Bitcoin Has Declined 20%. How Rapidly Would perhaps well perhaps the BTC Heed Revive?

The Trump Administration has supplied the crypto industry with various gifts in 2025.

The Securities and Trade Price (SEC) halted enforcement actions and investigations into most necessary crypto exchanges and companies appreciate Coinbase, Gemini, Uniswap, OpenSea, ConsenSys, and others. The White Home issued an Govt Whisper to advertise American leadership within the digital asset industry, and it has made musings about building a bitcoin stockpile.

Alternatively, none of those actions has been consequential ample to stem the most up to the moment decline within the mark of bitcoin and negative sentiments within the crypto industry total. At this time priced at $84,000, Bitcoin is down 18% since Donald Trump’s inauguration, virtually 23% since its all time high, and the broader crypto market has fallen by 21%.

Kavita Gupta, founder and total accomplice at Delta Blockchain Fund acknowledged, “It feels appreciate any of the determined things in crypto are occurring since the stop of us in politics are appreciate, “Let’s appropriate procure it.’ There is never any due course of, there’s no due diligence … and this circulation can [shift] at any given point of time. It doesn’t seem appreciate sustainability’s there.”

Three necessary forces riding the market down would possibly perhaps push it restful decrease earlier than it regains footing and begins to climb relieve. Genuinely, the industry would possibly wish to attend till 2026 earlier than it sees sustained bullish momentum again.

Crypto’s Self-Inflicted Wounds

There is never any shortage of reasons to settle between when explaining the most up to the moment downturn. First would possibly be the actions of crypto participants.

For occasion, the industry did itself no favors with multiple memecoin fiascos appreciate $MELANIA after which $LIBRA, which ensnared Argentine President Javier Milei in scandal. Now memecoin launches and buying and selling process are shedding across the industry, leaving questions about its sustainability over the long term. As an illustration, the open of day-to-day glossy tokens reached a native high of 66,471 on Jan. 24, appropriate six days after $TRUMP went are residing. On Feb. 27, the closing day of full recordsdata available, that quantity dropped to 27,741, a decline of 58%.

Brian Rudick, head of analysis at GSR, acknowledged of those debacles, “Other folks had looked at memecoins as the most gorgeous and efficient carry out of speculation in crypto, however $LIBRA demonstrated that this if truth be told turned into once no longer factual. Now you are seeing lots less onchain volumes, and [while] memecoins are taking the brunt of it, it’s bringing down the total crypto home.”

The opposite punch that if truth be told danger the industry turned into once North Korea’s $1.5 billion hack of Bybit, the greatest theft in crypto historical past, which once extra is forcing of us to query whether or no longer it’s safe to position their money into crypto. “All that these hacks procure is assemble of us that are sitting [on the] commence air deem that this industry, even [over] the closing 10 years, has no longer truly gotten ragged ample,” acknowledged Gupta.

Exogenous Headwinds

All of this negative sentiment inner the industry is being turbocharged by reduced probability appetites amongst investors extra broadly.

Most incessantly client optimism surges with the crack of morning time of a glossy administration, and industry leaders firstly cheered Trump’s election thanks to his pro-industry mindset. Alternatively, multiple glossy recordsdata aspects indicate that client self belief is weakening, possible attributable to the threats of 25% tariffs from President Trump directed against buying and selling partners appreciate China, Canada, Mexico, and the European Union

The February picture from the nonprofit deem tank Convention Board’s Person Self belief Index fell for the third straight month and reported its lowest studying since August of 2021.

These findings dovetail with findings from a University of Michigan secret agent on client sentiment that has proven a most necessary topple-off in client self belief. Consistent with the picture, “Person sentiment prolonged its early month decline, sliding virtually 10% from January. The decrease turned into once unanimous across groups by age, earnings, and wealth.”

