Bitcoin’s Microscopic Brother: Will Ethereum ETFs Also Boost Ether’s Designate?

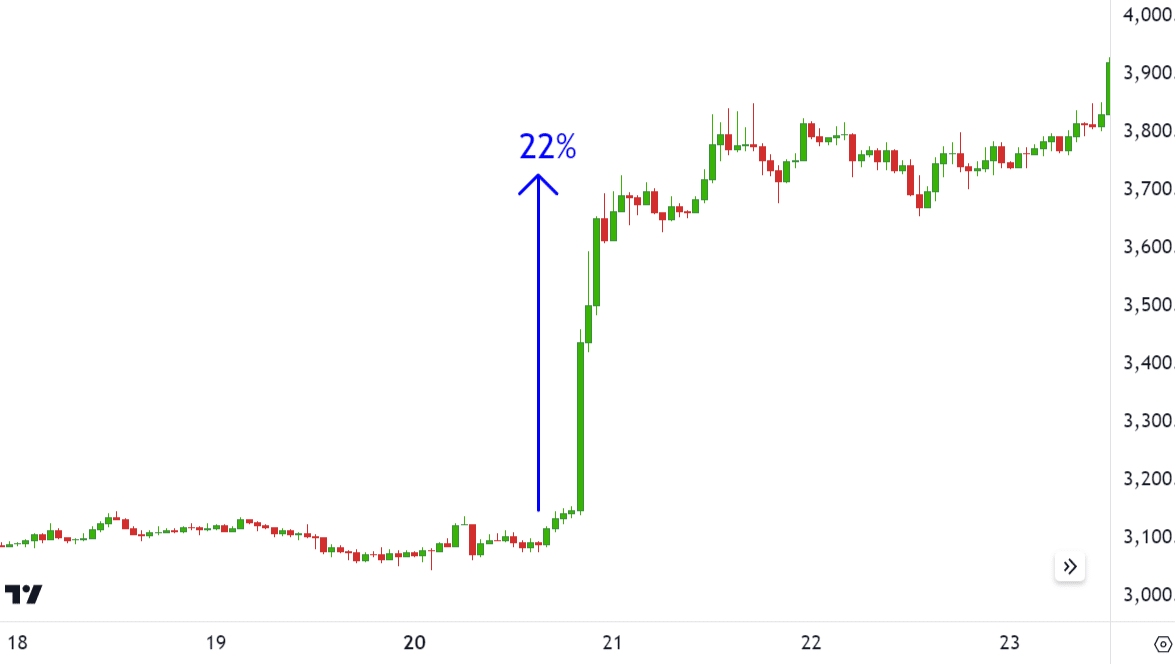

When the U.S. Securities and Replace Rate (SEC) accepted the 19b-4 forms for eight an excellent deal of region ether change-traded funds (ETFs), the cost of ether surged in the case of 20% inside of several hours of the info.

Now ETF applicants are submitting their S-1s, a registration invent which desires to be greenlit by the securities regulator before the funds can delivery shopping and selling on exchanges. The SEC’s Gensler alluded to this process being executed by the discontinue of the summer season when speaking to the Senate Appropriations Committee on Thursday.

The registrations are being reviewed at a “workers diploma,” Gensler talked about, and could additionally objective quiet rely on issuers and how responsive they are to any feedback they receive. With the ball within the courtroom of ETF issuers, the build does the market locate the cost of ether going before and after the commence?

Funding management firm VanEck, whose utility for a region ether ETF became as soon as one of the crucial eight to receive approval on their 19b-4 invent, lately raised their 2030 label target for ether to $22,000. Nonetheless Katie Talati, head of analysis at crypto asset management firm Arca, talked about in an electronic mail to Unchained that as of late “ether has struggled to construct a stable tale in comparison to other layer 1 solutions and the emergence of layer 2 solutions.”

ETH’s Likely Designate within the Non permanent (Pre-commence)

Non permanent, this lack of tale could additionally give ether a enhance — despite the reality that likely no longer as excessive as $22,000 — as traders have been below positioned within the asset when the approval announcement hit.

Coinbase Institutional’s shopping and selling desk, “has seen elevated shopping in ether following the 19b-4 approvals,” talked about David Duong, Coinbase’s head of institutional analysis, in an electronic mail, “It hasn’t been in the case of as aggressive as what we seen in bitcoin before region bitcoin ETFs launched within the US. That leads us to imagine that the market remains to be below positioned.”

