Quantity of Bitcoin and Ether on Exchanges Attain Account Multi-365 days Lows

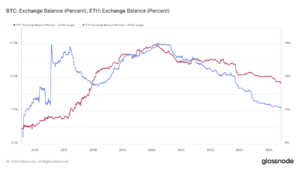

The p.c supply of bitcoin (BTC) and ether (ETH) held on exchanges dropped to multi-yr lows on Monday.

Fair over 11.5% of BTC’s supply is currently held in wallet addresses belonging to exchanges, a roughly 8% lower for the explanation that commence of the yr earlier than the U.S. Securities and Exchange Commission approved several space bitcoin ETFs, in step with data from blockchain analytics firm Glassnode.

For ETH, exchanges retain about 10.6% of the cryptocurrency’s supply of their wallet addresses, a pair of 10.6% decline in 2024, as those within the crypto dwelling and ancient finance are gearing up for the inaugurate of several space ether ETFs. (And no, the repeated numbers are no longer a mistake — ETH held on exchanges started the yr at 11.8% and has now dropped 10.6% to 10.6%.)

The closing time exchanges held a linked anecdote low share of the BTC supply became once in Dec. 2017, and for ETH, Oct. 2015, the identical yr Ethereum had its first transaction.

A tumble within the quantity of BTC and ETH held in exchanges is each at times a signal of investors adopting a long-time length diagram of holding since tokens off exchanges and into utter custody are much less accessible for selling.

Read More: Ethereum ETFs Seemingly Give protection to Ether From the SEC. Nonetheless What About Staked ETH?

The quantity of BTC held across all exchanges stands at over 2.28 million BTC, valued at around $154 billion, per Glassnode, and for ETH, exchanges retain with regards to 12.66 million ETH, about $forty eight billion.

The lower in BTC and ETH’s p.c supply on exchanges comes as centralized alternate Kraken witnessed its greatest outflows of bitcoin and ether in roughly seven years. On Would possibly well simply 29, Kraken saw a customary outflow of BTC and ETH worth over $4.Forty five billion at contemporary market prices, the greatest each day outflows for the 2 since 2017 for every cryptocurrencies, in step with onchain data firm CryptoQuant.

Despite the tall outflow, Kraken has an onchain portfolio of $20.5 billion at the time of writing, per crypto learn firm Arkham Intelligence.

Source credit : unchainedcrypto.com