BlackRock, Yes, BlackRock, Is Eyeing Crypto Reinforce

February 10, 2022 / Unchained Day after day / Laura Shin

Day after day Bits ✍️✍️✍️

-

Authorities in Russia are reportedly space to ask crypto as a gather of currency.

-

CFTC Chair Rostin Behnam wants to bring crypto space markets beneath the retain watch over of the CFTC in conserving on the side of his testimony ahead of the Senate Agriculture Committee the day long previous by.

-

Bitfnex’s LEO token has been surging after the US Division of Justice announced the seizure of $3.6 billion in BTC that had been stolen from the replace in 2016.

-

AssangeDAO obtained the snarl for a Julian Assange x Pak NFT for $53 million.

-

A invoice proposed in Tennessee would investigate cross-take a look at the train make investments in crypto and NFTs.

-

The issuance of El Salvador’s Bitcoin bond could well presumably also advance as soon as next month.

-

The managing director of the IMF thinks CBDCs are extra intellectual than cryptocurrencies and stablecoins.

-

Wells Fargo says it’s no longer too plain to aquire crypto.

-

Blockchain analytics firm Elliptic reports that Ukraine NGOs and volunteer groups are the usage of Bitcoin to crowdfund the strive in opposition to in opposition to Russia.

-

Shiba Inu announced plans for a metaverse-land mission, and its token, SHIB, jumped upwards of 40%.

On the fresh time in Crypto Adoption…

-

Zynga, the gaming firm within the serve of FarmVille and Words With Friends, plans to begin an NFT sport this 12 months.

-

The Terra DAO is partnering with the MLB’s Washington Nationals within the major-ever DAO-sports activities franchise deal.

-

McDonald’s and Panera filed for digital restaurant emblems.

- Sweet Digital launched a line of NASCAR NFTs.

The $$$ Nook…

-

OpenNode raised $20 million in a Sequence A funding round, valuing the bitcoin-payment firm at $220 million.

- Compute North, a BTC mining infrastructure firm, raised$385 million in equity and debt funding.

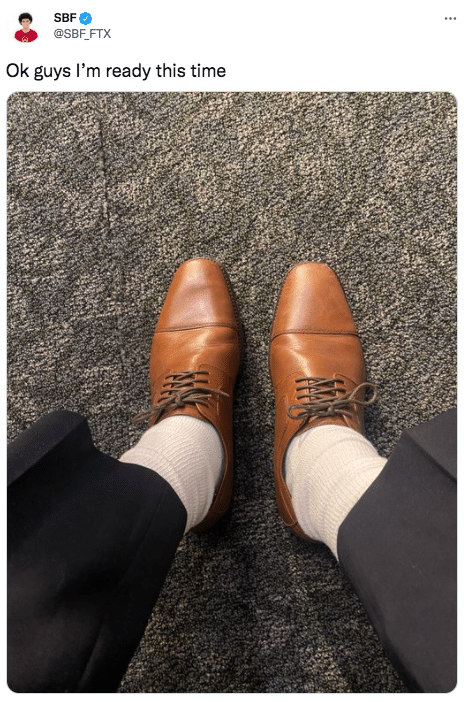

What Stop You Meme?

What’s Poppin’?

The World’s Biggest Asset Supervisor Is On the Brink of the Rabbit Hole

BlackRock, the Larry Fink-led asset supervisor, is gearing up to present crypto buying and selling products and companies to investor clients, per a file from CoinDesk.

CoinDesk cites three folks with data of BlackRock’s plans. Per CoinDesk, BlackRock will first enter the crypto dwelling with “client give a grasp to buying and selling after which with their personal credit ranking facility,” – which system clients could well presumably also use crypto as collateral to borrow from BlackRock. From there, one amongst CoinDesk’s sources says clients will most definitely be succesful to adjust crypto by Aladdin, BlackRock’s investment administration platform.

Chris Perkins, president of CoinFund, instructed Unchained this turned into once a in point of fact grand switch for two reasons. “First, Aladdin helps many of basically the most attention-grabbing sovereign wealth, pensions, and asset managers on the planet, and this connectivity will clear up many of the operational challenges which had been maintaining these institutions serve,” he wrote in a message. “2nd, Aladdin most frequently releases unusual efficiency per client ask. This tells you that many of basically the most attention-grabbing institutions on the planet are asking for crypto capabilities.”

In total, BlackRock at the moment has $10 trillion in assets beneath administration (AUM). For context, the market capitalization of cryptocurrencies is price $2.13 trillion. In essence, if factual a slice of BlackRock’s clients decides to make investments in crypto, it’d be a most indispensable boon to the crypto market writ colossal.

CoinDesk also reported sources asserting that BlackRock is seeking to “gather hands-on with outright crypto” and that a working neighborhood of “20 or so” folk is evaluating crypto in utter to “begin up making some cash from this [crypto].”

The rumor of crypto give a grasp to at BlackRock is never any longer a total surprise. Final June, the firm posted a job itemizing for a blockchain system lead at Aladdin. In addition, a BlackRock fund started buying and selling CME bitcoin futures in 2021 and owns 16.3% of MicroStrategy’s stock.

That being mentioned, the CoinDesk file emphasized that it’s no longer always particular when crypto will be supported.

With further reporting from Laura Shin

Instructed Reads

-

Fais Khan on coin listings, VCs in crypto, and Coinbase vs. Binance:

-

Forbes’s Jeff Kauflin on DAOs:

-

DeFi Education on the historical previous of DeFi:

On The Pod…

Will Every Portion of Media Enter the Cyber web as an NFT? Variant Fund Says Yes

Variant Fund is a endeavor capital firm that describes itself as “a prime-study crypto fund investing within the ownership financial system.” Jesse Walden and Li Jin, co-founders and classic partners at Variant, be half of Unchained to discuss the ownership financial system, concerns with web2 and web3, NFTs, the way forward for labor, and extra. Highlights:

-

where Li and Jesse met and how their backgrounds as merchants + founders led them to the crypto dwelling

-

how Li’s investing enviornment of interest, which she describes because the ardour financial system, ended up intersecting with crypto

-

why Li believes that web3 platforms will be greater for creators than the fresh web2 ecosystem

-

why Jesse turned into once so impressed by Bitcoin after working within the music replace for so a long time

-

why Jesse believes that NFTs are the “port of entry” for the mainstream adoption of crypto

-

what other use-cases exist for NFTs out of doors of the JPEG or PNG meme (and why Jesse is so brooding about music NFTs)

-

why Li believes that web3 tools can serve fix the problems inherent to the “gig financial system”

-

Li and Jesse reply to criticisms of web3 coming from Jack Dorsey and Moxie Marlinspike

-

how Variant Fund thinks about investing in crypto projects

-

what token allocation Variant Fund targets when investing in crypto projects

-

why mainstream platforms are experiencing backlash for integrating with NFTs and crypto

-

what trends in NFTs, DAOs, and the ownership financial system Jesse and Li narrate will pop in 2022

E-book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, is now on hand for pre-utter now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-utter it on the fresh time!

You could well presumably presumably aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com