Bitcoin 🐳🚀📈?

+ CFTC Chair Gushes About ETH

This week, one more mountainous institutional player invested an demand-opening sum in Bitcoin, while BTC’s overall bullish model reveals no signs of slowing down. CFTC Chairman Heath Tarbert praised Ethereum while dancing spherical whether or not ETH or the increased DeFi landscape might per chance simply aloof be labeled securities or commodities. We furthermore have a roundup of the most modern recordsdata in the BitMEX saga, a fight brewing over the DOJ’s insistence that tech companies private a backdoor for encryption, recordsdata of the long-awaited delivery of Filecoin, and more.

Meanwhile, on Unchained, SEC Commissioner Hester Peirce presents us the most modern on her token stable harbor proposal, explains her views on whether or not airdrops are securities choices and talks about whether or not DeFi governance tokens might per chance simply aloof be regarded as securities. And on Unconfirmed, the aged US attorney for the District of Columbia, Jessie Liu, talks about the DOJ’s not too long ago launched cryptocurrency enforcement framework, and what it system for crypto agencies worldwide.

This Week’s Crypto Details…

Stone Ridge Bets $115 Million on Bitcoin

Continuing the model site by MicroStrategy and Sq., the $10 billion asset administration agency Stone Ridge Holdings Community revealed in a Forbes article on Tuesday that it has invested in 10,000 bitcoin, at this time about $115 million. It has furthermore raised $100 million in funding for its crypto subsidiary, New York Digital Investment Community, or NYDIG, with $50 million in a not too long ago closed spherical. In an announcement to CoinDesk, the non-public agency known as Bitcoin its “major treasury reserve asset.” The announcement additional illustrates the rising belief in Bitcoin as a stable haven asset.

Stone Ridge’s transfer towards the investment started three years ago when its founders and senior employees started buying for bitcoin at an ever-increasing tempo, which in turn generated increased ardour from purchasers. To succor watch over the funds, Stone Ridge constructed execution and custody tools from scratch. Although most NYDIG customers aren’t public yet, the company confirmed that the $115 million set it manages for Stone Ridge will not be its finest.

Bullish Signs for Bitcoin

In somewhat a turnabout, JPMorgan now says investments admire Sq.’s $50 million bitcoin have are a “precise vote of self belief” in Bitcoin and its strategists ask “somewhat somewhat heaps of funds companies to employ in facilitating client bitcoin investments or threat being left in the succor of.” Meanwhile, Grayscale Investments posted its all-time handiest quarter with over $1 billion invested all over its cryptocurrency products. In the OTC markets, BTC and ETH are displaying renewed ardour following the Sq. recordsdata, as consideration appears to be like to be transferring away from DeFi tokens, succor to those more tried-and-appropriate crypto sources.