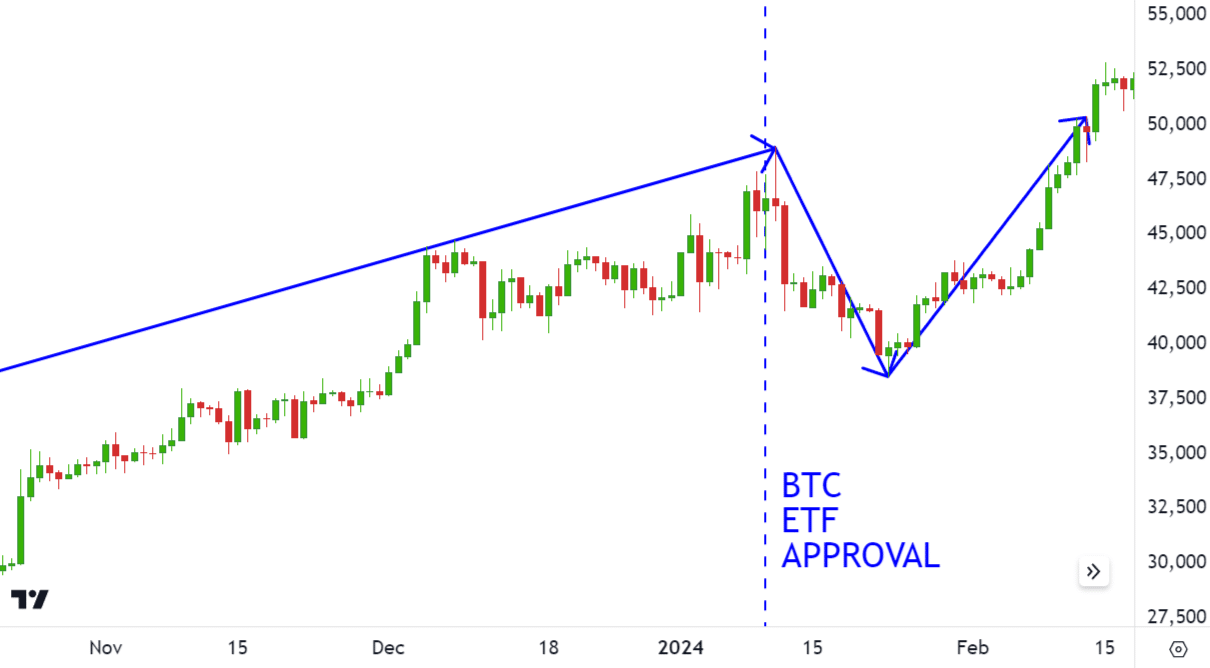

For bitcoin, it became as soon as a “purchase the rumor, sell the info” event as a consequence of there became as soon as so mighty speculation within the lead up to the January approval of the bitcoin ETFs. While within the case of ether, “traders didn’t sell the info—they offered it,” attributable to the surprise nature of the approvals, talked about Glen Goodman, creator of “The Crypto Vendor,” in an electronic mail to Unchained.

