BlackRock, ARK/21Shares Lower Bitcoin ETF Costs All all over again as Approval Looms

BlackRock and the partnership of ARK Invest and 21Shares reduced the annual charges for their respective space bitcoin alternate-traded funds (ETF) early on Wednesday as opponents continues to warmth up earlier than the anticipated approval of such funds this week. The ongoing flee to the backside in rate costs could well well manufacture the funds, which provide indirect publicity to bitcoin, much less dear than investing in BTC by a crypto alternate.

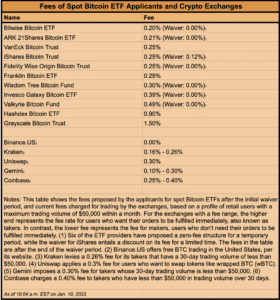

The aggressive panorama has ended in ETF issuers offering waivers that closing for either six months or a year, or till a obvious level of sources below management is reached, and likewise reducing their charges after those promotional periods live.

Read more: BlackRock and Others Respond After SEC Points Additional Comments on Field Bitcoin ETF Applications

On Wednesday, BlackRock, the enviornment’s greatest asset manager, stated in a submitting that its iShares Bitcoin Belief has reduced its rate from 0.20% to 0.12% throughout its twelve-month waiver length, and from 0.30% to 0.25% afterwards, decrease than many had anticipated. That places it among the many issuers with the lowest submit-waiver charges, tied with Constancy and VanEck and easiest undercut by Bitwise (0.20%) and Ark/21Shares, which also reduced its submit-waiver rate in a submitting on Wednesday, from 0.25% to 0.21%. Ark’s offering peaceable has no rate throughout its waiver length, which lasts for either six months or a thousand million bucks in sources has been reached.

Here’s how the many issuers stack up at the moment on proposed charges, when in comparison with the commissions charged by several main crypto exchanges:

The loads of capacity issuers are competing aggressively on label, but other key differentiating factors contain distribution, impress, and liquidity.

On Tuesday, an X story belonging to the SEC sent out a spurious announcement that the agency had accredited space bitcoin ETFs. SEC Chair Gary Gensler rapid posted a message that the story had been compromised and the approval news wasn’t precise. Crypto liquidations topped $200 million as a result of mishap.

Read more: Bitcoin ETF Price Battle Could well additionally Maintain Investing in Bitcoin Much less dear Than The employ of an Exchange

Source credit : unchainedcrypto.com