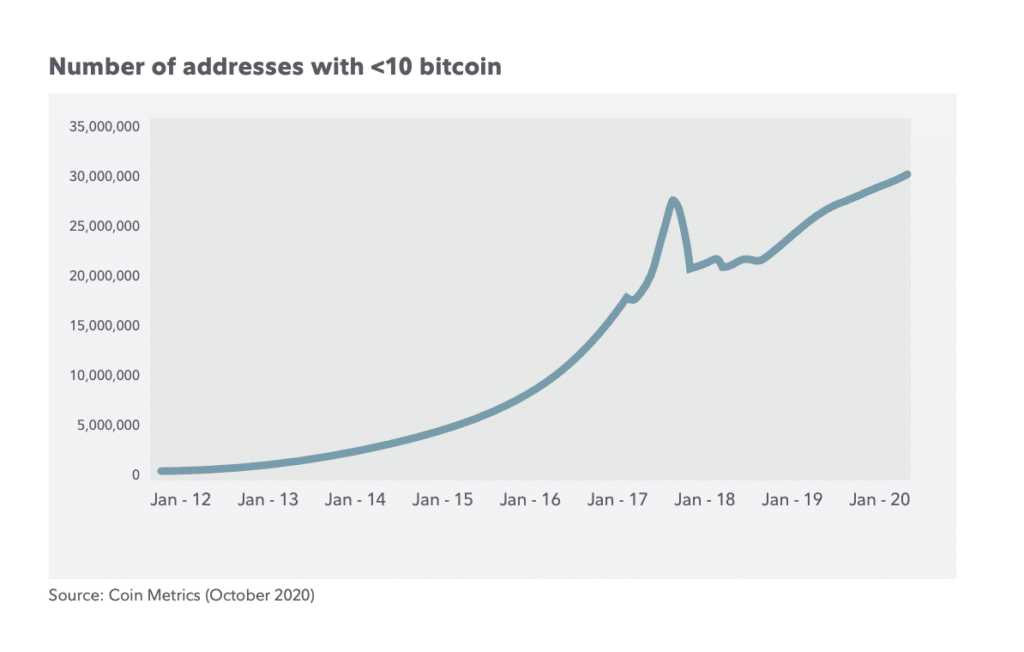

Constancy furthermore published guidance on Bitcoin as a change investment, highlighting what it sees as persevering with retail ardour in Bitcoin, as evidenced by the increasing collection of wallets conserving not up to ten bitcoins.

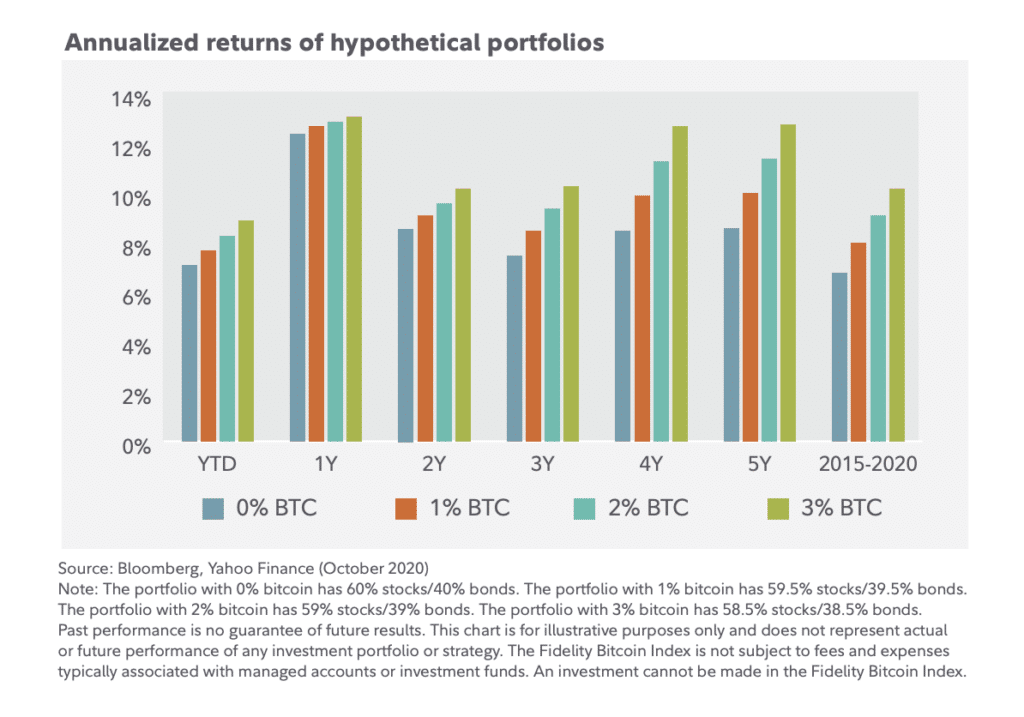

Constancy furthermore lays out annualized returns for hypothetical portfolios allocating 1-3% to BTC. It reveals that, even in 2018, when bitcoin’s tag fell 70%, with frequent rebalancing, a portfolio with 3% bitcoin site up in the muse of 2018 would have outperformed a portfolio without bitcoin by 1.1%. And from January 2015 to September 2020, this kind of portfolio would have outperformed one without bitcoin by 29%.

On the other hand, the characterize notes that Bitcoin’s historical pattern of accelerated returns might per chance simply not proceed as it exits early-stage behaviors. On the flip aspect, Bitcoin might per chance as a change enter a length of more precise and precise performance, presumably ensuing in lower volatility and favorable threat-adjusted terms.

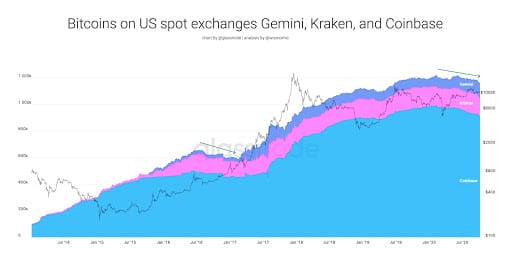

Lastly, market analyst Willy Woo posted some charts to Twitter illustrating why Sq. and MicroStrategy’s Bitcoin purchases are upright the tip of the iceberg. He identified that there has been a discount of 250,000 BTC on space exchanges over the supreme eight months, signaling somewhat somewhat heaps of mountainous merchants would be going in the game.

