Bitcoin’s Market Cap Reaches Heights No longer Viewed in 149 Days

October 7, 2021 / Unchained On each day foundation / Laura Shin

On each day foundation Bits ✍️✍️✍️

-

The US FDIC is wanting into whether or no longer stablecoin deposits would be eligible for its insurance protection.

-

CoinSwitch Kuber, India’s largest cryptocurrency alternate, raised $260 million at a valuation of $1.9 billion in a spherical led by a16z and Coinbase Ventures.

-

The US Division of Justice announced a cryptocurrency enforcement crew to toughen the regulator’s means to fight crypto-related crimes.

-

In accordance with a paper published the day outdated to this, the Federal Reserve believes that digital currencies may per chance well perhaps additionally “decrease reliance on the US dollar.”

-

MetaMask added crypto custodians BitGo, Qredo, and Cactus Custody to meet compliance requirements for its institutional arm.

-

The World Group of Securities Commissions (IOSCO) and the Bank for World Settlements (BIS) pronounce stablecoins will non-public to tranquil be regulated below the the same rulesas ragged funds.

-

The price ground for CryptoToadz, an Ethereum-primarily based NFT, has risen from .18 ETH to roughly 12 ETH in lower than a month.

-

a16z launched an clarify for how regulators will non-public to tranquil take care of crypto rules.

-

MoneyGram, a spoiled-border funds company, announced partnerships with USDC and Stellar.

-

A worm was expose in Rocket Pool, an ETH 2.0 staking platform, that may per chance well perhaps well additionally non-public affected thousands and thousands of dollars in ETH staked all the intention in which by means of more than one protocols.

What Rating You Meme?

What’s Poppin’?

Alright, Bitcoin is poppin’. The day outdated to this, the coin crossed the threshold of $55,000, increasing roughly 9% between Tuesday and Wednesday afternoon. On the time of writing, 6:14 PM ET, Bitcoin’s market cap was sitting above $1 trillion — a quantity no longer viewed since Might perhaps per chance well tenth.

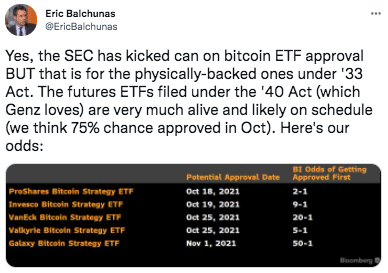

It appears to be like that rumors swirling all the intention in which by means of the approval of a bitcoin futures ETF will doubtless be pushing the BTC trace up. SEC Chair Gary Gensler is per chance the offer of such talk, twice sayingthat he would “see ahead to workers’s assessment of such filings.” Eric Balchunas, the senior ETF analyst at Bloomberg, estimates a 75% likelihood that a BTC futures ETF is well-liked in October.

Backing up Balchunas’s audacious prediction, CoinDesk reports that BTC-primarily based futures contracts on the Chicago Mercantile Alternate are procuring and selling at a 12.8% top rate to the dwelling trace — marking the largest top rate since mid-April. CoinDesk functions out that many analysts scheme shut into consideration CME sentiment to be swayed by institutions, preferring to commerce property by means of regulated exchanges.

Mike Bucella, a general accomplice at Block Tower, believes the head rate means that institutions will doubtless be “entrance-operating” the news of a futures-primarily based BTC ETF being well-liked.

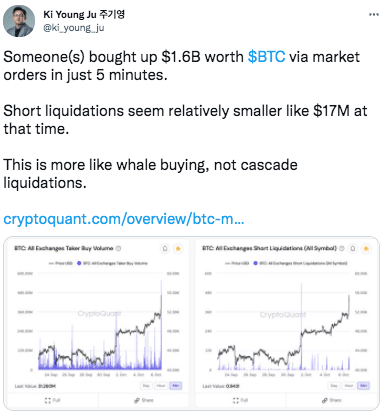

Besides speculation surrounding the approval of a bitcoin ETF, Bitcoin’s trace additionally purchased a bump from a billion-dollar dwelling aquire the day outdated to this, as properly-known by Ki Young Ju, the CEO of CryptoQuant. In accordance with Ju’s reading of the tips, it appears to be like that a whale purchased $1.6 billion of dwelling bitcoin in honest below five minutes.

To spherical out a bullish day for Bitcoin, the CEO of the $27 billion family dwelling of enterprise of billionaire George Soros confirmed that the fund invests in Bitcoin. The CEO, Break of day Fitzpatrick, told Bloomberg, “From our level of view over again, we hang some coins, no longer plenty, and the coins themselves are less bright than the exercise cases of DeFi and things treasure that.”

Fitzpatrick went on so as to add that cryptocurrencies non-public made it mainstream. “I’m no longer definite bitcoin is greater viewed as an inflation hedge. Right here I believe it’s crossed the chasm to mainstream. Cryptocurrencies now non-public a market cap of over $2 trillion. There’s 200 million customers all the intention in which by means of the sector, so I believe this has long gone mainstream,” Fitzpatrick added.

Suggested Reads

-

Pantera Capital dropped its October investor letter:

-

Arcane Compare on the enlighten of the Lightning Network (Twitter thread + chronicle):

-

Puru Goyal, a chemical engineer, on Bitcoin’s energy usage:

On The Pod…

How does the SEC resolve if a token is a security? Why is DeFi particularly exhausting to rearrange? What’s going to regulators make about stablecoins? On Unchained, Greg Xethalis, chief compliance officer at Multicoin Capital, and Collins Belton, founding accomplice at Brookwood P.C., dive into crypto rules, discussing securities authorized guidelines, DeFi rules, and why the US will non-public to tranquil be selling stablecoins in desire to trying to shut them down. Highlights:

-

why the SEC and CFTC non-public no longer announced better crypto enforcement news on the dwell of their fiscal years

-

why the SEC is going after DINO (decentralized in name most bright) companies

-

what the Howey and Reves tests are and the intention in which the SEC uses them to search out out whether or no longer an asset is a security or no longer

-

why Collins and Greg pronounce the SEC has as of late begun been making exercise of Reves more normally

-

why they pronounce centralized crypto lending merchandise will non-public to tranquil no longer be conception to be securities below the Howey test

-

whether or no longer new rules desires to be written for cryptocurrency-primarily based merchandise

-

what makes Collins pronounce the SEC is being “disingenuous” referring to the SEC registration process for crypto companies, treasure Coinbase

-

how regulators will dwell up handling DeFi and why both Greg and Collins are long-term optimistic

-

how the US government has a “gargantuan historic past” of respecting privacy and encryption

-

why regulatory rigidity is prone to rating spherical centralized crypto exchanges and what we are able to be taught from the EtherDelta case

-

why Collins thinks most cryptocurrency companies will non-public to tranquil be regulated

-

why the SEC is the explicit motivator for forcing protocols to completely decentralize

-

how orderly contracts may per chance well perhaps additionally theoretically be ragged to standardize SEC Commissioner Hester Peirce’s Steady Harbor proposal

-

how blockchain recordsdata makes cryptocurrency companies more transparent and more straightforward to rearrange than centralized entities

-

what Collins and Greg pronounce will happen with stablecoin rules going ahead

-

why the US will non-public to tranquil be pushing to assemble dollar-pegged stablecoins more well-known

E-book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Gigantic Cryptocurrency Craze, is now on hand for pre-insist now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-insist it this day!

You are going to non-public to buy it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com