linked Press launched an NFT assortment on Binance Trim Chain.

-

Mike Novogratz’s Galaxy Interactive raised a new $325 million “disclose material and technology” fund.

-

Coinbase is partnering with the Nationwide Basketball League and Females’s Nationwide Basketball League as their extraordinary cryptocurrency sponsor.

-

Chainalysis, a blockchain analytics company, added an undisclosed quantity of BTC to its steadiness sheet.

-

The Chamber of Digital Commerce doesn’t focus on stablecoins warrant new regulations.

-

Eastern regulators authorized the crypto alternate Huobi to give crypto spinoff products to voters.

-

Cosmos is constructing a new blockchain for checking out and experimentation.

- Celsius CEO claims that Tether is minting USDT backed by BTC and ETH.

What Attain You Meme?

What’s Poppin’?

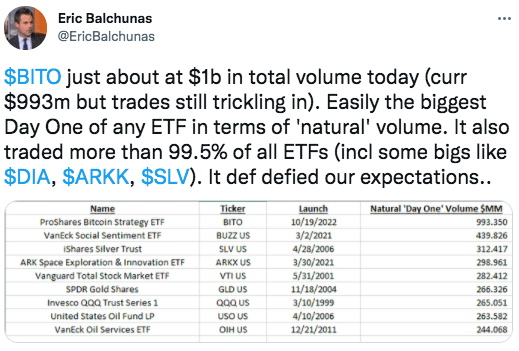

The ProShares’ Bitcoin Device ETF went dwell the day gone by, bringing the critical bitcoin futures ETF to market. Buying and selling under the ticker BITO on the Recent York Stock Alternate, traders poured roughly $993 million into the product — ample to create it the 2nd-excellent trading day for a US ETF on its first-day trading. Once after-hours trading turned into calculated, files from Bloomberg reveals that BITO hit $1 billion.

On Twitter, Eric Balchunas, a senior ETF analyst at Bloomberg, said BITO turned into the excellent initiate of 2021 in, all caps for emphasis, “UNDER AN HOUR.”

Notably, the value of Bitcoin bought a huge bump the day gone by, reaching a excessive of $64,608 on Tuesday at 7:49 pm ET — roughly $200 from its all-time excessive.

In linked news, Grayscale officially filed with the SEC to transform its Grayscale Bitcoin Belief (GBTC), the excellent bitcoin investment automobile within the realm, into an ETF for build bitcoin. On the time of writing, GBTC has $40 billion in AUM and holds roughly 3.5% of all BTC in circulation.

The company believes that BITO’s approval is a signal from the regulator of its comfort with Bitcoin. “This depart turned into triggered by the SEC’s clearance of a Bitcoin Futures ETF — which we think is a signal of the company’s comfort in Bitcoin as an underlying asset.,” said Grayscale in an announcement.

Turning GBTC into an ETF will most likely be a huge feat, because the SEC has but to let a build ETF depart thru attributable to concerns over market manipulation. As covered here on Monday, the SEC recently delayed its choice concerning four bitcoin ETF listings till November and December. The earliest shall we scrutinize a choice for a build bitcoin ETF will most likely be November 14, when the VanEck application reaches its final closing date.

Instructed Reads

- Token Terminal on why TVL in general is a deceptive statistic for measuring a protocol’s efficiency:

- Eric Balchunas, Bloomberg’s senior ETF analyst, on the efficiency of ProShare’s bitcoin futures ETF on its first day of trading:

- CoinDesk on DeFi law:

On The Pod…

Is the Metaverse Already Here? Two Consultants Disagree

Andrew Steinwold, managing accomplice at Sfermion, and John Egan, CEO at L’Atelier BNP Paribas, focus on NFTs and debate the characteristics of the metaverse. Present highlights:

- their backgrounds and the procedure in which they bought into NFTs

- how they every outline the metaverse

- what NFTs ought to create with the metaverse

- how John and Andrew’s depiction of the metaverse differs

- what John thinks about Facebook’s entrance into the metaverse

- whether Second Existence is a metaverse recreation

- how blockchain technology lets in for an originate metaverse (and why Web2 is “communist”)

- what NFTs on the 2nd free up for the metaverse

- whether the metaverse will basically ought to be skilled thru augmented fact

- whether there shall be more than one metaverses all the procedure in which thru diversified blockchain platforms

- why John thinks NFT maxis and crypto maxis are destined to clash

- how the metaverse is altering how of us make cash

- how to create the metaverse more accessible

- whether regulators will pressure the metaverse to be siloed

- how the metaverse will cope with jurisdictional disputes

- what happens when anyone’s Web3 avatar/identification is stolen within the metaverse

- what John and Andrew predict will happen within the metaverse over the next 6-one year.

E book Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, is now accessible for pre-bid now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-bid it nowadays!

Possibilities are you’ll well presumably furthermore aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com