Bitcoin’s Provide on Exchanges Falls to 4-Twelve months Low

The amount of Bitcoin held on exchanges has fallen sharply after the collapse of crypto switch FTX.

In accordance to info from Santiment, handiest 6.95% of Bitcoin is at the present held on exchanges. This marks basically the most famous time this metric has fallen beneath 7% since Nov. 24, 2018.

Santiment powerful that there had already been a dreary shift in direction of self-custody since the Sunless Thursday market fracture in March 2020, however the tempo at which coins moved off exchanges accelerated after FTX went beneath.

The wavered belief in centralized events has ended in a movement amongst some exchanges to amplify transparency by publishing a Proof-of-Reserves assertion. If truth be told, the PoR will document the switch’s reserve asset allocation to expose it has the funds to quilt users’ property on a 1:1 foundation.

On Nov. 25, Binance released its first PoR assertion, showing the whisper of its Bitcoin reserves. The switch claims to possess an on-chain reserve of 582,485 BTC with a reserve ratio of 101%.

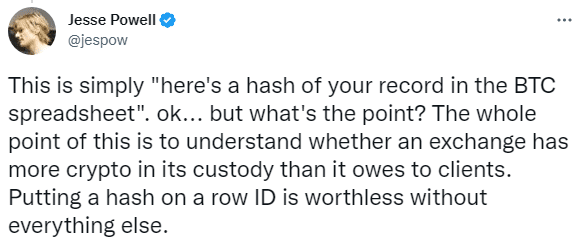

Kraken co-founder Jesse Powell questioned the authenticity of Binance’s PoR, announcing an announcement of property is pointless without showing liabilities.

Binance CEO Changpeng Zhao spoke back to Powell’s statements, clarifying that third-birthday party auditors would take a look at that no antagonistic balances may per chance per chance well be mirrored in the PoR. Zhao acknowledged the PoR assertion posted on Friday change into once an “incremental step” due to bottlenecks from its auditors.

Source credit : unchainedcrypto.com