It went on to teach, “Year-forward inflation expectations jumped up from 3.3% closing month to 4.3% this month, the highest studying since November 2023 and marking two consecutive months of unusually gargantuan will increase. Essentially the most up to the moment studying is now smartly above the 2.3-3.0% vary seen within the two years earlier than the pandemic.”

These expectations for inflation, which the secret agent reported span across multiple age groups and earnings brackets shall be specifically necessary to secret agent, since inflation can turned into a self-fulfilling prophecy. Rudick famed, “The closing I looked, the CME Fedwatch instrument turned into once pricing in two fee cuts this year. I deem if those got fully priced out [because of concerns around tariffs], there’d be extra scheme back within the oldschool markets than in crypto.”

How Low Can BTC Shuffle?

It is complex to mark out precisely where bitcoin can stride from here. Steve Sosnick, chief strategist at Interactive Brokers acknowledged that even amongst commodities, bitcoin stands on my own. “You respect the provision and query for extreme oil, espresso, or cocoa. Bitcoin doesn’t hold the same form of inherent query. It exists purely for speculative or funding applications.”

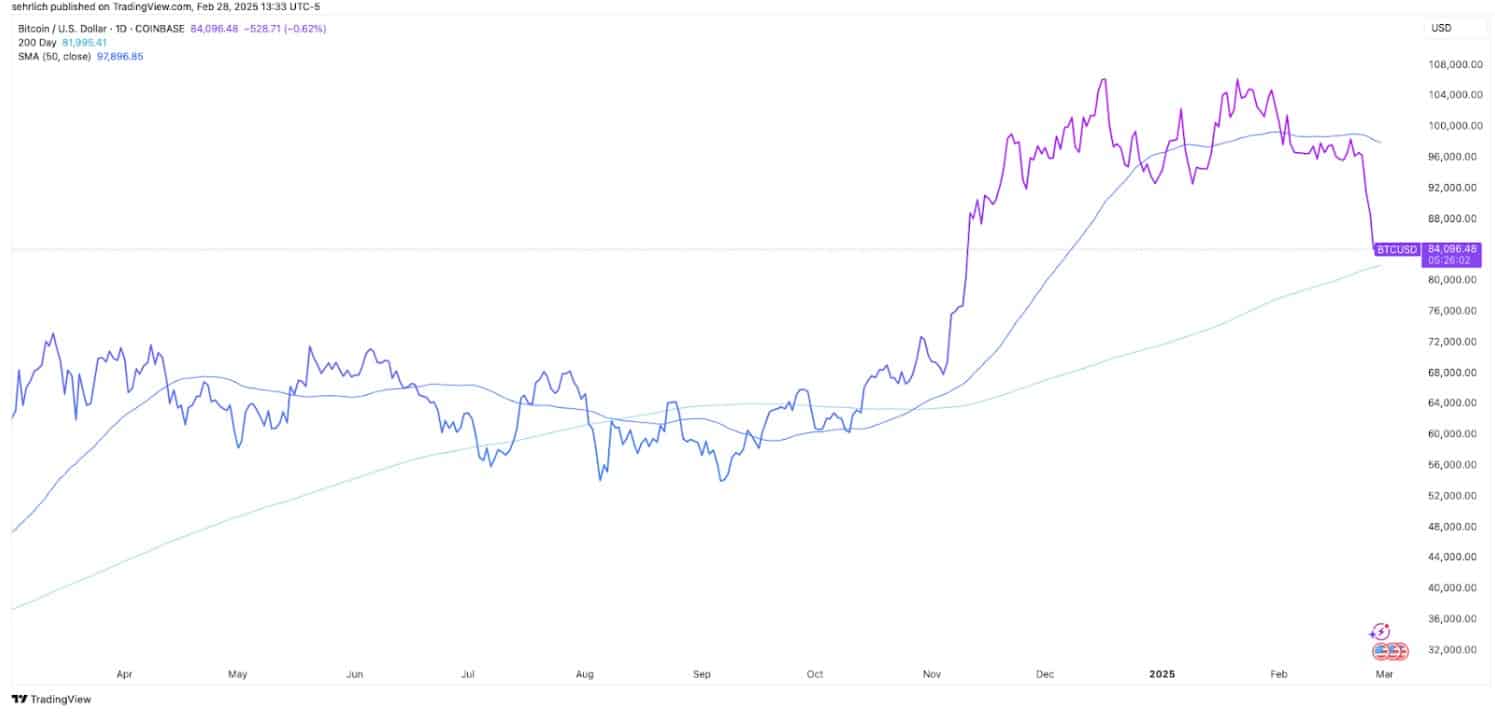

Alternatively, Sosncik pointed to a number of technical charts that would possibly perhaps present some perception into mark thresholds that investors must listen to. One appears to be like at bitcoin’s 200-day Easy Provocative Moderate. At its most up to the moment mark, the asset is shut to checking out this necessary marker for the first time since a definitive fracture relieve in mid-October. If that happens, which would imply that the asset falls below $80,000 then Sosnick believes the next threshold would be within the “high $60,000’s/low $70,000’s vary.”

