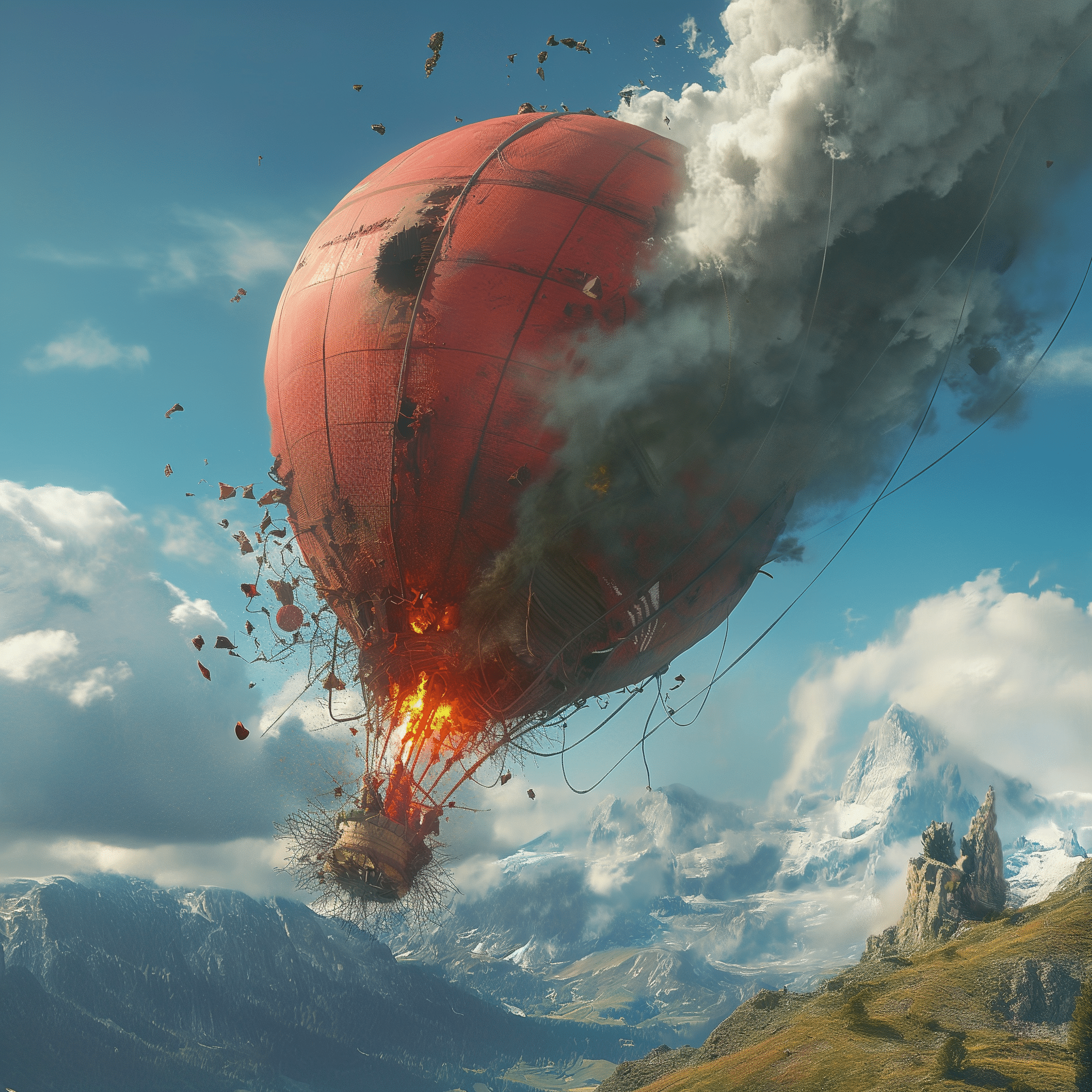

Airdrops Factual Aren’t Working Anymore

Airdrops, one amongst essentially the most well liked ideas for distributing tokens and gaining user traction in crypto, are initiating to lose their charm.

Many projects — corresponding to Ethereum layer 2s Mode and Manta as effectively as liquid staking protocol Renzo — have experienced most important declines in whole ticket locked (TVL) and job following their airdrops. Meanwhile, the disbursed tokens flounder, in most cases shedding more than 50% in ticket since initial distribution, as airdrop recipients offload their tokens.

Read more: 5 Perfect Airdrop Practices All Crypto Protocols Would maybe well also composed Apply

This habits is often in most cases known as “mercenary airdrop farming”, and is an equivalent to “mercenary yield farming” considered in the early days of decentralized finance (DeFi). This development entails participants becoming a member of crypto projects handiest to receive free airdrops, then rapid promoting these sources and leaving, a worrisome sample for those having a hit upon to manufacture lasting communities and genuine projects.