CFTC Chairman Praises Ethereum

Appearing Wednesday at CoinDesk’s invest: Ethereum economy virtual convention, Commodity Futures Buying and selling Commission chairman Heath Tarbert talked about how Ethereum and DeFi match into U.S. securities and commodity laws, but surprisingly gushed about Ethereum. “Let me upright in most cases express how impressed I’m by Ethereum, elephantine stop, length,” Tarbert said. When discussing whether or not a proof-of-stake Ethereum would be a security or commodity, he deferred to his colleagues at the SEC, announcing handiest, “the more decentralized it turns into over time and the more that it successfully runs itself, the more likely it’s far it’s going to tumble within the commodity class and never the securities.” Tarbert was equally hesitant to compose a agency judgment on the set of DeFi within securities and commodities laws and furthermore said, of the UNI token from Uniswap, which was airdropped to its users, “If of us didn’t basically pay for it … then it’s onerous to take into memoir at what point there would be an financial loss.”

BitMEX Continues Bringing In New Execs; seventy 9,000 BTC Circulate Off Platform

As fallout from the BitMEX court docket cases continues, questions remain about what might per chance simply happen next now that the U.S. authorities has gone after the crypto derivatives substitute and its aged executives. Per The Block, simply consultants most incessantly agree that BitMEX will steer away from a authorities shutdown and be allowed to proceed operations. As for whether or not somewhat somewhat heaps of exchanges might per chance face a associated costs, they furthermore fairly universally judge right here is probably going. What remains somewhat hazier is whether or not or not the U.S. will successfully extradite the defendants who remain at pretty.

Meanwhile, BitMEX CTO Samuel Reed was launched from custody after posting a $5 million bond. He pledged to appear in court docket to conform with sentencing or threat losing the bond. Furthermore, the synthetic’s father or mother neighborhood 100x equipped that Malcolm Wright had been appointed as chief compliance officer. Wright chairs the Advisory Council and AML Working Community at Global Digital Finance, and BitMEX’s announcement successfully-known Wright’s “extensive background in compliance and anti-money laundering.”