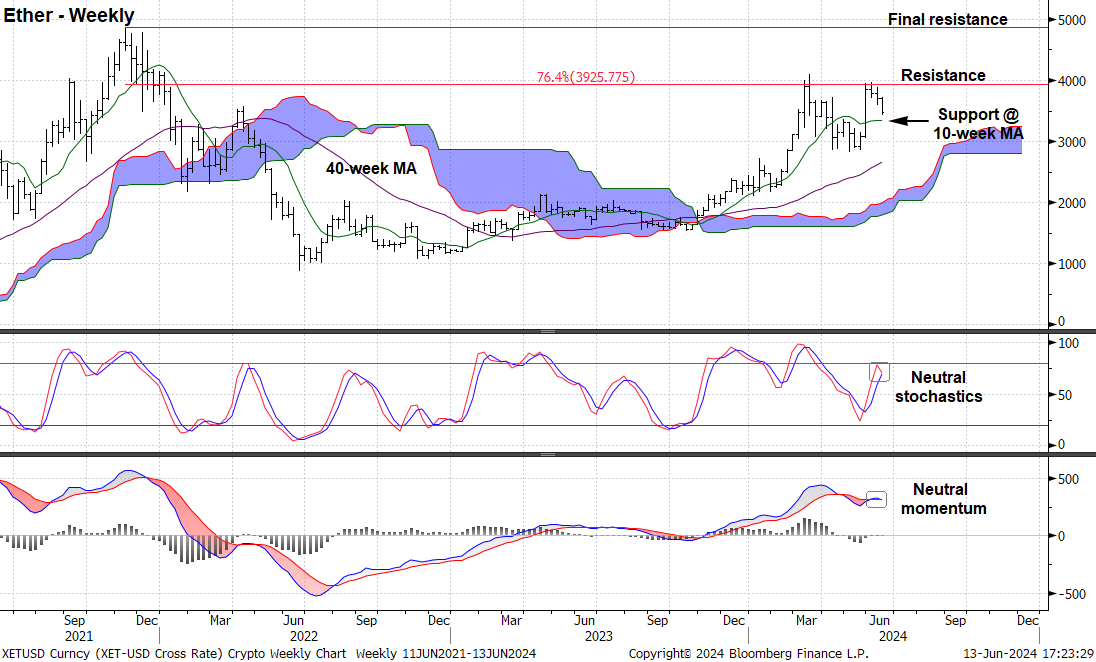

Investors have to quiet quiet tread with warning, Katie Stockton’s Fairlead Strategies’ June 10 document states that ether has already given help about a of its outperformance to bitcoin since the region ether ETF knowledge. The analysts foresee bitcoin persevering with to outperform ether within the end to timeframe, describing their prognosis of ether’s weekly MACD and stochastics as honest, adding that they “will speak a bullish bias as soon as ether clears resistance end to $3,925 on a consecutive weekly closing foundation.”

Where ETH Might perhaps maybe additionally Toddle Long-timeframe (Put up-commence)

After experiencing a pullback post-ETF approval, “bitcoin went on to rally 72% from $39,201 to $67,339, within the slay making a brand new all-time excessive label in March of 2024,” talked about Teddy Fusaro, president at Bitwise, a crypto funding firm that launched a region bitcoin ETF within the US.

If this have been to happen, ether would have to rally bigger than 35% p.c from its contemporary label to reach its November 2021 all-time-excessive of $4,867, Fusaro talked about.

While which will be plausible, Arca’s Katie Talati is no longer convinced that region ether ETFs can have as colossal of a long-timeframe impact on ether’s label on condition that institutional seek knowledge from is no longer as excessive for ether as it is for bitcoin.

In a old interview with Unchained, Ophelia Snyder, co-founder and president of crypto ETP provider 21Shares, alluded to this, announcing that institutional knowledge of ether pales in comparison to that of bitcoin. 21Shares manages the 21Shares Ethereum Staking ETP (AETH) in Europe as well as a region bitcoin ETF within the US identified as ARKB,

Talati also famous that “the Grayscale Ethereum Belief, which has $10 billion in resources below management (AUM), will likely also abilities constant outflows and trigger every single day promoting tension within the Ethereum market.”

A contemporary document from crypto analysis firm Kaiko shared a same sentiment. “Once the ether ETFs commence, it is low-cost to do a matter to promoting tension on ether from likely outflows or redemptions attributable to Grayscale’s ETHE, which has been shopping and selling at an excellent deal between 6% and 26% over the previous three months.”

Peaceful, crypto analysis firm K33’s senior analyst Vetle Lunde in a contemporary document anticipated that US region ether ETFs will entice $4 billion in rep inflows of their first 5 months after commence. In a message to Unchained, Vetle defined that he expects roughly 20% of this $4 billion to scheme help from institutional investors, placing their anticipated AUM at $700-800 million.

While some ask whether the absence of staking within the ether ETFs will restrict investor interest within the funds attributable to lack of APY (Annual Share Yield), Lunde does no longer locate this as a matter, writing that, “ninety 9.1% of the AUM in Canadian ether ETFs are held in non-staked merchandise, whereas 97.9% of European AUM sits in non-staked ETPs. This indicates that staking is much from a serious utter amongst ETP investors.”

In April, the Hong Kong Securities and Futures Rate accepted the shopping and selling of region ether ETFs along with their bitcoin counterparts. Utilizing Hong Kong’s market as a level of reference, Crypto Is Macro Now creator and economist Noelle Acheson wrote in a contemporary e-newsletter that, “when/if the ether region ETFs in the end commence, we must at all times quiet brace ourselves for a disappointing reception.” Acheson bases this prediction on the reality that since these securities began shopping and selling in Hong Kong, ether has accounted for lower than 15% of the entire region crypto ETF AUM.

Pranav Kanade, VanEck’s digital resources alpha fund portfolio manager, shares this assumption that interest within the region ether ETFs could additionally objective no longer be as explosive as it became as soon as with bitcoin, writing to Unchained that “the narratives for bitcoin lined up perfectly, especially in america … the stars don’t seem to be aligning as perfectly as they did with the bitcoin ETF.”

Regardless of this, Kanade talked about that their bullish 2030 label prediction for ether assumes that ETFs will be a catalyst for added interest into the Ethereum network and its various choices, equivalent to stablecoins and other tokenized financial resources. “This, in turn, will pressure increasing ranges of activity on Ethereum or its layer 2 solutions, leading to a much bigger quantity of ether being burned and a lower total present of ether,” Kanade talked about.

Source credit : unchainedcrypto.com