“The ecosystem appears to be shedding the arena,” acknowledged Robert Leshner, the founder of decentralized finance protocol Compound and venture investor at Robot Ventures, on essentially the most up-to-date episode of The Slicing Block podcast.

“Folks are gaming metrics to procure money, creating a convoluted system,” he acknowledged. “This methodology doesn’t seem to work that effectively for distributing a token.”

Founders looking at entitled airdrop farmers bitch about their allocations in the same breath that these farmers as we thunder dump their tokens are likely reconsidering the loyalty acquired, and ticket expended, for the duration of airdrops. $EIGEN, $ZK, $ZRO all identical habits.

We are capable of attain…

— Chris Burniske (@cburniske) June 19, 2024

The Dangers of ‘Mercenary Airdrop Farming’

Mercenary airdrop farming can distort a project’s user engagement figures. It rapid boosts participation numbers round the time of the airdrop and is then followed by a gripping decline as participants dump their tokens and exit, leaving projects combating unstable token prices and a diminished dependable user nefarious.

The arena veritably gets worse if the airdrop doesn’t meet participants’ expectations. Dissatisfied, they will also simply harshly criticize the project on-line and snarl off extra involvement, unfavorable the project’s popularity extra. Restaking protocols EtherFi, EigenLayer and Renzo are all projects that modified their initial airdrop plans following community backlash.

Read more: Who Knew Throwing Tantrums Would Be Such an Effective Solution to Salvage a Better Airdrop Allocation?

Claim, Promote and Circulate On?

As Ethereum layer 2 Mode started distributing its airdrop, its TVL sat at 218,300 ETH on Would maybe well also 8. Six weeks later, TVL dropped 18% to 179,886 ETH, while its token, MODE, experienced a more most important decline with its market cap plummeting 67% from $90 million to $30 million.

Manta, one other layer 2 on Ethereum, confronted a identical arena. After its airdrop on Jan. 18, TVL became slashed in half of from 585,000 ETH to 214,000 ETH in a subject of weeks. Manta’s token, MANTA, market cap is currently at an all-time low of $320 million — at commence the token became valued at $979 million.

Read more: Starknet Utilization Is Arrangement Down Put up-Airdrop, Displaying No Signs of Stopping

As no longer too prolonged ago as remaining week, Ethereum scaling resolution ZKsync’s TVL diminished from 228,000 ETH to 210,000 ETH (excluding its no longer too prolonged ago launched ZK token) following its token distribution announcement. ZK became expected to interchange round $0.4, however it’s undoubtedly buying and selling at round $0.23.

LayerZero, which launched its checker this day and is anticipated to instruct its airdrop this week, experienced a decline in job after announcing its airdrop snapshot. Earlier this year, LayerZero became recording approximately 300,000 whole messages per day, now it’s recording round 40,000 per day.

Renzo had grown to 1 million ETH in TVL by April 30, but after the airdrop, the TVL remained stagnant, no subject plans for a 2d round of airdrops. Renzo’s token REZ hasn’t fared effectively both, having launched at $0.25 and is now sitting at $0.1. In every single place in the Solana ecosystem, decentralized staunch property platform Parcl’s TVL has dropped over 70% from $180 million to $47 million after its airdrop, while its token, PRCL, is intention an all-time low of $0.22 at press time.

Read more: Parcl’s Airdrop Fell Flat. What Can Other Tokenless Crypto Initiatives Be taught?

What’s Next for Airdrops?

“This methodology doesn’t work effectively for distributing tokens,” acknowledged Haseeb Qureshi, managing companion of venture capital firm Dragonfly, on The Slicing Block podcast. “There ought to be better ways than this aggressively gamed airdrop system.”

No longer all projects have suffered. Ethena’s market cap has substantially grown from $1.5 billion to $3.5 billion since its first airdrop on April 2, attributable to excessive yields and plans for a 2d airdrop. EtherFi, one other liquid restaking protocol, more than doubled its TVL from 810,000 ETH on March 18 to 1.83 million ETH, aided by a 2d parts advertising and marketing campaign and partnerships with varied platforms. Gentle, each and each these projects have promises of some make of future airdrop or rewards program.

“Within the longer term, we’ll procure new mechanisms,” acknowledged Tarun Chitra, venture investor at Robot Ventures, on the podcast.”It won’t be wholesale airdrops but something more continuous and random.”

As projects and airdrop farmers change into smarter and more strategic, each and each sides will expertise more challenges. The airdrop formulation is now considered as a unsuitable formulation, with many calling for model new and more efficient ways to distribute tokens.

Source credit : unchainedcrypto.com