BlackRock Makes a Sizable Jog Into Crypto

August 5, 2022 / Unchained Day-to-day / Laura Shin

Day-to-day Bits✍️✍️✍️

- Crypto alternate Poloniex will make stronger Ethereum Proof of Work fork.

- One crypto developer in Solana deceived the total ecosystem.

- Meta expands NFT make stronger across Instagram in 100 countries.

- Tiffany NFTs are already being sold for a revenue.

- Uniswap will fight through a governance proposal to launch the Uniswap Foundation with a $74 million funds.

- Frax Finance’s cofounder proposed that the challenge’s stablecoin may per chance well perhaps moreover simplest be redeemed in Ethereum PoS chain.

Recently in Crypto Adoption…

- Binance and Mastercard partnered to launch a prepaid card in Argentina.

- Paraguay desires to cost increased electricity prices to crypto miners.

- Deel, a payroll software program company, reported that noxious-border funds in crypto are increasing impulsively.

The $$$ Nook…

- VC company Lattice Capital raised $60 million for its second fund.

- Lope, a liquid staking protocol on Cosmos, raised $6.7 million.

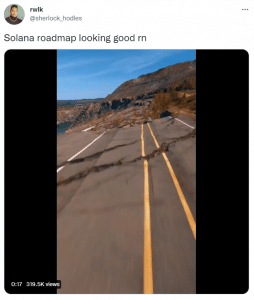

What Kind You Meme?

What’s Poppin’?

BlackRock Companions With Coinbase to Converse Institutional Merchants to Crypto

by Juan Aranovich

BlackRock, the arena’s finest asset supervisor with $10 trillion in assets below management, goes to commence up offering crypto investments to institutions through Coinbase Prime.

The news became introduced by Coinbase on Twitter, linking to a more detailed post on its weblog. Fixed with the corporate, this may per chance increasingly perhaps perhaps moreover give train obtain entry to to crypto to the customers of BlackRock’s investment platform Aladdin.

Coinbase stock (COIN) soared after the announcement. The day prior to this, it peaked at $116.30 and it closed at $88.90, accounting for a 10% carry. Trading in COIN became posthaste halted after surging 35% in minutes.

Factual final week, Cathie Wooden’s fund disclosed that it had sold Coinbase shares. Ever since then, COIN has skilled a most valuable pump. “Oof, that’s soiled,” acknowledged Hsaka.

“After years of hype, at present’s announcement supplies a ray of hope that institutional money in actuality *is* coming to crypto, and after at present’s announcement, Coinbase is poised to be a beneficiary of that pattern,” Matt Weller, world head of market examine at international exchange.com, suggested The Block.

Is that this correct for the crypto industry? On the one hand, institutional investments are obvious because that’s the attach the massive money repeatedly comes from, which may per chance well moreover mean increased prices and more money on hand for inclinations. However, it may per chance well probably probably perhaps perhaps moreover be seen as opposed news. BlackRock, having such a orderly amount of assets below its management, may per chance well perhaps moreover change into a most valuable holder of BTC and other crypto assets, making them far more centralized, which clearly goes in opposition to the ethos of crypto. “Rapidly Blackrock will management crypto upright cherish they already management the stock market,” acknowledged one particular person on Twitter.

It’s no longer the first time that Coinbase hit the news this week. On Monday, it introduced that it would commence up offering Ethereum staking to institutional investors within the US. It appears cherish institutions are at final having the instruments to spend money on crypto.

Advised Reads

- Magik Labs on below-collateralized loans in DeFi

- Maker DAO on its recent dynamics

- Delphi Digital on the long drag of crypto gaming

On The Pod…

Why Kevin Zhou Believes Ethereum Will Have 3 Forks After the Merge

Kevin Zhou, cofounder of Galois Capital, comes to chat regarding the doable of a Proof of Work chain on Ethereum after the Merge, the LUNA loss of life spiral, how he plans to play the Merge, and tons more… Existing highlights:

- how Kevin got started in crypto

- what Galois Capital is and what its investment thesis is

- why Kevin became more vocal than most regarding the doable of the LUNA loss of life spiral

- whether or no longer Kevin made money out of the Terra crumple and what became his contrivance

- what the pain bomb in Ethereum is

- the aptitude eventualities that may per chance well perhaps moreover come up after the Merge

- whether or no longer the public is no longer fascinated by the hazards of the Merge

- how the truth that all people became telling the equivalent fable about ETH made Kevin suspicious

- how Chandler’s assertion about forking Ethereum made it lots more likely that it would happen

- the groups unhurried the encouragement of a proof-of-work Ethereum chain

- whether or no longer there may per chance be a worth proposition for a Proof of Work chain

- how Kevin used The Cryptopians to absorb in ideas how the DAO fork went

- what replay security is and why it is well-known when forking a series

- why anybody would desire to have the pain bomb in a doable proof of labor chain

- Kevin’s predictions regarding the market cap of the aptitude Ethereum forks

- how a proof of labor chain of Ethereum would characteristic with out the finest stablecoins cherish USDT and USDC

- whether or no longer Tether goes to make stronger Ethereum 2

- why Kevin writes using metaphors related to historical past and gaming and how these analogies picture to Ethereum

- how Kevin desired to “stick it” to the Ethereum Foundation by offering his companies and products

- whether or no longer Vitalik trolled Kevin on Twitter

- whether or no longer Kevin will follow the equivalent contrivance he used with ETC after the DAO fork

Book Change

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Huge Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now on hand!

You would moreover buy it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com