ARK’s Cathie Wood Tranquil Sees BTC at $500K

Would possibly per chance merely 20, 2021 / Unchained Day-to-day / Laura Shin

🎉Welcome to Unchained Day-to-day 🎉

ICYMI, the Unchained E-newsletter is animated from a weekly recap to a day to day weblog. Every morning you are going to rep about a immediate bullet parts summarizing the outdated day’s news, a couple of memes, a transient breakdown of a trending topic, and some quick reads.

For those of you who were principal fans of the weekly recap, don’t nervousness — the weekly recap will mild be on hand on the assist half of of the Unconfirmed pod on Friday!

Without extra ado… here is the fourth model of the Unchained Day-to-day.

Day-to-day Bits ✍️✍️✍️

- Ark Funding CEO Cathie Woods says Bitcoin will reach $500,000

- Aave founder hints at an institutional DeFi product

- Coinbase and Binance went down all the blueprint during the outdated day’s dip

- Wells Fargo to present crypto investment products to filthy rich purchasers

- BlockFi by probability gave away wise quantities of BTC in a promotion gone awry

- About 80% of central banks are exploring CBDCs

- Instagram to host an NFT tournament all the blueprint through its “Creator Week.”

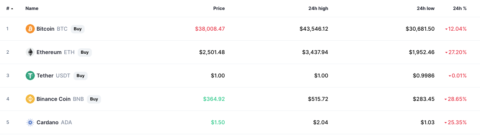

- The total crypto market is down 20%+ all the blueprint during the last day (as of Wednesday night)

Source: CoinMarketCap

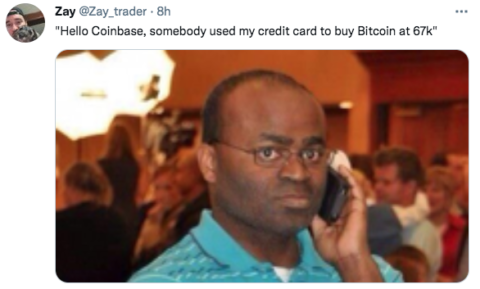

What Make You Meme?

“I chortle on yarn of I have to no longer yowl” – Abraham Lincoln (talking for HODLers in all locations).

What’s Poppin’?

US regulators are poppin’, as evidenced by comments from Michael Hsu, the acting head of the OCC, all the blueprint through a virtual listening to of the Home Financial Services and products Committee.

The major snarl of Hsu’s is that “the regulatory crew is taking a fragmented, agency by agency technique to the technology-driven adjustments taking set up on the fresh time.”

To clear up this fragmentation, Hsu is eyeing a collaboration between the OCC, Federal Reserve, and FDIC to win an “interagency run team” that can work on setting up a unified framework and dwelling of definitions for cryptocurrencies.

Earlier this week, Hsu requested a workers review of all crypto-associated steering issued all the blueprint during the last year.

The review will encompass the total lot of feeble comptroller Brian Brooks’ reign on the OCC, the set up the regulator established crypto steering largely seen as beneficial to the switch. As an illustration, Brooks wrote a chain of interpretive letters all the blueprint through his tenure, clarifying that federally chartered banks would possibly additionally custody stablecoins and succor them in reserve.

Whereas a review would possibly additionally no longer sound handle a meaningful budge, Caitlin Long, CEO of Avanti Financial institution, pointed out that, earlier on Tuesday, the OCC had reversed a final ruling, which, though unrelated to crypto, is a in point of fact rare occurrence — per chance signaling that Hsu’s time as acting comptroller would possibly additionally zig the set up Brook’s administration zagged.

In fact handy Reads

- Ethereum would possibly additionally expend ninety nine.95% less vitality after transitioning to 2.0:

- Paradigm on how to stay on a crypto cycle:

- Decrypt on 5 different reasons the crypto market is down:

On The Pod…

Bitcoin vs. the Petrodollar: Which Is More Environmentally Friendly?

Final week, Tesla announced they’ll no longer accept Bitcoin as price for autos. In a timely episode, Alex Gladstein, chief technique officer on the Human Rights Foundation, and James McGinniss, CEO and co-founder of David Energy, reach onto the whine to be in contact about Bitcoin, the petrodollar, and how to contextualize the vitality usage of the first cryptocurrency (BTC) versus the leading fiat foreign money (USD). Show conceal highlights:

-

their backgrounds and how they grew to vary into attracted to the intersection of foreign money and vitality usage

-

why Alex and James without a doubt think Tesla stopped accepting BTC as price

-

why James thinks Bitcoin’s vitality intensity is a “feature, no longer a malicious program”

-

Alex on the history of the petrodollar and how the USD in most trendy decades has been tied to fossil gas manufacturing

-

evaluating the carbon price of a buck to Bitcoin’s vitality consumption

-

what both James and Alex recall to mind the Sq. and Ark Invest learn paper pronouncing renewable vitality manufacturing will be tied with Bitcoin mining

-

why measuring Bitcoin’s vitality usage is sophisticated

-

how Bitcoin mining in China is changing for the upper

-

how the Biden administration would possibly affect Bitcoin

-

the set up to derive more recordsdata on Bitcoin and vitality consumption

E-book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Gargantuan Cryptocurrency Craze, is now on hand for pre-uncover now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-uncover it on the fresh time!

You ought to purchase it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com