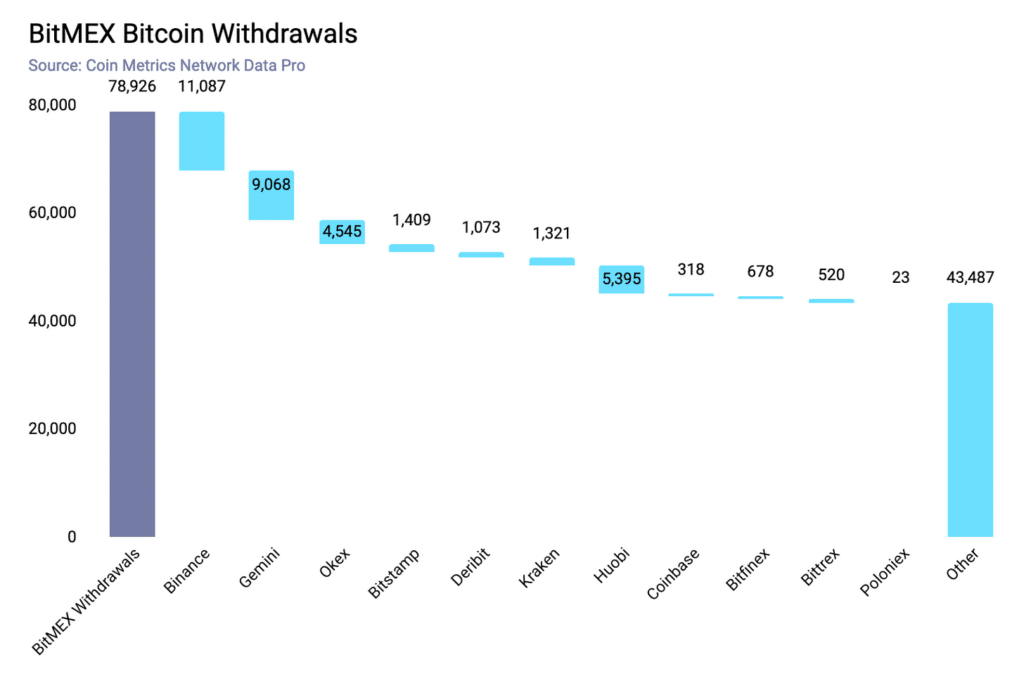

Coin Metrics aspects out that, unlike somewhat somewhat heaps of exchanges the usage of the usual hot/cool pockets structure, BitMEX holds all its Bitcoin in cool storage, processing withdrawals as soon as a day. Every BitMEX take care of is a multi-signature take care of that requires 3-of-4 keys to galvanize spending, three of which are each and each owned by one cofounder, while a fourth is mined. One of these tool system that had one more founder been incapacitated in any system while Samuel Reed was in custody, a freeze of all funds on the platform can have happened. Now that all three founders have stepped down, it might per chance maybe per chance also furthermore be assumed their keys have modified ownership. On the other hand, this kind of transition has not been confirmed.

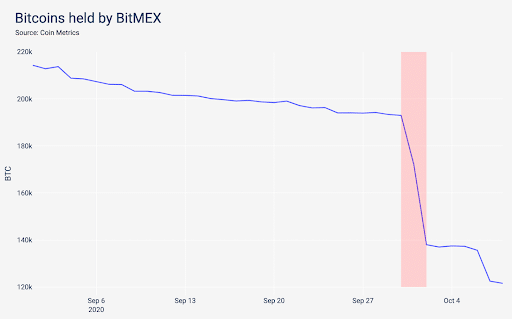

To this point, users have had no effort accessing funds, and thousands of users have successfully withdrawn Bitcoin in the times following the announcement of costs. Coin Metrics posted a bunch of graphs that charted the inviting lower in BTC held by BitMEX and showed the set some of the money might per chance simply have gone, with the top recipients being Binance, Gemini, Huobi and Okex.

It appears to be like few are conserving out hope BitMEX will ultimately recover from the previous month’s occasions. One buying and selling agency govt was blunt when asked if they take into memoir a cause to alternate on BitMEX in 2020: “Don’t think so.”

Crypto Neighborhood Pans DOJ’s Recommendation to Blueprint Backdoors for Encryption

The Division of Justice is asking on tech companies to work with governments to put into effect encryption so that companies themselves and law enforcement can act in opposition to unlawful verbalize and project. Crypto Twitter wasn’t supportive. Meltem Demirors of CoinShares criticized the DOJ’s point out of “sexually exploited teens” to forestall customers from the usage of pause-to-pause encrypted skills. In a Twitter thread, Compound usual counsel Jake Chervinsky introduced up the DOJ’s stance to increase his contention that a increased ideological war is brewing over self-custody and privateness.

Filecoin Mainnet is Stay

Filecoin equipped its mainnet delivery Thursday, reporting a hit operations so far as it enters “a quiet submit-delivery monitoring length to compose sure that that the community is working smoothly.” The community went stay at block 148,888 which Filecoin said in a blog submit system “prosperity for life” in Chinese, chosen to honor the legend contribution by our Chinese mining neighborhood to Filecoin’s long-term success ❤️.” The delivery is a truly long time coming for the $200 million ICO, with speculation it might per chance maybe per chance change into the quickest newly stay blockchain to place a market cap of over $1 billion. Gemini and Kraken both straight away opened buying and selling for Filecoin.

The Whale Alert Crew Gives a High In the succor of the Tweets

The Block interviewed Whale Alert, one of Crypto Twitter’s most famed accounts, known for monitoring addresses that preserve and transfer a gorgeous collection of tokens. The interview dives into the historical previous of Whale Alert, how the Twitter memoir straddles the line between privateness and transparency, and a tweet by Whale Alert about a “imaginable Satoshi owned pockets” that might per chance have ended in a tumble in the tag of bitcoin. One tidbit they dangled that sounds inspiring is “We are in a position to be releasing a piece of writing in the advance future about our views on Satoshi.”

The Block Launches New Dashboards

The Block launched a bevy of dashboards that chart on-chain metrics all over Bitcoin, Ethereum, exchanges, space markets, futures markets, choices, social media, net site visitors and more. Plus, there’s an complete part on DeFi that looks at stablecoins, lending, dexes, to boot to a ton of somewhat somewhat heaps of valuable records. Kudos to The Block and to the loyal records suppliers who made these charts imaginable, equivalent to Coin Metrics, CryptoCompare, Dune Analytics, and others.

Source credit : unchainedcrypto.com