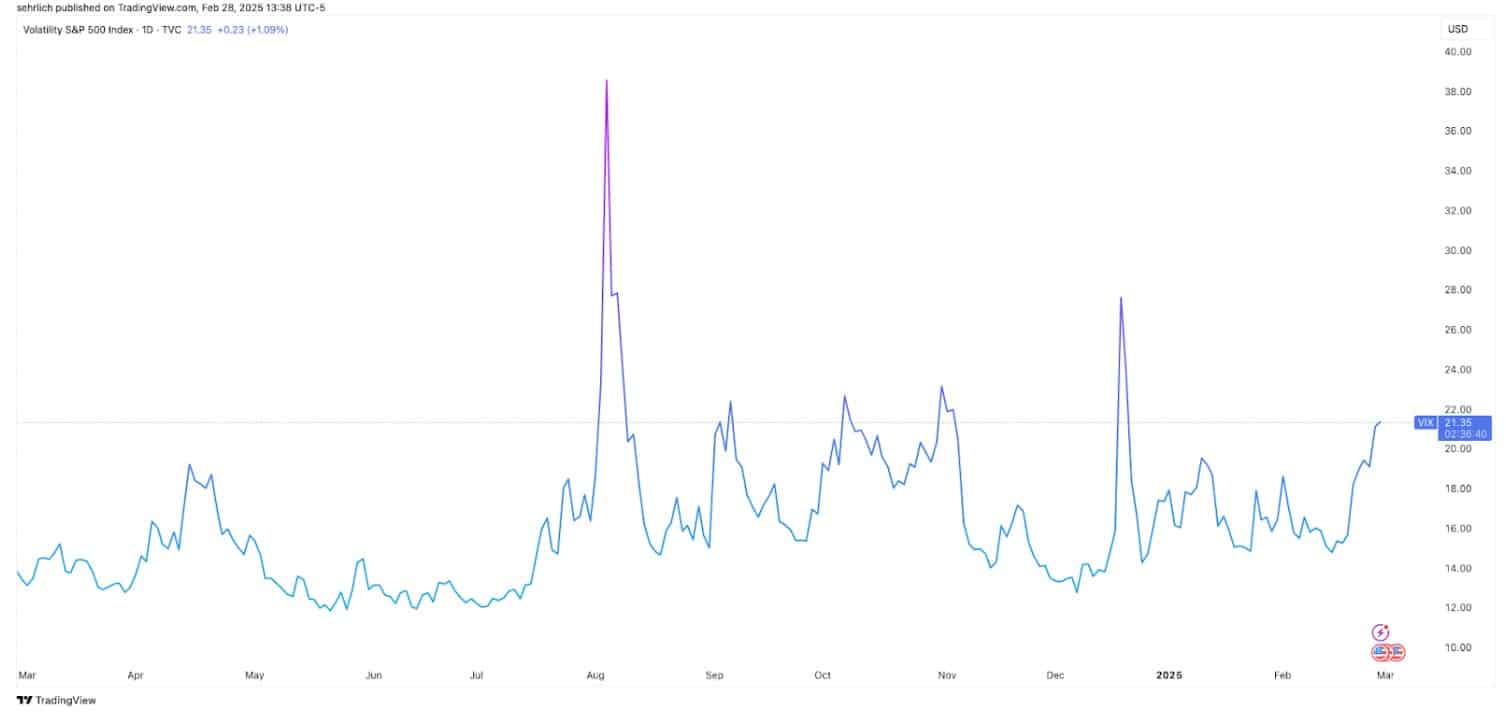

Even supposing no longer a dispute that bitcoin would possibly perhaps fall that a long way, Sosnick famed that for the total negative sentiment factual now amongst investors, total pain has no longer jam in precisely yet, as a minimal in line with Wall Street’s most necessary pain gauge, the S&P 500 Volatility Index (VIX). Even supposing it’s mountain climbing, it’s restful inner a typical vary over the past one year. “It’s no longer loopy high, and in some solutions it signifies that we’re no longer primarily out of the woods on narrative of those rallies are inclined to pause when VIX gets loopy.”

In relation to bitcoin, this suggests that it can perhaps restful fall on narrative of investors hold no longer reached height pain. For occasion, the VIX surged in August when the Financial institution of Japan raised its hobby fee and unwound the yen carry change; it’s presently distinguished decrease.

Trying forward to 2026?

Given all of those negative forces impacting the mark of bitcoin, it appears to be like that the industry would possibly wish to attend till 2026 for bitcoin and the industry to regain monumental forward momentum. When requested what forms of inner or exterior factors would possibly perhaps play a position here, the answers were two-fold, a strategic bitcoin reserve or legislation that devices the guidelines for the industry once and for all.

Even supposing the crypto community had wanted a strategic Bitcoin reserve, the White Home Govt Whisper jam an plan to evaluate something assorted: a federal stockpile, in which the government would settle to retain onto bitcoin that it obtained through legislation enforcement actions—no longer a strategic reserve in which it will aquire glossy bitcoin. (Alternatively, many states are evaluating their possess strategic reserves, though few are making significant progress.)

