Bitcoin ETF Price Conflict Would perhaps presumably Make Investing in Bitcoin More inexpensive Than The use of an Change

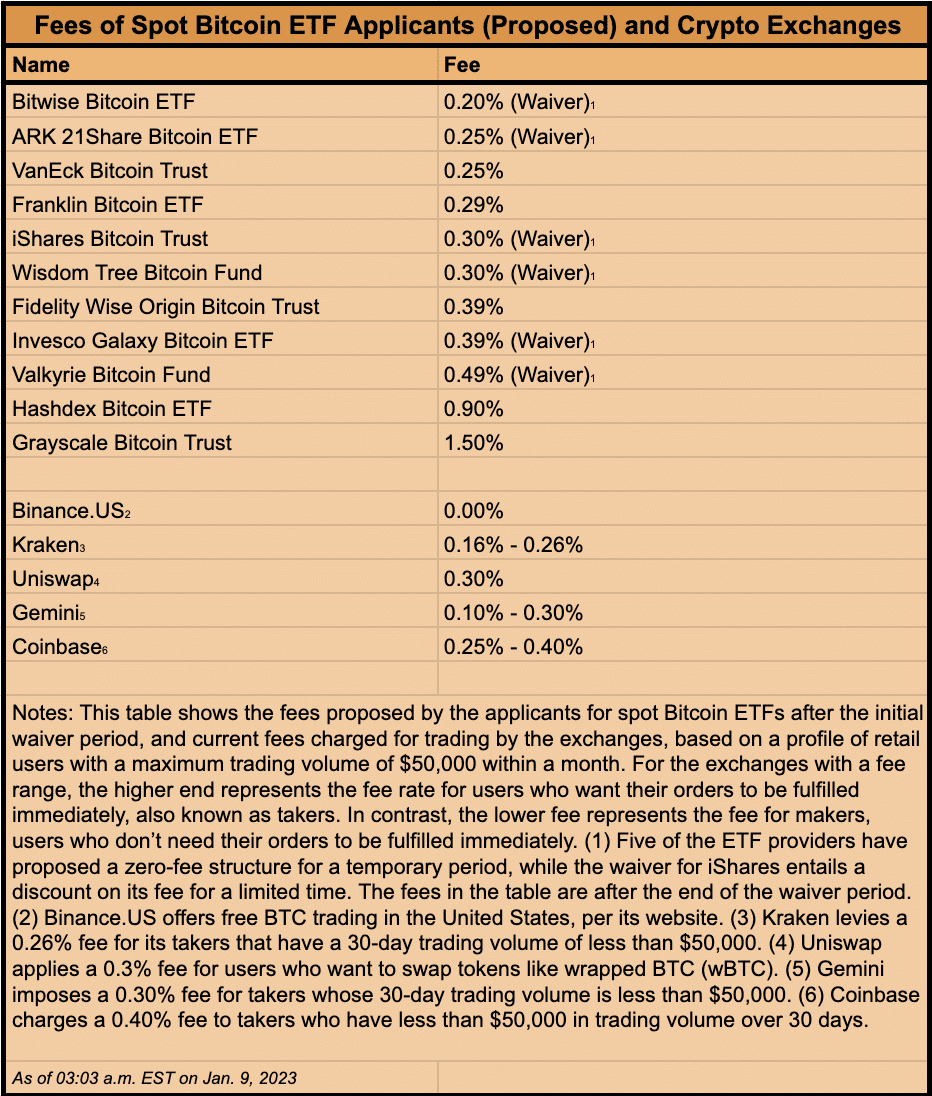

With trace competitors raging among doubtless diagram Bitcoin ETF issuers, investing in Bitcoin would possibly soon turn out to be more cost effective on an annual basis than exact now attempting to search out BTC on most cryptocurrency exchanges.

Days sooner than carefully anticipated approval of diagram Bitcoin ETFs by the U.S. Securities and Change Commission, Wall Boulevard heavyweights non-public situation their proposed annual expenses at slit payment-basement phases, signaling an expectation of giant inflows.

Some doubtless ETF companies are offering a payment waiver for an introductory length of the first six months or till the fund reaches a certain threshold in resources. The ETF applicants began to repeat their proposed payment structures on Jan. 7, initiating a payment battle that continues on the present time. On Tuesday morning, Bitwise, Valkyrie and Records Tree launched they slit their expenses by several basis positive aspects to as low as 0.20%. The day gone by, the bottom launched payment modified into once 0.24%, by Bitwise.

In the midst of the circulation of disclosures of strikingly low expenses that now fluctuate between 0.20% to 1.50% from Wall Boulevard titans including BlackRock (iShares), Constancy and Franklin Templeton, VanEck’s digital asset arrangement director Gabor Gurbacs famed on X that the expenses were decrease than those on Coinbase, the largest cryptocurrency exchange in the U.S. by procuring and selling volume.

It expenses much less to defend a Bitcoin ETF for a year than a single exchange on Coinbase. (~40-60bps vs ~25bps for a retail dimension exchange)

The “ETF terrordome” has arrived, as @EricBalchunas would dispute.

— Gabor Gurbacs (@gaborgurbacs) January 8, 2024

Crypto exchanges situation their expenses for diagram procuring and selling in step with several components, similar to a particular person’s procuring and selling volume, whether a particular person wants their clarify to be fulfilled without lengthen and the diagram in which critical a particular person holds of an exchange’s native token. “Charges are calculated on the time you space your clarify and would possibly aloof even be influenced by components similar to your chosen price attain, clarify dimension, market stipulations, jurisdictional situation and other expenses we incur to facilitate your transaction,” in step with the Coinbase net situation.

As of on the present time, Coinbase, Gemini, Uniswap and Kraken — all of that are on hand to U.S. residents — non-public expenses that are between 0.10% and nil.40% for retail patrons who non-public much less than $50,000 in procuring and selling volume over the prior 30 days. Binance.US, which has a 24-hour diagram procuring and selling volume of over $29 million, is an outlier, charging no payment for retail trades of Bitcoin. It launched this payment structure on Aug. 1, 2022.

glaring point nonetheless ETF issuers lowering their expenses to absolute slit payment basement phases implies huge expectations on their fragment round AUM

the largest financial instits on the planet are telling u one thing … will u hear?

— nic 🌠 carter (@nic__carter) January 8, 2024

Financial heavyweights aggressively slashing their ETF expenses to rock backside signals their anticipation of monumental tell of their resources beneath administration (AUM), in step with Nic Carter, a Bitcoin commentator and conducting capitalist. “ETF issuers lowering their expenses to absolute slit payment basement phases implies huge expectations on their fragment round AUM…,” he wrote on X.

“The sphere is now not any longer anymore the manner it faded to be,” he added.

Read More: Price Opponents Heats Up Among BlackRock and Other Feature Bitcoin ETF Applicants

Source credit : unchainedcrypto.com