Bitcoin Watchers React to BTC Returning to the $60,000 Tag

The Bitcoin ecosystem witnessed a surge in vitality on Wednesday, with BTC’s designate returning to levels no longer seen since Nov. 2021, fresh recount BTC change-traded funds shattering volume recordsdata, and market sentiment reaching low greed.

The worth of BTC has increased 6.6% previously 24 hours and 18.7% over the closing seven days to as high as $63,636, sooner than settling to around $60,455 at press time, recordsdata from CoinGecko displays.

Learn extra: Bitcoin Label Surges Previous $60,000

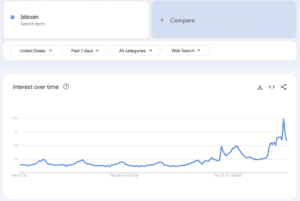

As a search term on Google in the U.S., “bitcoin,” had the maximum passion rating that you just will recall to mind of 100 earlier this present day at 12:20 p.m. ET, sooner than hovering below 60 extra no longer too lengthy previously. Meanwhile, ultimate seven days previously, its passion rating was below 15.

Learn Extra: Coinbase App Crashes Amid Bitcoin’s Huge Rally

“We’re seeing sizable inquire of from sizable consumers coming in and getting positions,” acknowledged co-founder of crypto index platform Phuture, Charles Storry, in a telephone name with Unchained.

“What’s triggering that? Nicely, the reality that they don’t possess publicity yet,” Storry added.

Despite this inquire of and the knowledge from Google Trends, this present day’s chatter around BTC and crypto is no longer where it was at in 2021, Storry famed. “Detect reduction at the outdated cycle – DeFi Summer season [2021] – what we saw was this mass retail inquire of, all people was talking about crypto, dependable? … And that isn’t in actuality happening in the shape of day-to-day life yet,” he acknowledged.

ETF Records

Essentially the most in vogue rise of a truly noteworthy cryptocurrency by market cap is “carefully tied to the on-line ETF flows,” wrote Jim Hwang, COO at digital funding agency Firinne Capital, in a text message to Unchained.

At the halfway label of the trading day on Wednesday, the “Fresh 9 bitcoin ETFs [which excludes Grayscale’s GBTC] possess already broken their all time each day volume issue w/$2.6b,” in keeping with Bloomberg ETF analyst Eric Balchunas on X. “We bought 4 btc ETFs in High 20. $IBIT is #4 total, it’s gonna change extra this present day than in its first two wks blended. Right here is officially a craze.”

“These numbers are absurd, extremely rare stuff right here,” Balchunas added.

The adoption of BTC has been in segment driven by folks worldwide who gape the need for a non-recount digital retailer of worth, nonetheless the appearance of recount BTC ETFs permits for extra institutional shopping, in keeping with Hwang.

Learn Extra: 21Shares and Chainlink Crew As much as Roll Out Proof-of-Reserve for Jam Bitcoin ETF ARKB

“ETFs are now catalyzing broader retail and institutional awareness and adoption. Over time, institutional presence will somewhat presumably surpass retail and despite the indisputable reality that retail will possess a minority role, this can remain indispensable,” wrote Hwang.

No longer Euphoric, But ‘Justifiable’ Greed

According to the Crypto Peril & Greed Index, the market sentiment is at “low greed.’

The index, a single number between 0 and 100 that acts as a proxy for the emotional and mawkish recount of a crypto market, at the 2nd stands at 82, the absolute most practical level since 2021, indicating a feeling of low greed.

A crypto native undergoing their third Bitcoin halving who goes by “Virotechnics” on X concurred with the index, announcing, “I don’t assume the market is euphoric. I assume the market is grasping.”

“I assume it’s significantly justifiable greed, because Bitcoin is appropriate, crypto is appropriate. We held out for somewhat a lengthy time, so I would agonize to spy someone who in actuality held by the cling market and in actuality believes in crypto to be selling off dependable now sooner than colossal all-time highs, I indicate, accounting for even inflation,” Virotechnics added in an interview with Unchained.

Source credit : unchainedcrypto.com