Bitcoin Revenue Dwarfed By Big, Ancient Losses, New Memoir Reveals

On-chain diagnosis from Glassnode has shown that the crypto market is within the midst of one among the “biggest deleveraging events in digital asset historical past,” as the ratio of realized profits to realized losses hits an all-time low.

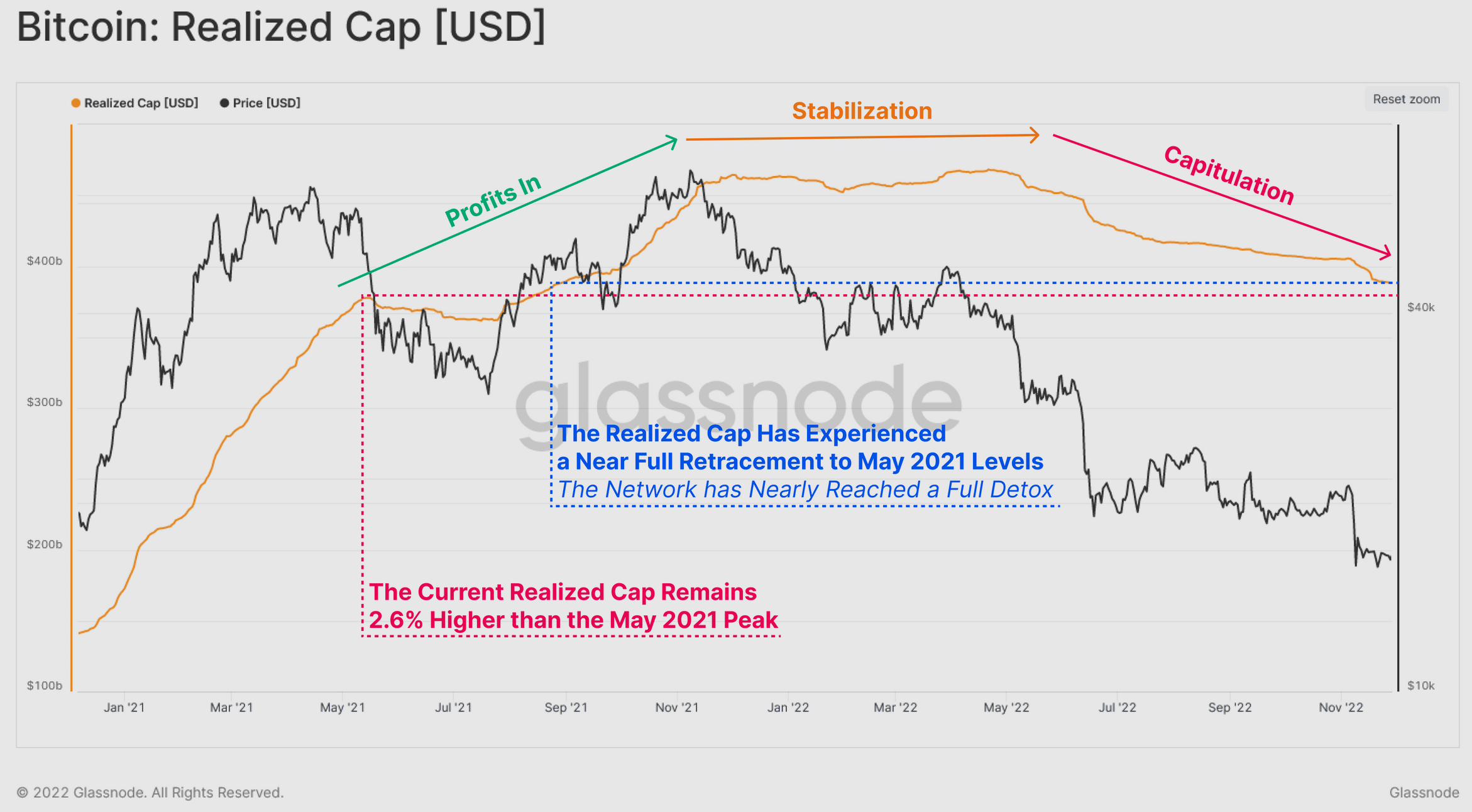

In a file Monday, Glassnode analysts talked about that the implosion of the income-loss ratio, identified as the “Bitcoin Realized Cap,” formulation that since Can also 2021 all “capital inflows”—that is, money invested within the crypto markets—dangle “been flushed out.”

“Losses locked in by the market dangle been 14x increased than income taking events,” the file talked about. Which formulation, it added, that the “entirety” of the 2020-2022 stamp action might possibly simply dangle been untethered to legitimate, realizable market value.

Bitcoin’s value has plummeted some 75 p.c, from round $69,000 on November 10 final one year to $17,000 at time of writing. Glassnode eminent that the decline used to be precipitated in fragment by “turbulent” deleveraging events, amongst them the collapses of Terra and FTX, the latter of which precipitated an all-time-high one-day loss of $4.435 billion. On the opposite hand, the initial impression of the FTX blowup has since waned, Glassnode added.

There dangle been, at substances, moments of income, collectively with the selloff in mid 2021 in which investors cashed out on the pause. But that starved the markets of liquidity and the next collapse of LUNA in Can also 2022 magnified losses for investors who had purchased on the pause and failed to promote sooner than the market collapsed.

“The exuberance skilled all the way by the [second half] 2022 rally to the all-time-high has nearly fully retraced,” talked about Glassnode.

The analysts talked about that the 17 p.c decline within the income-loss metric used to be the third biggest in crypto’s historical past, acceptable ahead of the 2018 collapse and behind the 24 p.c crunch skilled within the length between 2010 and 2011.

“The realized loss skilled by Bitcoin investors throughout the past 6 months has been historic in magnitude,” Glassnode talked about. “Profitability stress is initiating to diminish after the tournament, but has resulted in a whole flush out of all excess liquidity attracted over the final 18-months. This capacity that a whole expulsion of 2021 speculative top rate has now took place.”

Source credit : unchainedcrypto.com