Aerodrome’s Immediate Upward push: Excellent in Crypto Can a Project Develop into a $580 Million Alternate in Lawful 7 Months

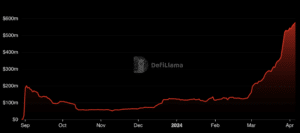

Decentralized trade Aerodrome, which supreme launched seven months within the past, reached an all-time excessive of $580 million in locked tag in its dapper contracts on Friday, rising bigger than 382% since Jan. 1 when its TVL sat at about $120 million, records from blockchain analytics agency DefiLlama reveals.

The three greatest shopping and selling pair swimming pools by TVL — DOLA/USDbC, WETH/USDC, and USDC/AERO — collectively are fee over $244 million, representing roughly 42% of general TVL on Aerodrome.

The Opposed-native DEX is already the sixth greatest trade all over all blockchain networks by TVL, within the lend a hand of Uniswap, Curve, PancakeSwap, Balancer, and Raydium.

Aerodrome’s excessive in TVL comes 10 days after AERO, its native token that is disbursed to liquidity suppliers, climbed to an all-time excessive of $2.00, sooner than settling round at $1.37 on the time of newsletter, per CoinGecko. No topic the tumble, the associated price of AERO has increased 81.2% within the past 14 days and 183.4% over the month, which has contributed to Aerodrome’s TVL growth. The USDC/AERO pool has $76 million in TVL, a Dune analytics dashboard reveals.

Aerodrome also has added over $126 million in USDC liquidity by its enhance program since Dec. 2023, a signal of the DEX’s commitment to amplify usage of Circle’s stablecoin on Opposed. In a publish on Warpcast earlier on the present time, Aerodrome launched the extension of its enhance program and its endured partnership with risk administration agency Gauntlet to double its USDC match program, meaning “per week Aerodrome will probably be distributing $25,000 in USDC voting incentive boosts per week skilled-rata to protocol incentivizers.”

“The native USDC adoption push on [Base] has been so successful due to of [Aerodrome] and the liquidity partners, it’s doubling down,” wrote Adam Atkins, the co-founder of crypto advisory agency Four Moons, on X on Friday. “Substantial for Aerodrome’s TVL and a astronomical gain for traders.

Over the past seven days, Aerodrome has generated between $35 million and $50 million in daily shopping and selling volume, a pleasant amplify in task for the explanation that predominant week of 2024 when it averaged appropriate $3.2 million in daily shopping and selling volume. No topic this growth, Aerodrome lags a ways within the lend a hand of the fifth greatest DEX by TVL – Raydium – which did over $556 million in shopping and selling volume the day earlier than on the present time, per DefiLlama.

Aerodrome’s ascent reveals how Opposed is turning into more liquid, a creep that helps with general adoption of the layer 2 network.

Read more: Coinbase to Retailer More Customer, Corporate Balances on Opposed

How It Started

Aerodrome was as soon as rolled out in August 2023 as a fork of Velodrome Finance, the supreme decentralized trade on layer 2 network Optimism. On the opposite hand, Aerodrome has since surpassed its predecessor Velodrome’s TVL figure of $170 million.

At presstime, Aerodrome’s TVL makes up 46% of the full TVL on Opposed, which has viewed sharp will improve in memecoin task and transactions. The daily quantity of transactions on Opposed has increased from 372,400 in the starting up put of the twelve months to round 2.9 million as of the day earlier than on the present time, primarily based entirely on onchain intelligence agency Artemis.

In a couple of weeks, Aerodrome will unveil Slipstream, contemporary concentrated liquidity swimming pools aimed to provide “low slippage onchain swaps,” primarily based entirely on a Velodrome weblog publish. Even though Slipstream has been rolled out on Velodrome, the concentrated liquidity swimming pools personal but to invent their approach to Aerodromease-native trade.

Slippage refers again to the incompatibility between a trader’s anticipated tag of an asset and the true tag at which the transaction is executed.

Source credit : unchainedcrypto.com