Arbitrum Instructions Virtually about Half of of Full Market Half in Ethereum Rollups: Nansen

Arbitrum, the leading scaling resolution for Ethereum, has captured roughly half of your total rollup market fraction, in accordance to blockchain analytics firm Nansen in a analysis yarn published Thursday.

Rollups are designed to serve users transact quicker and extra inexpensively on the Ethereum community by transferring computation off-chain and batching a series of transactions sooner than posting them to Ethereum’s negative layer.

With $11.47 billion in locked charge in its tidy contracts, Arbitrum has captured about forty eight% of your total rollup market fraction.

Arbitrum has “sturdy fundamentals,” Nansen analysis analyst Sandra Leow said in the analysis yarn. Notably, growth in day-to-day transactions and month-to-month earnings has been spectacular. Despite Ethereum surpassing it in day-to-day transactions, Arbitrum averages 600,000 to 900,000 transactions per day, outpacing its rollup rival, Optimism, the 2d supreme rollup with over $5.5 billion in locked charge, per L2Beat.

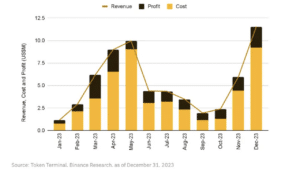

Arbitrum’s earnings trajectory has been consistently upward since Sept. 2023, Leow infamous. Last month, Arbitrum generated earnings of $11.9 million, its most sensible month-to-month earnings up to now.

Concerns About Upcoming Token Liberate

The outlook is now not all sunny for Arbitrum, on the other hand. Some crypto merchants gape dangers in Arbitrum attributable to its upcoming token unlocks that would also liberate a huge amount of ARB.

Token unlocks consult with the originate of frozen or locked cryptocurrencies. Ideally, token unlocks are tedious to dwell immense-scale promote-offs by early merchants. But Arbitrum is set to possess a “heavy release,” explained Charles Storry, co-founding father of crypto index platform Phuture, to Unchained on Telegram.

Simply now, Arbitrum has a truly small circulating provide of 1.275 billion ARB, fully 12.75% of its entire token provide. Nevertheless, in about two months, 1.11 billion ARB — 87% of its circulating provide — will be unlocked.

After the March release, which is valued at over $2 billion, Arbitrum will originate month-to-month unlocks for the next three years, in accordance to its governance documents.

Positive Catalysts

Lots of catalysts could well even improve sure sentiment amongst the Arbitrum neighborhood, on the other hand, in accordance to Nansen’s Leow. The first is a now not too lengthy ago handed proposal about the implementation of a staking mechanism, which would let token holders lock their ARB in trade for rewards.

The 2d is Arbitrum’s momentary incentive program (STIP), which enables protocols a lot like GMX and Camelot to employ and receive grants as one contrivance to elevate on-chain task.

The third is EIP-4844, which “is a gargantuan step forward in Ethereum’s Rollup-centric roadmap,” on tale of it reduces the charge of rollups by 10-20x, wrote Leow. While merchants possess expressed bearish remarks about ARB’s mark, “veritably of us are extra closely monitoring EIP-4844 (blobs) in the Ethereum Dencun toughen,” Carlos Mercado, an recordsdata scientist at blockchain analytics firm Flipside Crypto, said to Unchained over Telegram.

Learn More: Ethereum’s Dencun Upgrade Are residing on Testnet After Worm Delays Finalization

The final catalyst revolves spherical Arbitrum Orbit, which enables builders to originate unique chains atop Arbitrum’s layer 2 rollup. In step with Leow, the basic lend a hand of Arbitrum Orbit is that it enables the usage of tokens native to the chains atop Arbitrum as compensation for gasoline, which would “restrict promote pressure of the said token.”

“Despite investor concerns over forthcoming token unlocks and the ARB token’s underperformance, ARB is strategically positioned as a frontrunner in the optimistic rollup sector, commanding close to half of the total market fraction in rollups,” Leow said.

ARB, the governance token for Arbitrum, is for the time being trading at $1.91, down roughly 14% prior to now seven days, records from Coingecko reveals.

Disclosure: Arbitrum is a sponsor for Unchained.

Source credit : unchainedcrypto.com