Are L2s ‘Parasitic’? Analysis Shows Ethereum Handiest Gets a Runt Share of Charges

L2s not paying gargantuan sums of ETH for rent when compared to the quantity of charges they care for has sparked an ongoing conversation within the crypto ecosystem, including Solana crew individuals.

On Monday through X, Solana’s co-founder Anatoly Yakovenko stated, “[L2s] are parasitic when they rob more precedence [transactions] from the contaminated layer than they add.”

On the a host of hand, some, especially these within the Ethereum ecosystem, grasp stated the impacts had been half of the non-public to diminish transaction costs for customers. For instance, on Thursday, Ethereum Foundation developer Dankrad Feist, in an Ethereum Foundation AMA, posted to Reddit announcing, he didn’t judge rollups “may maybe finally be parasitic.”

“The very best-build transactions will happen on Ethereum, while rollups will develop the pie by providing loads of build for customers to transact on Ethereum,” he wrote. “The relationship will seemingly be symbiotic: Ethereum gives rollups with low-build records availability and in return they originate Ethereum L1 the natural crossroads for all financial task for the in truth precious transactions.”

Read Extra: Ether Has Been a Powerful Worse Investment Than Each Gold and Silver So A long way This Year

The explain of details from layer 2 analytics platform GrowThePie, Unchained has calculated that, of the total charges crypto customers pay to transact on Ethereum L2s, the overwhelming majority of it doesn’t accrue to Ethereum’s tainted layer.

While some grasp argued the definition of whether an L2 is parasitic or not is reckoning on whether it takes away charges, earnings, and customers from its L1, these taking allotment within the controversy have not drawn a particular threshold for what counts as parasitic.

However, ever since March’s Dencun enhance, which made transacting more inexpensive on Layer 2s, the financial provide of ETH has been more inflationary than deflationary. For instance, the provide of ETH has increased by 262,493.37 ETH price about $621.6 million since April 3, three weeks after the Dencun enhance, essentially essentially based on ETH provide analytics platform ultrasound.cash.

L2s Withhold Charges Continually Many of of Instances the Quantity Sent to Ethereum L1

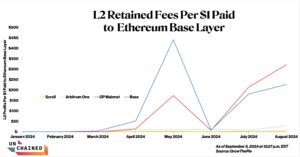

With the records from GrowThePie, Unchained calculated the retained charges of Scroll, Arbitrum One, OP Mainnet, and Inaccurate for every $1 expense connected to posting L2 transaction records and proofs onto Ethereum’s tainted layer.

In August, OP Mainnet led the pack, maintaining $321.31 for every $1 expense to leverage the safety of Ethereum’s tainted layer. Coinbase-incubated Inaccurate came in second build with $226.40, adopted by Arbitrum One at $28.62. Scroll, the youngest L2 within the cohort, had the bottom resolve, maintaining $3.54 for every $1 extinct to put up transaction records and proofs onto Ethereum L1.

With the exception of June, the ratio of monthly charges retained by every L2 vs. paid to layer 1 is multiples increased than in March when the Dencun enhance was carried out. Dencun enabled layer 2 blockchains to make explain of blobs, a a host of arrangement of storing records geared toward bettering Ethereum’s scalability properties.

Read Extra: Why You May maybe maybe Wish to Wait a Small Longer for a Crypto Bull Market

In March, the median retained charges of the four L2s for every $1 expense to send records to Ethereum’s tainted layer was $0.36. OP Mainnet had the bottom retained charges of $0.20, while Inaccurate’s resolve was the ideal at $4.22. (In June, the ratio of charges retained by the L2 to the L1 dropped vastly for OP Mainnet and Inaccurate. In May maybe well also and July, OP Mainnet and Inaccurate collectively paid about $24,000 in rent for every month to Ethereum’s L1, nonetheless in June the rent paid for the 2 tallied to roughly $650,000. Fault proofs had been added to the OP tech stack in June).

Share of Charges Kept by Arbitrum and OP Mainnet Powerful Better Put up-Dencun

Moreover, onchain records from blockchain analytics company Flipside Crypto reveals the percentage of charges Arbitrum and OP Mainnet keeps. On Thursday, Optimism particular person charges totaled 10.376 ETH of which better than ninety nine% stayed at some stage within the L2, while the closing was rent paid to Ethereum’s tainted layer. Similarly, Arbitrum so some distance has received a total of two.9 ETH in charges, of which not up to 26% will seemingly be dedicated to paying Ethereum L1, a dashboard created by Flipside records scientist Carlos Mercado reveals.

The transaction charges on L2s tend to be serene of two parts: a rate to preserve out a transaction on the L2 and one more for the estimated build to put up the transaction on the L1. L2s may maybe differ in their percentage of charges paid to L1, for the reason that L1 rate is reckoning on assorted factors that differ from chain to chain equivalent to the estimated dimension of the transaction in bytes, the hot build of gasoline and a host of parameters, per Optimism’s paperwork.

Following the Dencun enhance, Arbitrum and Optimism’s margins oscillate between as minute as 67% to as high as ninety nine%. In difference, the margins within the few months sooner than the Dencun enhance not regularly ever reached 50%.

“After blobs went live; the one sequencers of these L2s reduced notify costs for customers (decrease earnings), nonetheless increased their fragment of the earnings margin (in some cases 95-ninety nine%),” Mercado shared in a Telegram repeat to Unchained. “Obviously, this will not be free cash – records availability and offchain distributors (e.g. scanners) will grasp to be paid to toughen the ecosystem’s efficiency,” per Mercado who indicated that the prolong in retained charges for L2s highlights how Ethereum L2s suffer minute costs when posting records to Ethereum’s tainted layer.

Mercado – such as Ethereum Foundation’s Feist – doesn’t preserve the note that Ethereum is getting cannibalized by its L2s. “[The] L1 is composed the dominant DeFi chain and I perform quiz of the interoperability to rating solved in a trend that continues centering ETH as the major asset at some stage within the general layers.”

Source credit : unchainedcrypto.com