Bitcoin’s Post-Halving Ticket Performance So Some distance Is Worst Ever

Monday, August 19, marks the four-month anniversary of the 2024 Bitcoin halving, an computerized match that cuts mining rewards in half of every four years. Unlike old halvings, on the opposite hand, essentially the most modern slash has no longer been adopted by a upward push in bitcoin’s greenback cost as of this level.

Every halving makes it more difficult for miners to possess afloat, since BTC rewards for validating and securing the blockchain are halved. However the value of BTC in greenback terms has on the final increased after a halving, with analysts recurrently attributing impress rises to reduced provide of current coins.

However, the value movement of bitcoin following essentially the most most modern halving has been worse than any old halving events, which additionally took allege in 2020, 2016, and 2012.

BTC’s impress has dropped over 8.2% post-halving, from $63,825.87 on April 19, 2024, to $58,530.13 at the time of writing, in line with info from blockchain analytics agency CryptoQuant.

In all old halving years, bitcoin’s greenback cost rose in the next four months. 2020 noticed BTC’s impress soar roughly 21.4% in the four months post-halving, from $8,566.77 to $10,402.66. 2016 noticed BTC soar 11.12% over the similar length, from $638.19 to $720.97. Similarly, in 2012, BTC became once procuring and selling at $12.35 on the day of the halving, and 4 months later its impress had increased virtually 600% to $86.18, per CryptoQuant.

Read More: The 2024 Bitcoin Halving – What Miners Are Doing In every other case Now When put next to 2020

One reason behind BTC’s aged efficiency after its 2024 halving stems from the rating low cost in prominent treasury funds, in line with Arthur Hayes, a co-founder and used CEO of crypto alternate BitMEX.

“Because a rating low cost in T-funds prominent, liquidity became once eradicated from the intention,” Hayes wrote in a weblog post final week. “From April to July, when T-funds had been rating withdrawn from the market… Bitcoin traded sideways, punctuated with a couple of intense dips.”

With BTC dipping in impress after essentially the most modern halving, miners “are in a sharp space,” wrote the crew behind Alkimiya, a blockspace marketplace protocol that permits customers to alternate BTC transaction funds.

“The value of $BTC is down, mining difficulty is up, they in most cases’re promoting coins to hide costs,” Alkimiya wrote on X Wednesday. “Miners are the spine of the Bitcoin network, processing transactions and securing the blockchain. They derive rewarded in BTC, but with decrease costs, they wish to sell extra to possess worthwhile.”

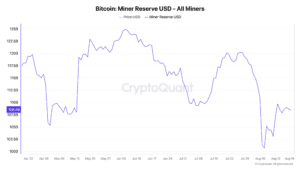

Per CryptoQuant, the amount of bitcoins held by the affiliated miners’ wallets denominated in USD has dipped by virtually $9.1 billion attributable to the day of the 2024 halving.

This underperformance comes after Wall Avenue heavyweights rolled out space bitcoin alternate-traded funds, which enabled primitive traders to assemble exposure to BTC by mainstream monetary marketplaces.

Read More: There Are Now 11 Situation Bitcoin ETFs. Right here’s the One That’s Most productive for You

BTC’s 2024 post-halving movement additionally comes in a heated election year, with both Democrats and Republicans actively relationship Bitcoin holders. Political instances, especially changes in who sits in the U.S. White Dwelling, are poised to substantially impact the value efficiency of BTC.

Source credit : unchainedcrypto.com