Bitcoin’s Ancient Fourth Halving Takes Situation, With Block Subsidy Rewards Minimize in Half of to three.125 BTC

Bitcoin’s fourth halving has within the rupture taken station, marking a new technology for the enviornment’s first cryptocurrency. On April 19 at 8:09 p.m. ET, miner ViaBTC produced the 840,000th block, triggering the protocol to gash subsidy rewards for miners in half from 6.25 BTC per block to three.125 BTC.

THE 4TH HALVING IS HERE! 😍 THANK YOU SATOSHI 🧡🙏🏻 #BitcoinHalving2024 pic.twitter.com/mtvljMEHpu

— Remo Uherek (@remouherek) April 20, 2024

The trace of bitcoin slipped reasonably from proper below $64,000 at 8:09 p.m. ET, nonetheless became lately holding neatly-liked at spherical $63,590.

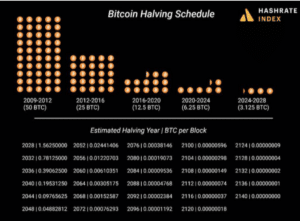

Satoshi Nakamoto, the anonymous creator of Bitcoin, designed the blockchain community to now now not be inflationary by capping the maximum supply of BTC at 21 million and implementing the periodic halving of rewards.

The halving occurs each 210,000 blocks, or about each four years, and reduces by 50% the price at which newly minted bitcoins enter into the circulating supply.

Sooner than block peak quantity 840,000, the different of bitcoins entering the circulating supply on a each day foundation via the community’s block subsidy rewards stood at 900. But with the successful trigger of the fourth halving, that quantity has dropped to 450 BTC, price about $27.5 million at unusual costs.

Block rewards are one amongst two incentives for miners to spend electrical energy and make a contribution their computing strength to genuine the 15-year-typical blockchain community. The 2d financial incentive comes from costs paid by rupture users who will have to maintain their transactions settled on Bitcoin’s ledger.

Fourth Halving Would possibly maybe Be an Anomaly

This most up-to-date mining cycle “will seemingly be an anomaly when put next to its predecessors,” in step with a March file from bitcoin mining agency Luxor Technology.

Bitcoin reaching an all-time high in trace earlier than the halving, which hasn’t befell in any of the outdated mining cycles, coupled with elevated transaction charge remark, “maintain furnished the different for quite a bit of miners to defend viable after the block subsidy drops to three.125 BTC,” Luxor’s file famend. BTC has soared over the final four years, leaping more than 600% since the final halving, which took station on Would possibly maybe 11, 2020, when the cryptocurrency became shopping and selling at $8,600.

BTC’s more most up-to-date trace appreciation is also traced to the gigantic capital inflows into space bitcoin replace-traded funds that had been authorized in January by the U.S. Securities Change Price.

Read Extra: How Principal Money Would possibly maybe Pour into Hong Kong’s New Bitcoin, Ether ETFs?

“In 2020, there weren’t any major discussions regarding the doable of space bitcoin ETFs,” talked about Kadan Stadelmann, the executive technology officer of Komodo Platform, which offers interoperability companies and products. “In 2024, we maintain now main space bitcoin ETFs and a technique more sturdy ecosystem that involves mainstream financial institutions.”

A dramatic gash in miners’ profitability is the quick impact of the halving since rewards are sliced in half. Some miners in outdated cycles maintain discontinued their mining operations on fable of mining BTC grew to alter into too unprofitable.

Alternatively, Luxor’s file talked about, “if Bitcoin’s trace holds or will improve from here, a modest quantity of hashrate may per chance maybe also merely come offline,” when put next to outdated cycles.

Rajiv Khemani, CEO of Auradine, a U.S based mostly entirely mostly agency making bitcoin mining rigs, talked about that while it’s likely for world hashrate to tumble after the most recent halving, particularly within the short term, he expects hash rates to at final expand as efficient miners change inefficient ones, and the strength beforehand utilized by inefficient miners is redirected to more efficient operations.

Because the provision of bitcoins coming into the market decreases by half, a pure supply-save a query to adherent would argue that “decrease supply would potentially expand the trace [of BTC]. Whether it occurs correct away or [after] some time duration, no person is aware of,” Auradine’s Khemani talked about.

Read Extra: Bitcoin’s Fourth Halving Is Exact Around the Nook. Is It Silent a Valid Time to Aquire?

“Throughout the trace, if you exclaim over with all kinds of analysts, what they’ll explain you is that everybody’s extensive bullish within the long-term [for BTC’s price, but] participants end request volatility to be decrease as we rush ahead. So the swings will seemingly be plenty less [as] the returns within the long-term are anticipated to be now now not up to what they had been the main 10 years,” Khemani added.

New Use Conditions

The 2024 halving furthermore comes as Bitcoin as an ecosystem is experiencing a surge of new experimental innovations that maintain elevated the quantity of transaction costs, providing a stark difference to Bitcoin within the 2020 halving. “Excitement is rising on different uses for the Bitcoin blockchain,” wrote Jesse Shrader, CEO of Amboss, a recordsdata analytics provider for the Bitcoin Lightning Network, to Unchained.

As an illustration, nodes are no doubt storing jpegs of cartoon monkeys and wizards as a results of the Ordinals protocol introducing non-fungible tokens to Bitcoin.

Memecoins maintain furthermore infiltrated Bitcoin via the BRC-20 Token Usual which permits crypto users to mint and switch fungible tokens on the Bitcoin deplorable layer. To boot, in difference to the outdated mining cycle, the new one involves many more projects aiming to attract layer 2 networks and sidechains to tackle scalability and transaction bolt on Bitcoin.

The L2 home on Bitcoin all around the outdated mining cycle became largely nonetheless of The Lightning Network and Stacks. Alternatively, in 2024 the L2 home has since grown substantially to incorporate a different of a broad selection of teams engaged on layer 2 networks. For instance, Bitcoin Layers, a danger prognosis platform for Bitcoin, shows nine a broad selection of projects alongside side layers to Bitcoin.

“This halving will highlight the rising collaboration between miners and Bitcoin L2 projects, with miners seeking extra revenue and L2s seeking to harness the safety of the Bitcoin L1,” wrote Alexei Zamyatin, co-founding father of BOB, a hybrid L2 resolution that’s attempting to to merge Bitcoin and Ethereum capabilities, in a text message. “Miners will continue to perceive for more revenue and have to serene be incentivized to bootstrap new L2 Bitcoin projects, since the more successful spend circumstances constructed on Bitcoin, the more miners are in a neighborhood to originate.”

“This halving will trace the origin of a serious portion of innovation within the Bitcoin ecosystem,” Zamyatin concluded.

UPDATE (April 19, 2024 9:00 p.m. ET): Added BTC trace data.

Source credit : unchainedcrypto.com