Bitcoin Label Tesla $23M in Q2

July 27, 2021 / Unchained Day to day / Laura Shin

Day to day Bits ✍️✍️✍️

-

Digital asset funds noticed a salvage outflow of $28M final week, in step with data from CoinShares.

-

Aave plans to open its institutional platform within the next few weeks.

-

Binance has begun limiting recent user leverage to 20x.

-

Amazon denied a document asserting this may possibly possibly possibly perchance settle for BTC as price.

-

Tesla took a $23M impairment in Q2 thanks to its BTC funding.

- Shopify now allows companies to promote NFTs straight away via their very comprise storefront.

- Goldman Sachs has filed with the SEC for a “DeFi” and blockchain ETF.

What Produce You Meme?

What’s Poppin’?

The US Department of Justice (DOJ) is investigating whether or not Tether executives dedicated financial institution fraud, in step with a document from Bloomberg. The prices may possibly possibly possibly also level of interest on Tether’s early days, after they allegedly lied about being a crypto firm when opening preliminary financial institution accounts.

Per Bloomberg, three unnamed sources “with bid data of the matter” claim that federal prosecutors are inspecting “whether or not Tether hid from banks that transactions had been linked to cryptocurrency.”

As of now, no prison prices were filed in opposition to Tether touching on the concealment of cryptocurrency transactions. Nonetheless, Bloomberg experiences that federal prosecutors have sent letters to folk at Tether, alerting them of an investigation. Such notices signal that senior DOJ officials will be making a resolution soon on whether or not prices are warranted.

In response to the Bloomberg article, Tether revealed a press unlock which did not fully dispute the document however with out a doubt indicated it became unhealthy:

“This article follows a sample of repackaging damaged-down claims as “data.” The continued efforts to discredit Tether will not trade our resolution to stay leaders within the community. Tether automatically has originate dialogue with law enforcement agencies, including the U.S. Department of Justice, as fragment of our commitment to cooperation, transparency, and accountability.”

At this level, regulatory scrutiny and USDT creep hand in hand. The stablecoin honest not too lengthy within the past came beneath fire after releasing the composition of its reserves. After years of maintaining that USDT became backed 1:1 with US greenbacks, the firm honest not too lengthy within the past reported that cash splendid makes up 3.87% of its reserves.

Furthermore, Tether is lawful months a long way off from a settlement with the Sleek York Attorney Traditional’s issue of job over an investigation into Tether’s relationship with Bitfinex and the alleged duvet-up of losing $850M in buyer funds. Tether settled for $18.5M, admitted no wrongdoing, and agreed to the aforementioned quarterly experiences on the composition of Tether’s reserves.

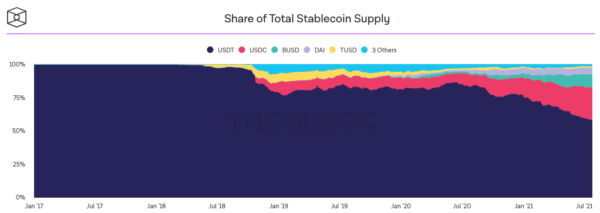

USDT is right this moment the third-largest cryptocurrency. At a $60B+ market capitalization, USDT makes up 57% of all stablecoins in circulation, towering over 2nd-issue USDC ($27B) by bigger than two instances.

Bonus Rec. Read

CoinDesk’s David Z. Morris on why Tether’s collapse may possibly possibly possibly also possibly be appropriate for crypto within the lengthy flee:

Immediate Reads

- Arca’s Jeff Dorman with a mid-one year overview of the firm’s 2021 digital asset predictions:

- Alex Gladstein on Bitcoin and Palestine:

- Andre Cronje, founder Yearn.finance, on comely launches in crypto:

On The Pod…

Why ShapeShift’s Erik Voorhees Thinks Toxic Bitcoin Maximalism Is Bullshit

ShapeShift honest not too lengthy within the past announced an intent to decentralize — a transfer that may possibly possibly possibly well transition the one-time centralized alternate to a corpulent-on DAO. Erik Voorhees, founder and CEO of ShapeShift, comes onto the declare to communicate about decentralizing the alternate, alongside with his thoughts on Bitcoin maximalism and crypto regulation. Prove highlights:

- why ShapeShift is decentralizing the firm

- how ShapeShift damaged-all the model down to work

- what needs to happen for ShapeShift to decentralize

- why user experience ought to not trade at some stage within the transition

- how the FOX token works

- what facets of a firm can’t be decentralized but

- how ShapeShift’s forthcoming basis will operate

- how ShapeShift determined upon the allocations for the FOX token airdrop

- why ShapeShift employee and shareholder FOX tokens are locked up for three years

- what Erik’s role will be going forward

- how ShapeShift plans to plan devs

- why Erik believes FOX will not be a safety

- how Erik wants the SEC to handle crypto

- why he believes THORChain is one amongst the most serious projects in crypto

- why he’s in opposition to Bitcoin maximalism

- Erik’s thoughts on BitMEX’s and Binance’s regulatory factors

- what he thinks about stablecoin regulation

- Why Erik believes ShapeShift and Uniswap are not competitors

Guide Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Grand Cryptocurrency Craze, is now on hand for pre-convey now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-convey it as of late!

You will be ready to safe it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com