Rudick feels something appreciate a bitcoin stockpile or reserve would possibly perhaps be a boon for the industry, on the opposite hand it’s removed from a dispute: “[A reserve] in my mind continuously had low odds, however I deem bitcoin would with out worry transfer to $500,000. Even supposing we don’t procure it within the carry out of a Strategic Bitcoin Reserve, I procure deem there would possibly be some possible for the US to raze a sovereign wealth fund and add Bitcoin.”

However for Rudick, the extra sustainable course against development is the crafting of market structure legislation that legitimizes regulated companies to enter the home, however he feels appreciate the industry can hold to attend till next year for significant progress: “It [legislation] is possible a 2026 tournament. However the reason why here’s so necessary in my mind is on narrative of here’s what you will need for institutions to return in in a monumental manner.”

As evidence he pointed to most up to the moment statements from Financial institution of The usa CEO Brian Moynihan announcing that his crypto-reticent bank would preserve in mind launching a stablecoin if the guidelines for that industry grew to turned into clearer. (At the least one source nearer to the negotiations in D.C. believes stablecoin legislation would possibly perhaps even be signed in 2025.)

However till that time the industry will wish to preserve precise within the face of those headwinds. As a minimal, this investor whiplash is allotment of the sizable bargain that comes from investing in crypto.

“There’s an worn announcing that markets snatch the stairs to the attic and the elevator to the basement,” acknowledged Sosnick. “On this case, I would train Bitcoin took the elevator to the roof, and now the elevator the total style down to the basement… It’s a unstable asset. Volatility is gargantuan if it’s going your manner—I call that socially acceptable volatility. However volatility sucks when it’s going the reverse course.”

Source credit : unchainedcrypto.com